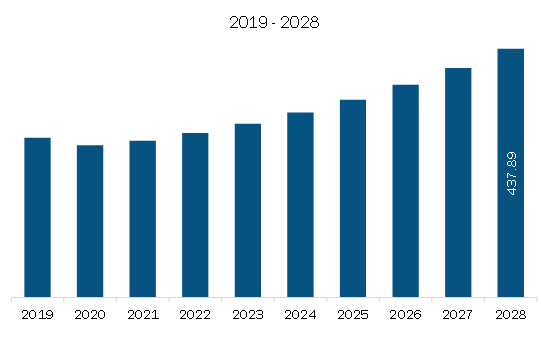

The North America bucket elevator market is expected to grow from US$ 289.48 million in 2022 to US$ 437.89 million by 2028. It is estimated to grow at a CAGR of 7.1% from 2022 to 2028.

Increased Use of Bucket Elevators in Cement Plants with Growth in Infrastructure Projects is Driving the North America Bucket Elevator Market

The migration of people from rural to urban areas over the years has been a common phenomenon worldwide, particularly in developing countries. According to the United Nations Conference on Trade and Development (UNCTAD), 56.2% of the global population resided in urban areas in 2020, compared to 51.6% in 2010. The percentage of urban dwellers was above 79% in developed countries, including the US. With the growing urban population, the need for high-rise buildings has increased in urban areas. According to the Council on Tall Buildings and Urban Habitat (CTBUH), 1,480 skyscrapers with heights greater than 200 m have been built in the last 20 years in the US. The number also includes 40 new residential skyscrapers constructed during 2019–2022. Government bodies are increasingly emphasizing on supporting construction and infrastructural developments. The resultant surge in construction work across the residential, commercial, and several other sectors has boosted the growth of the cement industry. Per the United States Geological Survey (USGS), the US, China, and India manufactured approximately 92 million MT, 2,500 million MT, and 330 million MT of cement, respectively, in 2021, compared to approximately 89 million MT, 2,400 million MT, and 295 million MT in 2020. Similarly, Siam Cement Group (SCG) recorded a 6% year-on-year rise in total national cement consumption throughout Thailand in the first 9 months of 2022. The group stated commercial construction as the main driver of demand growth. Cement manufacturers are among the largest deployers of bucket elevators. They have been upgrading their plants for coping with the rise in demand for cement, which has been boosting the installation of bucket elevators. In October 2022, MDG America was selected to supply Drake Cement’s plant located in Paulden, Arizona, US, with four high-quality chain bucket elevators. Nevertheless, owing to factors such as a weakened global economy, geopolitical turmoil, and rising inflation, the impact of this driver is expected to remain moderate in the next two years (2023–2024) in major countries such as the US and China. Portland Cement Association (PCA) expects a decrease in cement consumption in the US in the second half of 2023 due to a worsening general economic outlook. However, the downturn is expected to be for a short period due to the expected ease in interest rates, leading to an anticipated rise in construction in 2024 and beyond.

North America Bucket Elevator Market Overview

The North American bucket elevator market is segmented into the US, Canada, and Mexico. In North America, several industries such as construction, mining, food, and energy & utilities are significantly growing owing to favorable government regulations and increased investment by both public and private authorities. North American countries are witnessing a rise in the development of several commercial and residential infrastructures. A few major projects are highlighted below:

These rise in construction activities across the North American countries is increasing the demand for bucket elevator from the construction industry for applications like vertical transportation of sand, cement, and bricks. This is contributing to the growth of the North America bucket elevator market. North America has a significantly developed food industry with several food brands operating the market. Some of the major food companies in the region include Kraft-Heinz, Inc.; CAMPBELL SOUP COMPANY.; THE HERSHEY COMPANY.; Kellogg's Company; and Frito-Lay North America, Inc. These companies have several manufacturing facilities across the region. Additionally, the North American countries have also experienced investment in the opening of new food production plants. For instance, Western grads in August 2022 announced the opening of its vegan food manufacturing facility in London, Ontario. These factors are further expected to increase the demand for bucket elevators from the food industry across the region, thereby contributing to the growth of the market over the years. Companies like FEECO International Inc, KWS Manufacturing Co Ltd, and Sukup Manufacturing Co are operating in the North American bucket elevator market. The rising organic and inorganic growth strategies adopted by the North America bucket elevator market players to expand their product portfolio, expand their manufacturing capabilities, and geographical presence is contributing to the growth of the market. For instance, Sukup Manufacturing Co in December 2021 announced the expansion of its manufacturing sites with a new plant in Hampton, Iowa.

North America Bucket Elevator Market Revenue and Forecast to 2028 (US$ Million)

Strategic insights for the North America Bucket Elevator provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the North America Bucket Elevator refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

North America Bucket Elevator Strategic Insights

North America Bucket Elevator Report Scope

Report Attribute

Details

Market size in 2022

US$ 289.48 Million

Market Size by 2028

US$ 437.89 Million

Global CAGR (2022 - 2028)

7.1%

Historical Data

2020-2021

Forecast period

2023-2028

Segments Covered

By Type

By Capacity

By Industry

Regions and Countries Covered

North America

Market leaders and key company profiles

North America Bucket Elevator Regional Insights

North America Bucket Elevator Market Segmentation

The North America bucket elevator market is segmented into type, capacity, industry, and country.

Based on type, the North America bucket elevator market is segmented into centrifugal discharge elevators, continuous discharge elevators, positive discharge elevators. In 2022, the centrifugal discharge elevators segment registered a largest share in the North America bucket elevator market.

Based on capacity, the North America bucket elevator market is segmented as upto 350 cubic feet per hour, 351–830 cubic feet per hour, 2001 – 2800 cubic feet per hour, 831 – 2000 cubic feet per hour, above 2801 cubic feet per hour. In 2022, the 350 cubic feet per hour segment registered a largest share in the North America bucket elevator market.

Based on industry, the North America bucket elevator market is segmented into construction, agriculture, mining, fertilizers & chemicals, energy and utilities, paper and pulp, others. In 2022, the construction segment registered a largest share in the North America bucket elevator market.

Based on country, the North America bucket elevator market is segmented into the US, Canada, and Mexico. In 2022, the US segment registered a largest share in the North America bucket elevator market.

AGCO Corp; BEUMER Group GmbH & Co KG; FEECO International Inc; KWS Manufacturing Co Ltd; Motridal SpA; Ryson International Inc; Satake Corp; Skandia Elevator AB; and Sukup Manufacturing Co are the leading companies operating in the North America bucket elevator market.

The North America Bucket Elevator Market is valued at US$ 289.48 Million in 2022, it is projected to reach US$ 437.89 Million by 2028.

As per our report North America Bucket Elevator Market, the market size is valued at US$ 289.48 Million in 2022, projecting it to reach US$ 437.89 Million by 2028. This translates to a CAGR of approximately 7.1% during the forecast period.

The North America Bucket Elevator Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Bucket Elevator Market report:

The North America Bucket Elevator Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Bucket Elevator Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Bucket Elevator Market value chain can benefit from the information contained in a comprehensive market report.