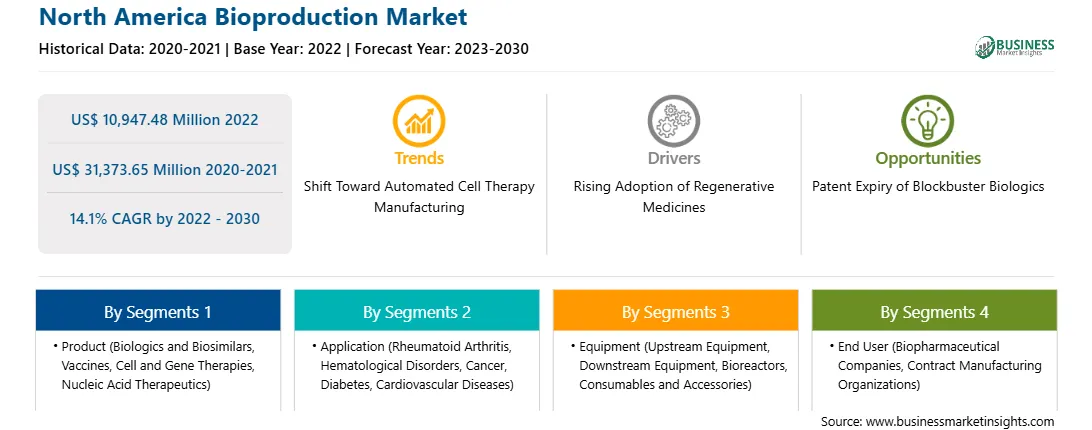

The North America bioproduction market was valued at US$ 10,947.48 million in 2022 and is expected to reach US$ 31,373.65 million by 2030; it is estimated to register a CAGR of 14.1% from 2022 to 2030.

Regenerative therapies help in the regeneration of cells, tissues, and organs to restore their functions. A number of regenerative medicine applications for human clinical trials are submitted to the Food and Drug Administration (FDA) each year. As per the Alliance for Regenerative Medicine, in 2019 (Q3), 1,052 clinical trials utilizing regenerative medicine were underway globally; 218 cellular therapy trials were underway (41 Phase I, 147 Phase II, 30 Phase III) in 2019. Rapid advancements are being made in regenerative medicines to provide effective solutions for chronic conditions. Cell therapy is one of the fastest-growing segments of the regenerative medicine domain. Novartis' Kymriah was the first cell therapy solution offered to treat B-cell acute leukemia. Moreover, RepliCel, a regenerative medicine provider, has a wide range of regenerative medicine products in the pipeline, with three products-RCH-01, RCS-01, and RCT-01-in the development phase. Further, Sernova is engaged in the development of regenerative medicine technologies and has a huge pipeline of products for conditions such as diabetes, hemophilia A, and hyperthyroidism. Thus, the rising adoption of regenerative medicines is driving the bioproduction market.

The North America bioproduction market is subsegmented into the US, Canada, and Mexico. In Mexico, the demand for cell therapy is quite noteworthy owing to growing medical tourism for stem cell therapy. The bioproduction market in North America accounted for the largest market share in 2022 due to increasing incidence of diabetes and infertility, as well as rising product developments in biosimilars.

Growing incidences of genetic and cellular disorders are leading to increasing demand for cell therapies. A 2020 PhRMA report on the cell and gene therapy pipeline revealed that there are 400 cell and gene therapies in development to target a variety of diseases and conditions from cancer to genetic disorders to neurologic conditions in the US. As of February 2020, nine cell or gene therapy products were approved in the US to treat cancer, eye diseases and rare hereditary diseases. Also, an increasing number of start-ups are innovating cell therapies in the country.

Strategic insights for the North America Bioproduction provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 10,947.48 Million |

| Market Size by 2030 | US$ 31,373.65 Million |

| Global CAGR (2022 - 2030) | 14.1% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Product

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America Bioproduction refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The North America bioproduction market is categorized into product, application, equipment, end user, and country.

Based on product, the North America bioproduction market is segmented into biologics and biosimilars, vaccines, cell and gene therapies, nucleic acid therapeutics, and others. The biologics and biosimilars segment held the largest North America bioproduction market share in 2022.

In terms of application, the North America bioproduction market is segmented into rheumatoid arthritis, hematological disorders, cancer, diabetes, cardiovascular diseases, and others. The cancer segment held the largest North America bioproduction market share in 2022.

By equipment, the North America bioproduction market is divided into upstream equipment, downstream equipment, bioreactors, and consumables and accessories. The consumables and accessories segment held the largest North America bioproduction market share in 2022.

In terms of end user, the North America bioproduction market is categorized into biopharmaceutical companies, contract manufacturing organizations, and others. The biopharmaceutical companies segment held the largest North America bioproduction market share in 2022.

By country, the North America bioproduction market is segmented into the US, Canada, and Mexico. The US dominated the North America bioproduction market share in 2022.

Bio-Rad Laboratories Inc, Danaher Corp, F. Hoffmann-La Roche Ltd, Lonza Group AG, Merck KGaA, Sartorius AG, and Thermo Fisher Scientific Inc. are some of the leading companies operating in the North America bioproduction market.

1. Bio-Rad Laboratories Inc

2. Danaher Corp

3. F. Hoffmann-La Roche Ltd

4. Lonza Group AG

5. Merck KGaA

6. Sartorius AG

7. Thermo Fisher Scientific Inc

The North America Bioproduction Market is valued at US$ 10,947.48 Million in 2022, it is projected to reach US$ 31,373.65 Million by 2030.

As per our report North America Bioproduction Market, the market size is valued at US$ 10,947.48 Million in 2022, projecting it to reach US$ 31,373.65 Million by 2030. This translates to a CAGR of approximately 14.1% during the forecast period.

The North America Bioproduction Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Bioproduction Market report:

The North America Bioproduction Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Bioproduction Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Bioproduction Market value chain can benefit from the information contained in a comprehensive market report.