Advantages of Butterfly Needles over Straight Needles Drive North America Butterfly Needles Market Growth

Butterfly needles are widely preferred over straight needles as they are highly flexible during angled insertion, less painful, and highly accurate. Also, the phlebotomist may have a close grip on the needle and precision while placing it in the vein due to their bilateral wings and a short length. Butterfly needles can be efficiently used on people with small or rolling veins and are also effective for the tiny veins of body parts such as the hand, foot, scalp, and heel. Over the years, newer models of butterfly needles have been launched into the market, providing various advantages over the other types of needles. The latest models of butterfly needles have a slide-and-lock sheath that automatically slides over the needle as it is extracted from a vein. This prevents needlestick injuries and the reuse of a used needle. VACUETTE EVOPROTECT butterfly needles developed by Greiner Group AG are equipped with mechanisms that provide semi-automatic retraction of the needle from the vein, which minimizes the risk of needlestick injury. Furthermore, the company reported that the semi-automatic safety feature is more effective at preventing NSIs than devices with manually activated mechanisms. Devices with semi-automatic safety features also resulted in lower needlestick injuries than manually activated mechanism devices. Thus, the advantages of butterfly needles over other types of needles are fueling the growth of the North America butterfly needles market.

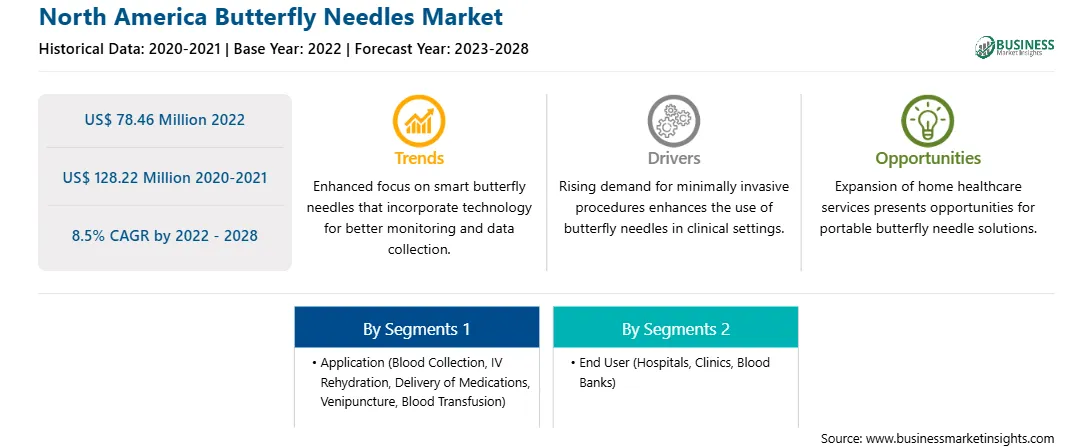

North America Butterfly Needles Market Overview

The North America butterfly needles market is segmented into the US, Canada, and Mexico. The US is dominating the market in the region. Blood collection using butterfly needles is typically performed on children, older patients, and some adults with thin veins. It is also the recommended needle type for patients with rolling veins or those who are hesitant about needles. ClickZip Safety Butterfly Needle is a high-quality needle, free from latex and DEHP, and simple and safe to use. In the US, blood donation is regulated by the FDA and the American Association of Blood Banks to ensure the blood donation process is safe. According to American Blood Centers, an estimated 6.8 million people in the US donate blood yearly. There are 13.6 million units of whole blood and red blood cells collected in the country annually. Blood transfusion is required after every two seconds in the US, according to the American Red Cross. Also, according to the lay press, 75% of Americans are chronically dehydrated. While this is not supported by medical literature, dehydration is common in elderly patients. It has been observed in 17% to 28% of older adults in the US. Dehydration is a frequent cause of hospital admission. This leads to over-treatment with fluids. Therefore, the butterfly needles market is expected to grow in the coming years with the rise in blood donations in the US. Unfortunately, current blood shortages are leading to delayed critical blood transfusions for needy people.

Strategic insights for the North America Butterfly Needles provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the North America Butterfly Needles refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.North America Butterfly Needles Strategic Insights

North America Butterfly Needles Report Scope

Report Attribute

Details

Market size in 2022

US$ 78.46 Million

Market Size by 2028

US$ 128.22 Million

Global CAGR (2022 - 2028)

8.5%

Historical Data

2020-2021

Forecast period

2023-2028

Segments Covered

By Application

By End User

Regions and Countries Covered

North America

Market leaders and key company profiles

North America Butterfly Needles Regional Insights

North America Butterfly Needles Market Segmentation

The North America butterfly needles market is segmented on the basis of application, end user, and country.

Based on application, the North America butterfly needles market is segmented into blood collection, IV rehydration, delivery of medications, venipuncture, and blood transfusion. The blood collection segment held the largest North America butterfly needles market share in 2022.

Based on end user, the North America butterfly needles market is segmented into hospitals, clinics, blood banks, and others. The hospitals segment held the largest North America butterfly needles market share in 2022.

Based on country, the North America butterfly needles market is segmented into the US, Canada, and Mexico. The US dominated the North America butterfly needles market in 2022.

B. Braun SE, Becton Dickinson and Co, Cardinal Health Inc, ICU Medical Inc, ISO- MED Inc, Medline Industries Inc, Nipro Corp, SB-Kawasumi Laboratories Inc, and Terumo Corp are among the leading companies operating in the North America butterfly needles market.

The North America Butterfly Needles Market is valued at US$ 78.46 Million in 2022, it is projected to reach US$ 128.22 Million by 2028.

As per our report North America Butterfly Needles Market, the market size is valued at US$ 78.46 Million in 2022, projecting it to reach US$ 128.22 Million by 2028. This translates to a CAGR of approximately 8.5% during the forecast period.

The North America Butterfly Needles Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Butterfly Needles Market report:

The North America Butterfly Needles Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Butterfly Needles Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Butterfly Needles Market value chain can benefit from the information contained in a comprehensive market report.