Major manufacturers of wood pellets are significantly investing in research and development activities to improve the efficiency of the wood pellet production process. Biomass pellets manufacturers invest in technological advancement to develop new and improved designs for pellet mills, ensuring better output with optimum fuel input. Also, extensive research activities have been carried out to promote the calorific value of wood pellets from the available feedstock. Further, manufacturers are increasingly focusing on maximizing market share by investing in plant expansion activities concerning wood pellets. For instance, in May 2021, Drax Group, a biomass producer and supplier, strategized to establish three new wood pellet production plants in Arkansas worth US$ 40 million. The three “satellite” plants are expected to possess a combined capacity of ~120,000 kilo tons/year of wood pellets. Similarly, in December 2020, Pinnacle Renewable Holdings started operations in the wood pellets production facility in Alberta, Canada. The new facility is aligned with the company’s objective to diversify its fiber supply with the help of high-quality wood fiber obtained from Tolko’s existing sawmill in Canada. In 2021, Drax Group PLC announced targets of 8 million tons of biomass pellets production capacity per annum by 2030, an increase compared to 4 million tons in 2021. In 2022, Drax Group PLC signed an acquisition agreement with Princeton Standard Pellet Corporation (Canada), with a production capacity of 90,000 tons of wood pellets per year. Hence, significant investment in research and expansion of facilities are expected to proliferate the growth of the North America biomass pellets market over the coming years.

The North America biomass pellets market is significantly driven by the regional cost competitiveness of biomass pellets as compared to residential heating oil and propane. The production of wood pellets in North America has gained traction over the past few years due to rising demand from overseas markets. According to the United States Department of Agriculture, the US and Canada supply wood pellets to the power plants in the Netherlands and Belgium. The increase in domestic demand for biomass pellets in the region has prompted manufacturers to expand their production capacities. In 2023, Grand River Pellets (Canada) invested US$ 30 million to expand the biomass pellets production capacity from 140,000 to 220,000 metric tons per year. There are ~1 million residences in the US that use wood pellets for several applications, such as heat, freestanding stoves, fireplace inserts, furnaces, and boilers. According to the Pellet Fuels Institute, wood pellets in the region are produced in manufacturing facilities in the US and Canada, and distributed through fireplace dealers, nurseries, building supply stores, and discount merchandisers. Thus, the expansion of biomass pellets production facilities in the region is expected to drive the market during the forecast period.

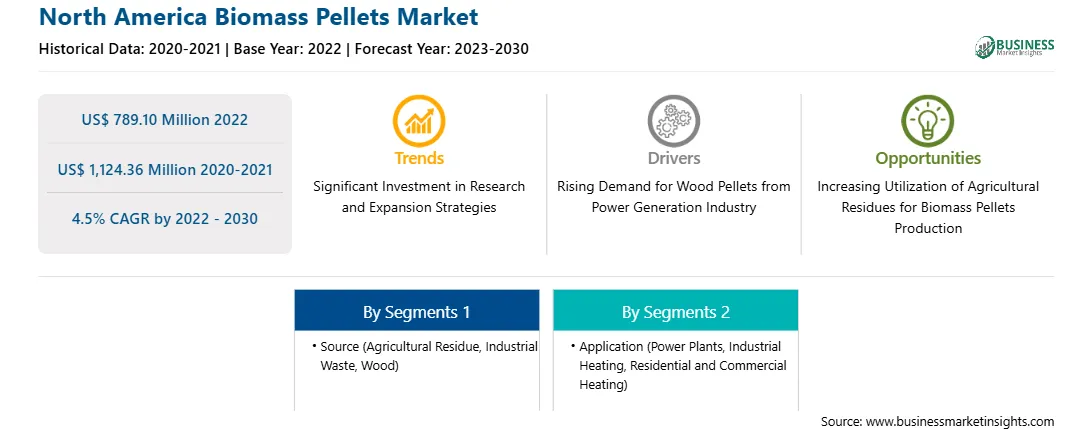

The North America biomass pellets market is segmented into source, application, and country.

Based on source, the North America biomass pellets market is segmented into agricultural residue, industrial waste, wood, and others. In 2022, the wood segment registered the largest share in the North America biomass pellets market.

Based on application, the North America biomass pellets market is segmented into power plants, industrial heating, residential and commercial heating, and others. In 2022, the residential and commercial heating segment registered the largest share in the North America biomass pellets market.

Based on country, the North America biomass pellets market is segmented into the US, Canada, Mexico. In 2022, the US registered the largest share in the North America biomass pellets market.

AS Graanul Invest, Drax Group Plc, Energex American Inc, Enviva Inc, Lignetics Inc, Mallard Creek Inc, and Valfei Products Inc are some of the leading companies operating in the North America biomass pellets market.

Strategic insights for the North America Biomass Pellets provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 789.10 Million |

| Market Size by 2030 | US$ 1,124.36 Million |

| Global CAGR (2022 - 2030) | 4.5% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Source

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America Biomass Pellets refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The North America Biomass Pellets Market is valued at US$ 789.10 Million in 2022, it is projected to reach US$ 1,124.36 Million by 2030.

As per our report North America Biomass Pellets Market, the market size is valued at US$ 789.10 Million in 2022, projecting it to reach US$ 1,124.36 Million by 2030. This translates to a CAGR of approximately 4.5% during the forecast period.

The North America Biomass Pellets Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Biomass Pellets Market report:

The North America Biomass Pellets Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Biomass Pellets Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Biomass Pellets Market value chain can benefit from the information contained in a comprehensive market report.