The Asia Pacific cannabis testing market is expected to grow at highest rate during the forecast period owing large population countries such as China and India, increasing number of accidents with cannabis intoxication, adoption of trends from western regions in terms of legalization of medical and recreational use of cannabis are expected to fuel the market growth in Asia Pacific region.

The United States is anticipated to be the main driving force of growth of use of medical cannabis. 30 states of the United States of America have legalized the use of cannabis. These 30 states comprise of 60% of total population and have approved the use of medical marijuana. This has become the driving force for the growth of cannabis testing marked in the entire North America region. Currently more than 8000 active licenses for cannabis businesses in USA. It is the only country with such numbers of market players.

Several countries across the region are strongly considering to end regulation and prohibition for using marijuana for adults. The steady growth of public support around the region will likely convert into major state-level success for marijuana policy reform. Many campaigns are organizing to support the legalizing marijuana by the government in Illinois, Minnesota, New Hampshire New Jersey, New York and many other states of the United States. In addition, according to the NORML and the NORML Foundation, in the 2018 midterm election, the Proposal 1 to legalize marijuana in Michigan was approved by the voters and Michigan became the first Midwestern state to legalized recreational marijuana. Moreover, Michigan became the 10th state that allows possessing the drug in small amounts for recreational use for adults. Moreover, in 2001, Canada legalized medical cannabis use and cultivation and in July 2018, legalized marijuana for adult-use in the country.

Thus, due to the growing legalization of cannabis, the cannabis testing market is expected to grow at a rapid pace during the forecast period.

The medical use of cannabis has witnessed a significant changes in this decade as many government have legalized use of cannabis. The governments of various states have attempted to spread the use of cannabis in medical industry. Due to this, various government institution have initiated the process of legalizing the use of medical cannabis and have started to place a legal framework to practice. These rapid changes in the industry have enabled medical experts and professionals to organize events and spread the use of medical cannabis.

Currently, medical cannabis conferences have been taking places in various parts of the world. In US, conferences symposium and seminars take place at various states to acquaint its citizens and authorities with the use of medical marijuana and legal framework related to it.

World Medical Cannabis Conference and Expo (April 2018), is one of the most popular conference in USA with participants across the world. This is the largest cannabis symposium in the world which brings all business stakeholder together. It involves over 3000 guests and 150 exhibitors.

CannaCon, is first ever symposium that features legal sale of cannabis for business purposes. The expo provide a platform for guest to get access to knowledge from business experts with over 12000 guests.

U.S Cannabis Conference and Expo, this conference involves high profile discussion, presentation and will educate entrepreneur to boost the development and evolution of medical cannabis industry.

Thus, owing to rising number of conferences, expo and other awareness programs, the cannabis testing market is expected to witness rapid growth in the region.

The cannabis testing market by type is segmented into products and software. In 2017, the products segment held a largest market share of 73.7% of the cannabis testing market, by type. This segment is also expected to dominate the market in 2025 owing to increasing use of the consumables as well as capital equipment for cannabis tests. Moreover, the software segment is anticipated to witness the significant growth rate of 10.9% during the forecast period, 2018 to 2025 owing to several advantages offered by automated workflow solutions to ease the cannabis testing procedures and maintain the results.

The North America cannabis testing market on the basis of service is segmented into potency testing, microbial analysis, residual solvent screening, heavy metal testing, pesticide screening, terpene profiling, and genetic testing. The potency testing segment is anticipated to grow at a CAGR of 12.7% during the forecast period. Depending on the state in which testing occurs, a sample’s THC and CBD levels, along with its tetrahydrocannabinolic and cannabidolic acids are required. Other labs may opt to test samples for their CBC and CBG as well. Testing for potency involves gas or liquid chromatography for a range of matrices.

The North America cannabis testing market on the basis of end user is segmented into potency testing, microbial analysis, residual solvent screening, heavy metal testing, pesticide screening, terpene profiling, and genetic testing. In 2017, testing laboratories segment held the largest share of the market, by end user, and is expected to grow at the fastest rate during the coming years owing to the increasing number of diagnostic testing performed in the reference labs for the numerous diseases.

Strategic acquisition and product launches were observed as the most adopted strategy in North America cannabis testing industry. Few of the recent product launch and product approval are listed below:

2016: Agilent Technologies, Inc. introduced Agilent 5110 ICP-OES that allow scientists to perform faster, more precise ICP-OES analysis.

2017: SCIEX launched the X-Series Quadrupole Time of Flight (QTOF) mass spectrometry (MS) platform, X500B QTOF System.

2018: Restek and Separation Science entered into a collaboration to develop a multi-speaker eSeminar focused on testing methods and associated topics for medicinal cannabis labs.

• North America

Strategic insights for the North America Cannabis Testing provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

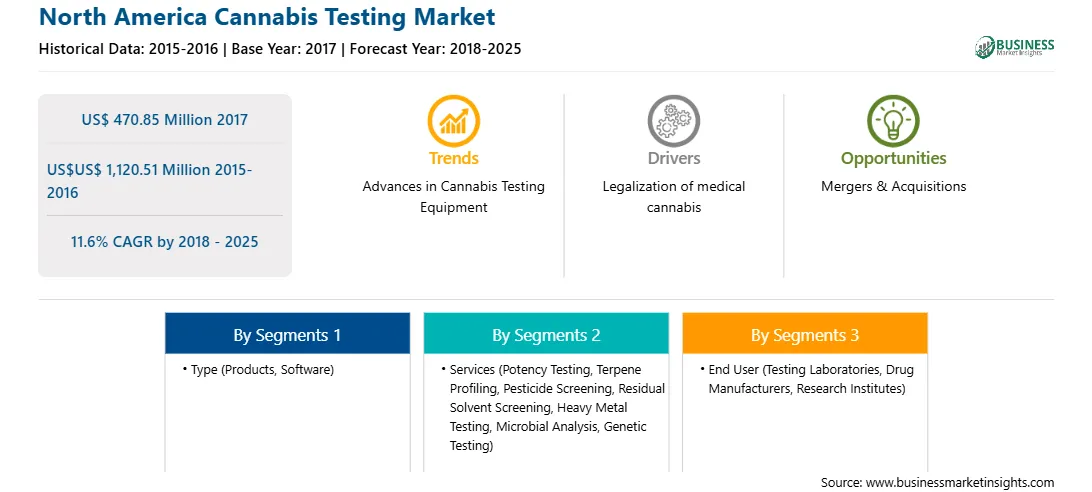

| Market size in 2017 | US$ 470.85 Million |

| Market Size by 2025 | US$US$ 1,120.51 Million |

| Global CAGR (2018 - 2025) | 11.6% |

| Historical Data | 2015-2016 |

| Forecast period | 2018-2025 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America Cannabis Testing refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The North America Cannabis Testing Market is valued at US$ 470.85 Million in 2017, it is projected to reach US$US$ 1,120.51 Million by 2025.

As per our report North America Cannabis Testing Market, the market size is valued at US$ 470.85 Million in 2017, projecting it to reach US$US$ 1,120.51 Million by 2025. This translates to a CAGR of approximately 11.6% during the forecast period.

The North America Cannabis Testing Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Cannabis Testing Market report:

The North America Cannabis Testing Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Cannabis Testing Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Cannabis Testing Market value chain can benefit from the information contained in a comprehensive market report.