Government regulations and policies have shaped the bioplastics and biopolymers market. Recognizing the environmental impact of conventional plastics, many governments worldwide have implemented stringent measures to promote the production and use of sustainable alternatives. Several countries have introduced bans or restrictions on single-use plastics, such as plastic bags, straws, and cutlery. These policies aim to reduce plastic waste and encourage the adoption of bioplastics and biopolymers that are biodegradable and have a lower environmental footprint. In addition to bans, governments offer various incentives such as tax breaks, subsidies, grants, and research funding, as well as support mechanisms to promote the growth of the bioplastics industry. These incentives help reduce the cost of bioplastics, making them more competitive with conventional plastics. Thus, all these benefits have encouraged companies operating in the market to invest in research and development, scale up production, and bring innovative bioplastic products to the market.

Governments are increasingly incorporating sustainability criteria into public procurement policies by prioritizing the use of biobased materials, including bioplastics and biopolymers, in government-funded projects, thus creating a significant demand for these materials. Further, regulatory frameworks are being established to ensure the quality and safety standards of bioplastics. Governments collaborate with industry associations and regulatory bodies to establish certification systems and standards for biodegradability, compostability, and environmental performance. These standards guarantee consumers, businesses, and industries that the plastics they use meet a certain criteria, fostering market growth.

The US, Canada, and Mexico are the key economies in North America. In North America, bioplastics and biopolymers are widely consumed in the packaging sector in the form of plastic bottles and bags. Production and consumption of bioplastics and biopolymers are expected to grow in the region, primarily in food packaging applications. Unlike traditional plastics, bioplastics, and biopolymers are obtained from renewable sources. First-generation bioplastics are obtained from starches or sugars, such as corn, wheat, sugarcane, or soy. Second-generation bioplastics use cellulose from crops or industrial processes as raw materials, including sugarcane bagasse or sawdust, and other industrial residues, such as whey.

Other end-use industries for bioplastics and biopolymers include consumer products, automotive, agriculture, textiles, building & construction, and pharmaceuticals. The growth of these end-use industries is further driving the bioplastics and biopolymers market in North America. The construction industry in North America is expanding tremendously due to a strong economy, combined with an increase in federal and state funding for public works and institutional buildings. Further, the higher demand for and production of large engine capacity vehicles, such as extended cabs, in this region is bolstering the market growth. The automotive market is inclined toward light trucks and SUVs in this region owing to their better traction in changing weather conditions and off-road capabilities. Light commercial vehicle (LCV) production is also increasing in North America. The automotive industry in this region is one of the most advanced industries globally due to substantial investments in infrastructure, R&D activities, and new production facilities. Bio-polyamides (Bio-PA), polylactic acid (PLA), and bio-based polypropylene (Bio-PP) are bioplastics used in automotive manufacturing. These factors are driving the bioplastics and biopolymers market growth.

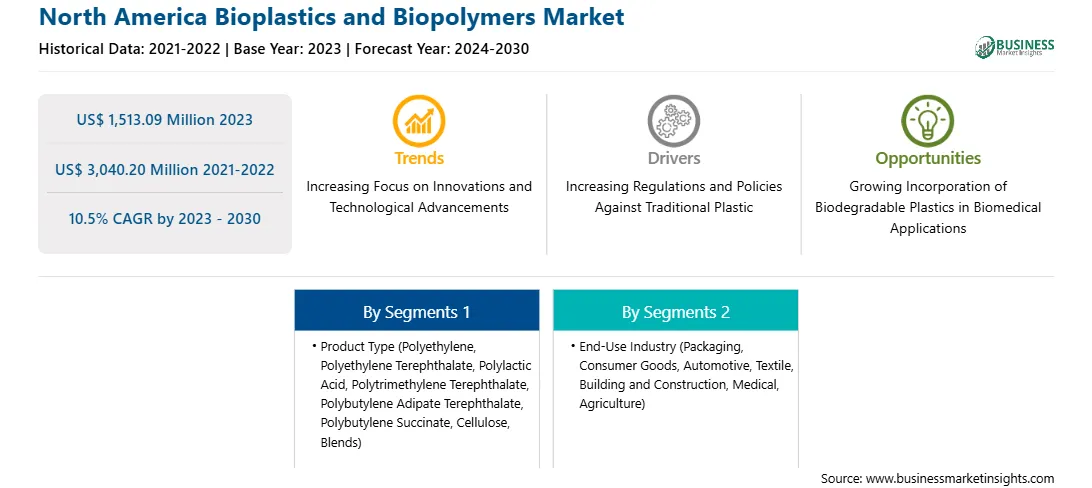

The North America bioplastics and biopolymers market is segmented into product type, end-use industry, and country.

Based on product type, the North America bioplastics and biopolymers market is segmented into polyethylene, polyethylene terephthalate, polylactic acid, polytrimethylene terephthalate, polybutylene adipate terephthalate, polybutylene succinate, cellulose, blends, and others. The blends segment accounted the largest share of the North America bioplastics and biopolymers market in 2023.

Based on end-use industry, the North America bioplastics and biopolymers market is divided into packaging, consumer goods, automotive, textile, building and construction, medical, agriculture, and others. The packaging segment held the largest share of the North America bioplastics and biopolymers market in 2023.

Based on country, the North America bioplastics and biopolymers market is segmented into the US, Canada, and Mexico. The US dominated the North America bioplastics and biopolymers market in 2023.

Arkema SA, BASF SE, Braskem SA, Cardia Bioplastics Australia Pty Ltd, Corbion NV, Eastman Chemical Co, Mitsubishi Chemical Holdings Corp, Mitsui Chemicals Inc, Novamont SpA, and Saudi Basic Industries Corp are some of the leading companies operating in the North America bioplastics and biopolymers market.

Strategic insights for the North America Bioplastics and Biopolymers provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 1,513.09 Million |

| Market Size by 2030 | US$ 3,040.20 Million |

| Global CAGR (2023 - 2030) | 10.5% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2030 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America Bioplastics and Biopolymers refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The North America Bioplastics and Biopolymers Market is valued at US$ 1,513.09 Million in 2023, it is projected to reach US$ 3,040.20 Million by 2030.

As per our report North America Bioplastics and Biopolymers Market, the market size is valued at US$ 1,513.09 Million in 2023, projecting it to reach US$ 3,040.20 Million by 2030. This translates to a CAGR of approximately 10.5% during the forecast period.

The North America Bioplastics and Biopolymers Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Bioplastics and Biopolymers Market report:

The North America Bioplastics and Biopolymers Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Bioplastics and Biopolymers Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Bioplastics and Biopolymers Market value chain can benefit from the information contained in a comprehensive market report.