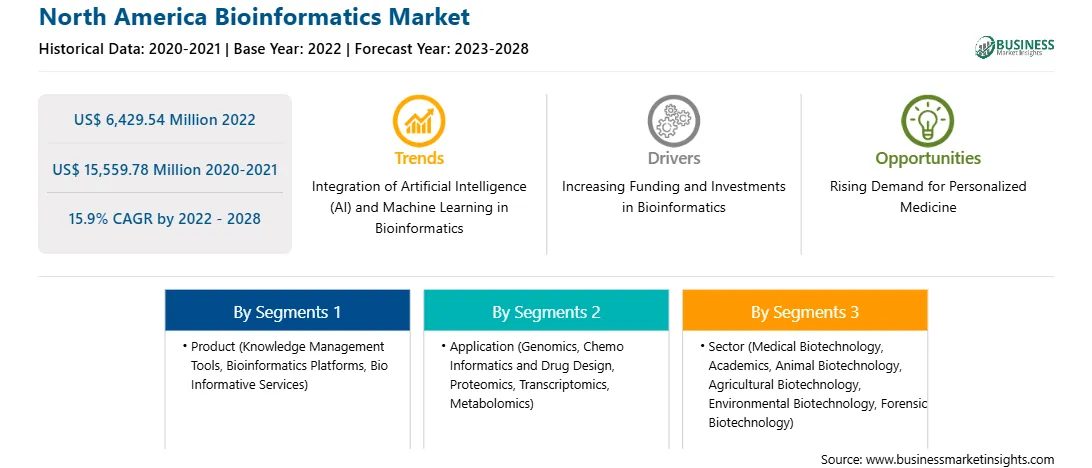

Increased Number of Genomic Research Activities with Corresponding Adoption of Bioinformatics Drives Market Growth

In the field of genetics and genomics, the bioinformatics aids in sequencing and annotating genomes. Bioinformatics plays a major role in the analysis of gene and protein expression and regulation. Bioinformatics tools aid in the comparison of genetic and genomic data, generally in the understanding of evolutionary aspects of molecular biology. The role of human genomics research and related biotechnologies has the potential to achieve several public health goals, such as reducing health inequalities by providing countries with efficient, cost-effective, and robust means of preventing, diagnosing, and treating major diseases, such as cancer, that burden their populations. The initiatives to generate and collect human genomic data are rapidly increasing across multiple countries. Thus, the increasing number of genomics activities, along with the rising adoption of bioinformatics, is driving the bioinformatics market across the region.

Market Overview

The North America bioinformatics market is segmented into the US, Canada, and Mexico. The US held the largest share of the North America bioinformatics market in 2022. The market growth is due to growing healthcare and research expenditure, an increasing number of pharmaceutical and biopharmaceutical companies, and a surge in government support to enhance research and academic institutes. According to US Centers for Medicare & Medicaid Services, the national healthcare expenditure in the US increased reached US$ 4.1 trillion in 2020, registering an increase of 9.7% from 2019 to 2020. The national health spending is expected to grow at a 5.4% annual rate from 2019 to 2028, and it is expected to reach US$6.2 trillion by 2028. The US government initiated various research programs to boost the genomic research, including the ‘All of Us Research Program’ led by NIH, which provided US$ 28.6 million in funding to develop three genome centers across the US. This research program will accelerate precision medicine discoveries through bioinformatics services in different institutions in the US. Further, rapid healthcare expenditure growth results in the launch of diagnostic tools for the evaluation of various genetic diseases and cancer studies for potential medical treatments. Similarly, the pharmaceutical & biopharmaceutical industry's growth is significantly contributing to the US bioinformatics market growth. As a result, the industry expansion accelerates the growth of the development and commercialization of pharmaceutical and biopharmaceutical products. The market players in the country received various patents for their innovations. Thus, the growing bioinformatics services and launch of products for various genetic diseases and cancer studies in the pharmaceutical & biopharmaceutical industries will boost the bioinformatics market growth.

North America Bioinformatics Market Revenue and Forecast to 2028 (US$ Million)

Strategic insights for the North America Bioinformatics provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the North America Bioinformatics refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.North America Bioinformatics Strategic Insights

North America Bioinformatics Report Scope

Report Attribute

Details

Market size in 2022

US$ 6,429.54 Million

Market Size by 2028

US$ 15,559.78 Million

Global CAGR (2022 - 2028)

15.9%

Historical Data

2020-2021

Forecast period

2023-2028

Segments Covered

By Product

By Application

By Sector

Regions and Countries Covered

North America

Market leaders and key company profiles

North America Bioinformatics Regional Insights

North America Bioinformatics Market Segmentation

The North America bioinformatics market is segmented on the basis of product, application, sector, and country.

Based on product, the North America bioinformatics market is segmented into knowledge management tools, bioinformatics platforms, and bio informative services. The bioinformatics platforms segment held the largest market share in 2022. Based on application, the North America bioinformatics market is segmented into genomics, chemo informatics and drug design, proteomics, transcriptomics, metabolomics, and others. The genomics segment held the largest market share in 2022. Based on sector, the North America bioinformatics market is segmented into medical biotechnology, academics, animal biotechnology, agricultural biotechnology, environmental biotechnology, forensic biotechnology, and others. The medical biotechnology segment held the largest market share in 2022. Based on country, the North America bioinformatics market is categorized into the US, Canada, and Mexico. Further, the US dominated the market in 2022. Agilent Technologies, Inc.; Biomax Informatics AG; Bruker Corporation; Dassault Systèmes; Eurofins Scientific; Illumina, Inc.; PerkinElmer Inc.; QIAGEN; and Thermo Fisher Scientific Inc. are the leading companies operating in the North America bioinformatics market.

The North America Bioinformatics Market is valued at US$ 6,429.54 Million in 2022, it is projected to reach US$ 15,559.78 Million by 2028.

As per our report North America Bioinformatics Market, the market size is valued at US$ 6,429.54 Million in 2022, projecting it to reach US$ 15,559.78 Million by 2028. This translates to a CAGR of approximately 15.9% during the forecast period.

The North America Bioinformatics Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Bioinformatics Market report:

The North America Bioinformatics Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Bioinformatics Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Bioinformatics Market value chain can benefit from the information contained in a comprehensive market report.