The market's growth is due to increased single-handed operations and a rise in the incidence of injuries. However, inherent problems associated with blade removers, such as scalpel injuries, are expected to restrict the market growth during the forecast period.

The increasing awareness about dangers related to sharp objects in the medical environment led to various methods to protect medical personnel from accidental cuts and punctures. According to the Centers for Disease Control and Prevention, up to 1,000 people are accidentally exposed to needle sticks and lacerations while receiving medical care in the US every day. After needle sticks, blade injuries are the most common injuries caused by sharp objects. When activation rates are considered of how effectively the new users are achieving perceived value of blade removers in the medical field, combining a one-handed scalpel blade remover with a bowl or neutral zone is up to five times safer than safety scalpels. A few companies offer one-handed scalpel blade removers that meet regulatory requirements, such as US Occupational Safety and Health Administration standards.

Removing, storing, and disposing blades without a painful injury from sharp objects requires removal techniques, including fingers, tweezers, or re-sheathing. A single-handed blade remover eliminates the risk of serious injuries, such as sharps injuries that are a serious occupational hazard in healthcare. Knife cuts are more common and severe than needlestick injuries.

The one-hand technique for removing the blades minimizes risk. This essential security solution makes compliance a practical reality and drastically reduces the cost of injury. Healthcare workers report between 600,000 and 1 million sharps injuries every year in the US. Therefore, the ease of single-handed operation with the usage of blade removers would help avoid various hazards and injuries, thereby boosting the market for blade removers.

In North America, the US was heavily impacted by the outbreak of the COVID-19 pandemic. The COVID-19 pandemic led to many technological changes that are critical to better care. During the COVID-19 pandemic, outpatient appointments were frequently avoided. This increased the risk of infection for both the patient and the medical staff running the clinic. The impact of the pandemic on surgical practice has been widespread, such as staffing issues, procedure prioritization, intraoperative virus transmission risk, changes in perioperative practice, and methods of treatment to the impact on surgical education and training. Surgical research, both laboratory and clinical, are discontinued, as many surgeons in the academy were transferred back to the clinical setting to help treat COVID-19 patients. However, due to the growing number of cases in North America, all surgical procedures are performed with caution and cleanliness. The blade removers help ensure safety and cleanliness during surgery or any other procedure. Thus, the COVID-19 pandemic has increased the demand for blade remover market North America.

Strategic insights for the North America Blade Removers provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

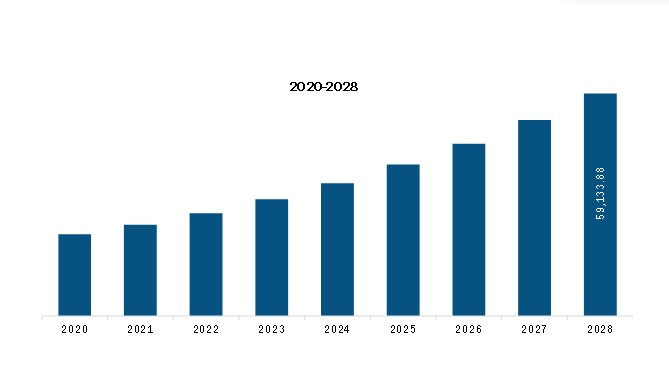

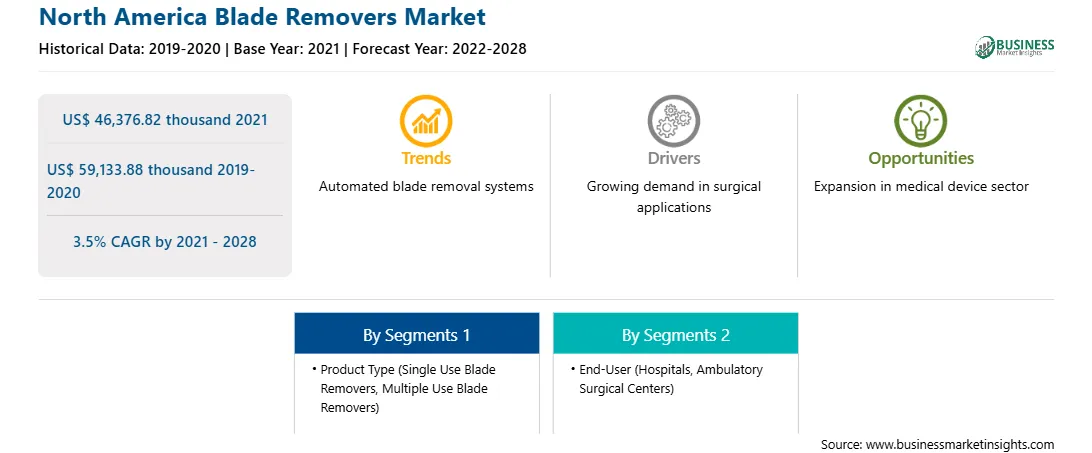

| Market size in 2021 | US$ 46,376.82 thousand |

| Market Size by 2028 | US$ 59,133.88 thousand |

| Global CAGR (2021 - 2028) | 3.5% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America Blade Removers refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The North America Blade Removers Market is valued at US$ 46,376.82 thousand in 2021, it is projected to reach US$ 59,133.88 thousand by 2028.

As per our report North America Blade Removers Market, the market size is valued at US$ 46,376.82 thousand in 2021, projecting it to reach US$ 59,133.88 thousand by 2028. This translates to a CAGR of approximately 3.5% during the forecast period.

The North America Blade Removers Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Blade Removers Market report:

The North America Blade Removers Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Blade Removers Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Blade Removers Market value chain can benefit from the information contained in a comprehensive market report.