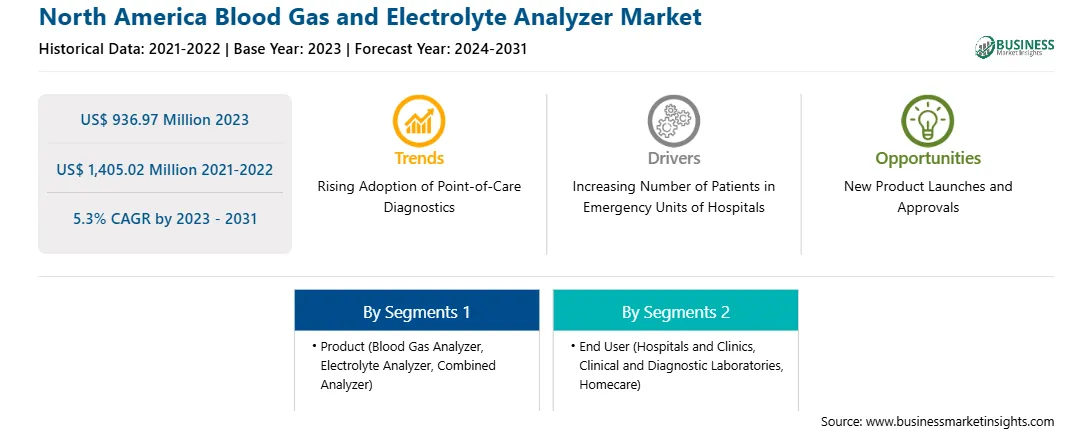

The North America blood gas and electrolyte analyzer market was valued at US$ 936.97 million in 2023 and is projected to reach US$ 1,405.02 million by 2031; it is estimated to record a CAGR of 5.2% from 2023 to 2031.

Increasing Number of Patients in Emergency Units of Hospitals Fuels North America Blood Gas and Electrolyte Analyzer Market

The rising prevalence of diabetes, cancer, heart disease, and other chronic conditions propels the requirement for hospital emergency rooms (ER). Hospital emergency rooms offer vital medical care for patients affected by severe chronic conditions who need immediate attention and medical intervention. These services are complex, with each part being crucial to providing care. The primary objective of emergency medical services is immediately treating medical, surgical, and obstetric problems. The increasing number of patients seeking care in emergency hospital emergency units positively impacts the demand for blood gas and electrolyte analyzers. According to the World Health Organization (WHO), around 150 million patients visit hospital emergency rooms across the world annually. The US records about 139.8 million ER visits per year, according to data released by the CDC in 2023. In addition, there was a 7.4% rise in ED visits in California between 2011 and 2021. As emergency departments face mounting pressure to deliver rapid and accurate assessments of critically ill patients, timely diagnostic information on blood gas values, electrolyte levels, and acid-base balance becomes paramount. Blood gas and electrolyte analyzers provide on-the-spot diagnostic data for evaluating and managing patients affected by respiratory distress, metabolic abnormalities, or critical conditions. The ability of these analyzers to provide real-time insights into a patient's oxygenation status, acid-base equilibrium, and electrolyte levels is crucial for guiding resuscitative measures and optimizing clinical outcomes in emergency settings.

The growing demand for blood gas and electrolyte analyzers in emergency units drives advancements in technology, such as portable and point-of-care devices, that enable rapid testing at the patient's bedside. These compact analyzers enhance workflow efficiency and improve patient outcomes by facilitating prompt diagnosis and treatment initiation. As hospitals prioritize enhancing emergency care services to meet the needs of a rising patient population, the blood gas and electrolyte analyzers market is witnessing increased adoption of technologically advanced solutions tailored to the urgent and critical care setting.

North America Blood Gas and Electrolyte Analyzer Market Overview

The North America blood gas and electrolyte analyzer market has been segmented into the US, Canada, and Mexico. The US held the largest share of the North America blood gas and electrolyte analyzer market in 2023. The growth is driven by increasing public awareness regarding cardiovascular diseases and growing research and collaboration to explore innovative therapeutic applications in the blood gas and electrolyte analyzer market. The market for blood gas and electrolyte analyzer test kits in North America is projected to spur with the presence of various key players in the market. In addition, the adoption of medical devices in healthcare operations for improving quality and reducing costs augments the growth of the blood gas and electrolyte analyzer market in the region.

North America Blood Gas and Electrolyte Analyzer Market Revenue and Forecast to 2031 (US$ Million)

Strategic insights for the North America Blood Gas and Electrolyte Analyzer provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the North America Blood Gas and Electrolyte Analyzer refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.North America Blood Gas and Electrolyte Analyzer Strategic Insights

North America Blood Gas and Electrolyte Analyzer Report Scope

Report Attribute

Details

Market size in 2023

US$ 936.97 Million

Market Size by 2031

US$ 1,405.02 Million

Global CAGR (2023 - 2031)

5.3%

Historical Data

2021-2022

Forecast period

2024-2031

Segments Covered

By Product

By End User

Regions and Countries Covered

North America

Market leaders and key company profiles

North America Blood Gas and Electrolyte Analyzer Regional Insights

North America Blood Gas and Electrolyte Analyzer Market Segmentation

The North America blood gas and electrolyte analyzer market is categorized into product, end user, and country.

Based on product, the North America blood gas and electrolyte analyzer market is categorized into blood gas analyzer, electrolyte analyzer, combined analyzer, and others. The combined analyzer segment held the largest market share in 2023.

By end user, the North America blood gas and electrolyte analyzer market is segmented into hospitals and clinics, clinical and diagnostic laboratories, homecare, and others. The clinical and diagnostic laboratories segment held the largest market share in 2023.

By country, the North America blood gas and electrolyte analyzer market is segmented into the US, Canada, and Mexico. The US dominated the North America blood gas and electrolyte analyzer market share in 2023.

Abbott Laboratories, Dalko Diagnostics Private Limited, Erba Diagnostics Mannheim GmbH, Hoffmann-La Roche Ltd, Medica Corporation, Nova Biomedical Corporation, Siemens Healthineers AG, Werfen SA, Radiometer Medical ApS, and Sensa Core Medical Instrumentation Pvt Ltd. are some of the leading companies operating in the North America blood gas and electrolyte analyzer market.

The North America Blood Gas and Electrolyte Analyzer Market is valued at US$ 936.97 Million in 2023, it is projected to reach US$ 1,405.02 Million by 2031.

As per our report North America Blood Gas and Electrolyte Analyzer Market, the market size is valued at US$ 936.97 Million in 2023, projecting it to reach US$ 1,405.02 Million by 2031. This translates to a CAGR of approximately 5.3% during the forecast period.

The North America Blood Gas and Electrolyte Analyzer Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Blood Gas and Electrolyte Analyzer Market report:

The North America Blood Gas and Electrolyte Analyzer Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Blood Gas and Electrolyte Analyzer Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Blood Gas and Electrolyte Analyzer Market value chain can benefit from the information contained in a comprehensive market report.