The US, Canada, and Mexico are major economies in North America. The region is notable for technological advancements and is characterized by high disposable individual incomes, higher standards of living, and rapid technological advancements in the arena of military & defense. Also, North America has the largest fleet of defense aircrafts in the world. General Dynamics Corporation, Honeywell International Inc., United Technologies, and Raytheon Corporation are other major aircraft manufacturers having their bases in North America. Northrop Grumman, General Dynamics, and Lockheed Martin are among the major defense aircraft suppliers operating in the region, thus presenting a tremendous opportunity for the market players to enhance their footprint globally. Huge volumes of military fleets operating in domestic as well as international arena coupled with an increasing border security in the region is increasing the need for defense aircraft, which are integrated with advanced laser and radar technology. The region has a maximum number of laser weapon manufacturing companies, which leads to robust competition in the laser weapon systems for border security. Rising competition in the region encourages these companies to offer enhanced designs, power, and strength for defense weapons, through continuous development, at a lower cost than their counterparts in the market. The market players are developing new laser and radar weapon systems with enhanced range, power, and energy consumption. For instance, the US Navy is deploying laser weapon systems on its nine destroyers as an evolution part of the weapon systems. The nine destroyers are being nonlethal Optical Dazzling Interdictor, defense bases from aerial attack, and Navy (ODIN) system to protect ships. Similarly, the US Air Force awarded a contract of US$ 15.5 million to Raytheon Technologies to upgrade its ground-vehicle laser weapon systems.

The US is the most affected country in North America in terms of number of infections which has led the government to impose various containment measure such factories shut down, travel restrictions, closure of international borders and lockdowns. Due to dependence on the global supply chain for supply of raw materials, there has been delays in execution of the Pentagon’s major defense acquisition programs. The region is expecting market recovery and economic improvement with the start of the COVID-19 vaccination. Although the companies in this region still has the risk of market uncertainties from tough business environment associated with the disruptions in supply chain, various factors such as government efforts like increased progress payments and payroll tax deferrals have helped the manufacturers to have a positive cash flow.

Strategic insights for the North America Border Security provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

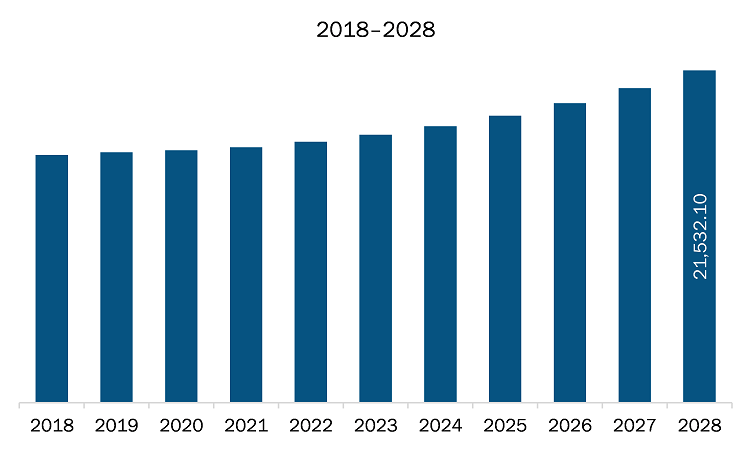

| Market size in 2021 | US$ 16562.82 Million |

| Market Size by 2028 | US$ 21532.10 Million |

| Global CAGR (2021 - 2028) | 3.8% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Environment

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America Border Security refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The border security market in North America is expected to grow from US$ 16562.82 million in 2021 to US$ 21532.10 million by 2028; it is estimated to grow at a CAGR of 3.8% from 2021 to 2028. Development of laser weapon system for fighter aircraft; Laser weapon systems are gaining major demand from countries such as the US which hold high military power globally. Escalating development of advanced weapons system and increasing adoption of drones or unmanned vehicle for military operations are creating enormous demand for advanced defensive weapons. Several drones and advanced weapons are creating severe damage owing to which the demand for high-precise laser weapon systems is increasing. The growing investment by various nations and intensive R&D activities performed by the market players create new opportunities for the growth of the laser system for enhanced border security. For instance, the US's self-protect high-energy laser demonstrator (SHiELD) initiative opens a new application area for laser weapon systems. Lockheed Martin developed a laser weapon system for fighter jets, thus bringing a new level of advancement for war fighters. The laser weapons in fighter jets are intertwining the ability to shoot down missiles in flight and get an advantage over adversaries. This is bolstering the growth of the border security market

In terms of environment type, the ground segment accounted for the largest share of the North America border security market in 2020. In terms of system type, the unmanned vehicles segment held a larger market share of the border security market in 2020.

A few major primary and secondary sources referred to for preparing this report on the border security market in North America are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are BAE Systems plc

The North America Border Security Market is valued at US$ 16562.82 Million in 2021, it is projected to reach US$ 21532.10 Million by 2028.

As per our report North America Border Security Market, the market size is valued at US$ 16562.82 Million in 2021, projecting it to reach US$ 21532.10 Million by 2028. This translates to a CAGR of approximately 3.8% during the forecast period.

The North America Border Security Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Border Security Market report:

The North America Border Security Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Border Security Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Border Security Market value chain can benefit from the information contained in a comprehensive market report.