The unprecedented rate of aging population and extended periods of physical inactivity are boosting the prevalence lifestyle disorders, such as obesity and diabetes. Genes can cause conditions such as cardiovascular disease (CVDs), diabetes, obesity, Alzheimer's disease, and depression. According to the National Council on Aging, Inc., 80% of adults (aged 65 and more) are reported to suffer from at least one chronic condition in their lifetime, while 68% have two or more. According to the Centers for Disease Control and Prevention (CDC), nearly 6 of 10 people in the US suffered from at least one serious disease, and 4 of 10 people have had two or more chronic conditions in 2020. CVDs, such as angina pectoris, atherosclerosis, and acute myocardial infarction, caused due to hectic lifestyles are significant causes of mortality across the region. Diabetes is a life-threatening chronic disease with no functional cure. Diabetes of all types can cause various complications in different body parts, thereby increasing the overall risk of death. Heart attack, kidney failure, stroke, leg amputation, nerve damage, and vision loss are among the major complications associated with diabetes. According to the International Diabetes Federation (IDF), diabetic cases in North America are expected to reach 62 million by 2045 from 46 million in 2017. The data further reported that 425 million people suffered from diabetes in 2017, and the count is likely to reach 629 million by 2045 worldwide. The disease prevalence is likely to increase by about 35% during the forecast period. Recognition of biosimilars as efficacious and safe agents by patients, specialists, primary care clinicians, and other healthcare professionals is propelling its demand. Biosimilars have proven to improve the quality of life for millions of patients. They are effective and cost-effective options in treating many diseases, including chronic skin conditions (such as psoriasis, Atopic Dermatitis), bowel diseases (such as Crohn’s disease, irritable bowel syndrome, and colitis), diabetes, autoimmune disease, cancer, kidney conditions, and arthritis. Biosimilar developers are adopting advanced bioprocessing technologies to achieve lower manufacturing costs, an important factor determining final consumer prices. Nearly all biosimilar developers are using modern, often cutting-edge bioprocessing techniques. This indicates that a majority of biosimilars are being developed using single use (disposed of after-use) bioprocessing systems. With the growing prevalence of chronic diseases, the demand for biosimilars to treat life-threatening illnesses is spurring, thereby propelling the demand for bioprocessing technologies.

According to the Food and Drug Administration (FDA) report, over 30 million people in the US suffer from ~7,000 rare diseases, accounting for life-threatening conditions with low treatment options. Drug, biological, and device development in the treatment of rare diseases is challenging due to a lack of understanding of the history of rare diseases and difficulty in conducting clinical trials. Therefore, the growth of bioprocess technologies such as gene and cell therapies (CGTs) and specialty pharmaceuticals represent a radical shift in the treatment of rare diseases. For example, CGTs have revealed significant health benefits than formulated drugs for treating rare diseases. In the US, more than 900 investigational new drug (IND) applications targeting gene therapy products are underway. Also, 10-20 gene therapies are approved annually by the FDA. Likewise, in August 2022, the FDA approved Bluebird Bio's "Zynteglo (betibeglogene autotemcel)." It was the most expensive single-application drug approval in the US intended for the treatment of a rare neurological disorder—cerebral adrenoleukodystrophy (CALD).

Strategic insights for the North America Bioprocess Technology provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the North America Bioprocess Technology refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

North America Bioprocess Technology Strategic Insights

North America Bioprocess Technology Report Scope

Report Attribute

Details

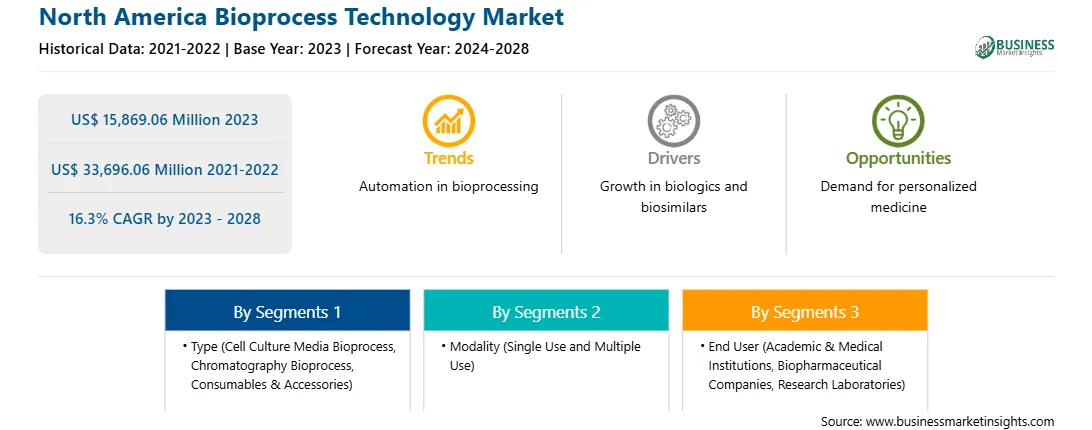

Market size in 2023

US$ 15,869.06 Million

Market Size by 2028

US$ 33,696.06 Million

Global CAGR (2023 - 2028)

16.3%

Historical Data

2021-2022

Forecast period

2024-2028

Segments Covered

By Type

By Modality

By End User

Regions and Countries Covered

North America

Market leaders and key company profiles

North America Bioprocess Technology Regional Insights

North America Bioprocess Technology Market Segmentation

The North America bioprocess technology market is segmented into type, modality, end user, and country.

Based on type, the North America bioprocess technology market is segmented into cell culture media bioprocess, chromatography bioprocess, and consumables & accessories, and others. In 2023, the cell culture media bioprocess segment registered a largest share in the North America bioprocess technology market.

Based on modality, the North America bioprocess technology market is bifurcated into single use and multiple use. In 2023, the single use segment registered a larger share in the North America bioprocess technology market.

Based on end-use, the North America bioprocess technology market is segmented into academic & medical institutions, biopharmaceutical companies, research laboratories, and others. In 2023, the biopharmaceutical companies segment registered a largest share in the North America bioprocess technology market.

Based on country, the North America bioprocess technology market is segmented into the US, Canada, and Mexico. In 2023, the US segment registered a largest share in the North America bioprocess technology market.

Corning Inc; Danaher Corp; Eppendorf SE; Lonza Group AG; Merck KGaA; Repligen Corp; Sartorius AG; STAMM Biotech; and Thermo Fisher Scientific Inc are the leading companies operating in the North America bioprocess technology market.

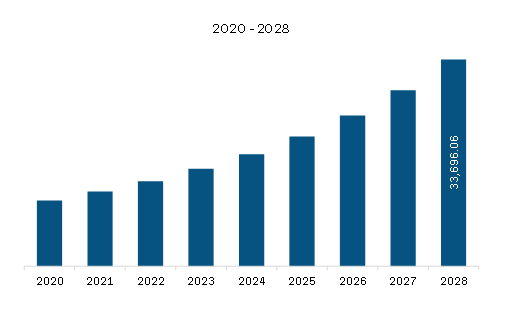

The North America Bioprocess Technology Market is valued at US$ 15,869.06 Million in 2023, it is projected to reach US$ 33,696.06 Million by 2028.

As per our report North America Bioprocess Technology Market, the market size is valued at US$ 15,869.06 Million in 2023, projecting it to reach US$ 33,696.06 Million by 2028. This translates to a CAGR of approximately 16.3% during the forecast period.

The North America Bioprocess Technology Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Bioprocess Technology Market report:

The North America Bioprocess Technology Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Bioprocess Technology Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Bioprocess Technology Market value chain can benefit from the information contained in a comprehensive market report.