The US and Canada are developed countries in terms of modern technologies, standard of living, and infrastructure, and have experienced innovations across residential, commercial, and industrial infrastructure, thereby influencing the growth of the real estate industry in the region. For instance, in 2018, the private construction spending across the US accounted for US$ 992 billion. This is promoting the growth of the construction industry across the region. With the presence of well-established automotive manufacturers, the economic growth of the region has positively impacted the sales of commercial vehicles and passenger cars in North America. The increasing sales of passenger cars and commercial vehicles are creating a demand for broaching tools. In 2020, 13,375,622 units of passenger cars and commercial vehicles were produced in the region. Additionally, the rising investment in the automotive industry is boosting the industry’s production capabilities. For instance, as per the Centre for Automotive Research (CAR), in 2018, automakers declared a significant investment projects of ~US$ 4.8 billion throughout the region. Companies involved in these investments include GM, Hyundai, FCA, Ford, Nissan, Toyota, and Volkswagen. CAR stated that in 2018, the US held 78% of the region’s investment in North America. Major automakers invested ~US$ 3.7 billion across their US facilities, where most of the shares were invested for modernizing manufacturing. Other investments across the country were focused on distribution centers and research & development (R&D) facilities. Thus, a huge investment by automakers to gain traction in the global automotive industry increases the demand for various components used within the vehicles, which contributes to the growth of the broaching tool market.

In case of COVID-19, the US is the worst-hit country in North America due to the outbreak. The outbreak has created significant disruptions in primary industries such as manufacturing, healthcare, energy & power, electronics & semiconductor, aerospace & defense, and construction. A significant decline in the growth of mentioned industrial activities is impacting the performance of the North America broaching tools market. The increasing number of infected individuals has led governments of North American countries to shut down nation’s borders during Q2 of 2021. Most of the manufacturing plants are either temporarily shut or are operating with minimum staff strength; moreover, the supply chains of components and parts are disrupted. The US is one of the largest markets for broaching tools, especially due to its technologically advanced aerospace & defense and manufacturing sectors. However, the outbreak has severely affected the production and revenue generation due to lowered production volumes. Thus, the COVID-19 pandemic continues to have a negative impact on the growth of the broaching tools market in North America.

Strategic insights for the North America Broaching Tools provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

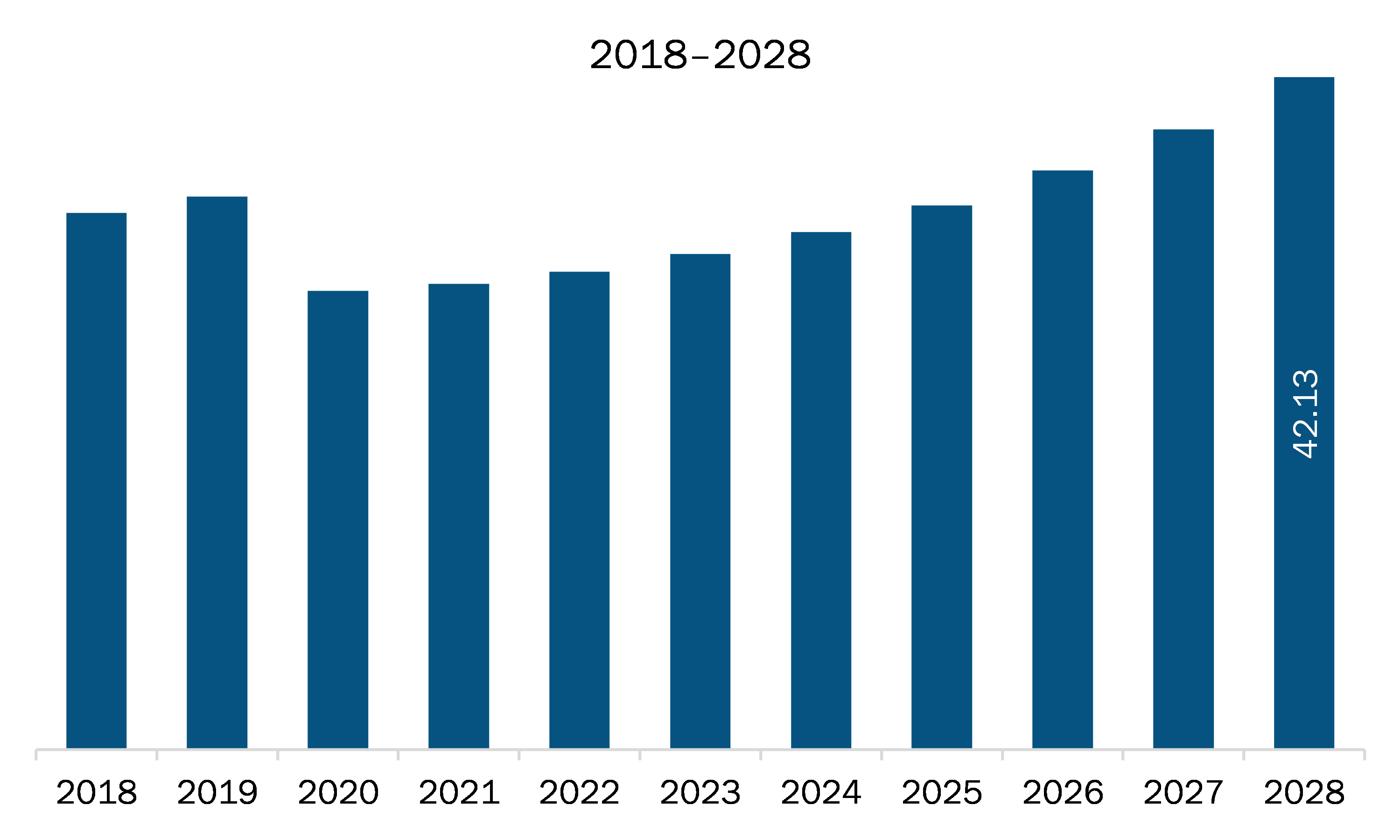

| Market size in 2021 | US$ 29.16 Million |

| Market Size by 2028 | US$ 42.13 Million |

| Global CAGR (2021 - 2028) | 5.4% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America Broaching Tools refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The North America broaching tools market is expected to grow from US$ 29.16 million in 2021 to US$ 42.13 million by 2028; it is estimated to grow at a CAGR of 5.4% from 2021 to 2028. Escalating defense sector is expected to surge the market growth. The rapid change in modern warfare has been urging the governments to allocate higher funds toward respective military forces. The higher military budget allocation enables the military forces to engage themselves in the development of robust arms and ammunition, indigenous technologies, rugged devices, and various other technologies. At present, the soldier and military vehicle modernization practices are peaking among most military forces to keep the personnel and vehicles ready for mission. With an objective to modernize armed forces, ministries across the North America are investing substantial amounts. Countries such as the US and Canada are increasing their defense budgets year-on-year. The broaching tools are widely used in manufacturing various components of arms and ammunition, armed vehicles, military aircrafts, battle tanks, IFVs, and communication and computing devices. Thus, increasing defense budget will subsequently create growth opportunities for market players across North America region.

In terms of type, the internal broaches segment accounted for the largest share of the North America broaching tools market in 2020. In terms of end user, the automotive segment held a larger market share of the North America broaching tools market in 2020.

A few major primary and secondary sources referred to for preparing this report on the North America broaching tools market are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are American Broach & Machine Company; Blohm Jung Gmbh; Colonial Tool Group Inc.; Ekin S. Coop; Messer Räumtechnik Gmbh & Co. KG; Miller Broach; Mitsubishi Heavy Industries Machine Tool Co., Ltd.; Nachi-Fujikoshi Corp; and The Broach Masters, Inc.

The North America Broaching Tools Market is valued at US$ 29.16 Million in 2021, it is projected to reach US$ 42.13 Million by 2028.

As per our report North America Broaching Tools Market, the market size is valued at US$ 29.16 Million in 2021, projecting it to reach US$ 42.13 Million by 2028. This translates to a CAGR of approximately 5.4% during the forecast period.

The North America Broaching Tools Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Broaching Tools Market report:

The North America Broaching Tools Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Broaching Tools Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Broaching Tools Market value chain can benefit from the information contained in a comprehensive market report.