Market Introduction

The North American blood brain barrier technologies consists of the US, Canada, and Mexico. The US is the largest market for North American blood brain barrier technologies. The United States blood brain barrier technologies market is estimated to be the largest in the region and is likely to continue its dominance during forecast years. The market across the country is expected to grow due to the well-established infrastructure, increasing prevalence of neurological diseases such as Alzheimer’s Disease, Epilepsy, Parkinson’s Disease, Multiple Sclerosis, Hunter’s Syndrome, Brain Cancer. For instance, according to the American Society of Clinical Oncology (ASCO), in 2021, an estimated 24,530 adults (13,840 men and 10,690 women) will be diagnosed with primary cancerous tumors of the brain and spinal cord in the United States. In a person's lifetime, the chances of having this form of tumor are fewer than 1%. Most primary central nervous system (CNS) malignancies are brain tumors, which account for 85% to 90% of all cases. Market players are adopting organic and inorganic growth strategies for market development. For instance, in June 2021, The U.S. Food and Drug Administration (FDA) granted Eli Lilly and Company’s Breakthrough Technology designation for donanemab antibody therapy for Alzheimer's disease (AD). Thus, owing to the factors mentioned above, it is expected that the blood brain barrier technologies market is likely to propel exponentially during the forecast years. Similarly, In June 2021, U.S. Food and Drug Administration approved Pfizer’s Aduhelm (aducanumab) for the treatment of Alzheimer disease. Aduhelm was approved using the accelerated approval pathway, which can be used for a drug for a serious or life-threatening illness that provides a meaningful therapeutic advantage over existing treatments Also, In October 2020, Bristol Myers Squibb announced that Health Canada approved ZEPOSIA (ozanimod) for the treatment of patients with relapsing-remitting multiple sclerosis (RRMS) to decrease the frequency of clinical exacerbations.

The worldwide impacts of COVID-19 are being felt across several markets. Although the healthcare sector has witnessed SARS, H1N1, and other outbreaks in the last few years, the severity of the COVID-19 has made the situation more complicated due to its mode of transmission. New research published in December 2020 suggests COVID-19 can cross the blood-brain barrier. The finding gives credence to the many patients who complain of lingering cognitive side effects long after contracting the disease. The University of Washington School of Medicine researchers in Seattle led the study, which looked at how the coronavirus spike protein behaves in mice. This S1 protein, they found, can cross the blood-brain barrier and grab onto other cell receptors, which may be toxic to brain tissue.

Strategic insights for the North America Blood Brain Barrier Technologies provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the North America Blood Brain Barrier Technologies refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

North America Blood Brain Barrier Technologies Strategic Insights

North America Blood Brain Barrier Technologies Report Scope

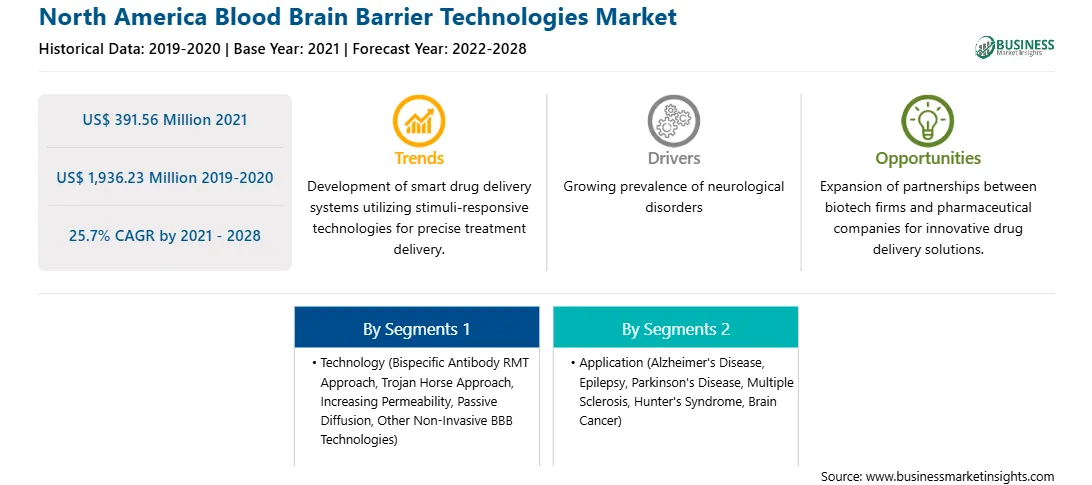

Report Attribute

Details

Market size in 2021

US$ 391.56 Million

Market Size by 2028

US$ 1,936.23 Million

Global CAGR (2021 - 2028)

25.7%

Historical Data

2019-2020

Forecast period

2022-2028

Segments Covered

By Technology

By Application

Regions and Countries Covered

North America

Market leaders and key company profiles

North America Blood Brain Barrier Technologies Regional Insights

Market Overview and Dynamics

The blood brain barrier technologies market in North America is expected to grow from US$ 391.56 million in 2021 to US$ 1,936.23 million by 2028; it is estimated to grow at a CAGR of 25.7% from 2021 to 2028. Efficient drug delivery to treat brain-related diseases is challenging. The reason is the barriers, such as the blood brain barrier, present in the central nervous system. The blood-brain barrier formed by the endothelial cells of the cerebral capillaries restricts the entry of most drugs and delivery systems. The blood-cerebrospinal fluid barrier and blood tumor barrier also present a massive problem for the effective delivery of therapeutics to the central nervous system (CNS). Therefore, market players are launching various techniques such as molecular trojan horse technology, biology-based approach, BBB disruption, stereotactically guided insertion, intranasal delivery, chemical methods, and transporter-mediated delivery to enhance the amount and concentration of therapeutic compounds in the brain. A few of the recent developments related to the blood-brain barrier technologies market have taken place in recent years. For instance, In January 2019, The US Food and Drug Administration (FDA) approved the first generic version of Sabril (vigabatrin) tablets, manufactured by US subsidiary of Teva Pharmaceutical Industries, for the treatment of complex partial seizures as add-on therapy in patients. Further, In June 2021, the US FDA granted breakthrough therapy designation for donanemab antibody therapy for Alzheimer's disease (AD) developed by Eli Lilly and Company. Thus, the active participation of market players in product innovation and development and increase in approvals of products are likely to fuel the market growth in the coming years

Key Market Segments

In terms of technology, the increasing permeability segment accounted for the largest share of the North America blood brain barrier technologies market in 2021. In terms of application, the parkinson’s disease segment accounted for the largest share of the North America blood brain barrier technologies market in 2021.

Major Sources and Companies Listed

A few major primary and secondary sources referred to for preparing this report on the blood brain barrier technologies market in North America are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Teva Pharmaceutical Industries Ltd.; F. Hoffmann-La Roche Ltd.; Eli Lilly and Company; Bristol-Myers Squibb Company; Pfizer, Inc.; Johnson & Johnson Services, Inc.; Fabre-Kramer Pharmaceuticals, Inc.; and Bioasis Technologies, Inc. among others.

Reasons to buy report

North America Blood Brain Barrier Technologies Market Segmentation

North America Blood Brain Barrier Technologies Market – By Technology

North America Blood Brain Barrier Technologies Market – By

Application

North America Blood Brain Barrier Technologies Market – By Country

North America Blood Brain Barrier Technologies Market – Companies Mentioned

The North America Blood Brain Barrier Technologies Market is valued at US$ 391.56 Million in 2021, it is projected to reach US$ 1,936.23 Million by 2028.

As per our report North America Blood Brain Barrier Technologies Market, the market size is valued at US$ 391.56 Million in 2021, projecting it to reach US$ 1,936.23 Million by 2028. This translates to a CAGR of approximately 25.7% during the forecast period.

The North America Blood Brain Barrier Technologies Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Blood Brain Barrier Technologies Market report:

The North America Blood Brain Barrier Technologies Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Blood Brain Barrier Technologies Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Blood Brain Barrier Technologies Market value chain can benefit from the information contained in a comprehensive market report.