Battery and bread premixes are food coatings that can be added to meat, poultry, vegetables, fish, and seafood in order to enhance its flavor, texture and preserve its moisture content while frying or grilling. The batter is a thin coating in order to preserve food moisture during deep frying. It's a mixture of flour and liquids, such as water, milk, or eggs. This mixture can also be prepared by soaking grains in water or other liquid and grinding them. Leaving agents, such as baking powder, are used in combination with batteries to improve fluffiness. Breader, also known as breadings, is made from cereal-flour-based blends or thermally processed wheat-flour dough-based dry bread crumbs. They also contain seasonings and chemical leaven agents and are used as fries or baked food coatings in order to achieve the desired texture.

Strategic insights for the North America Batter and Breader Premixes provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2019 | US$ 726.74 Million |

| Market Size by 2027 | US$ 1,149.04 Million |

| Global CAGR (2020 - 2027) | 6.2% |

| Historical Data | 2017-2018 |

| Forecast period | 2020-2027 |

| Segments Covered |

By Batter Premixes Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America Batter and Breader Premixes refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

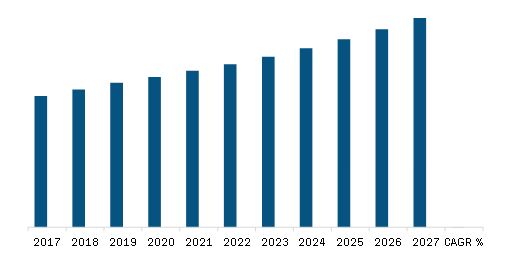

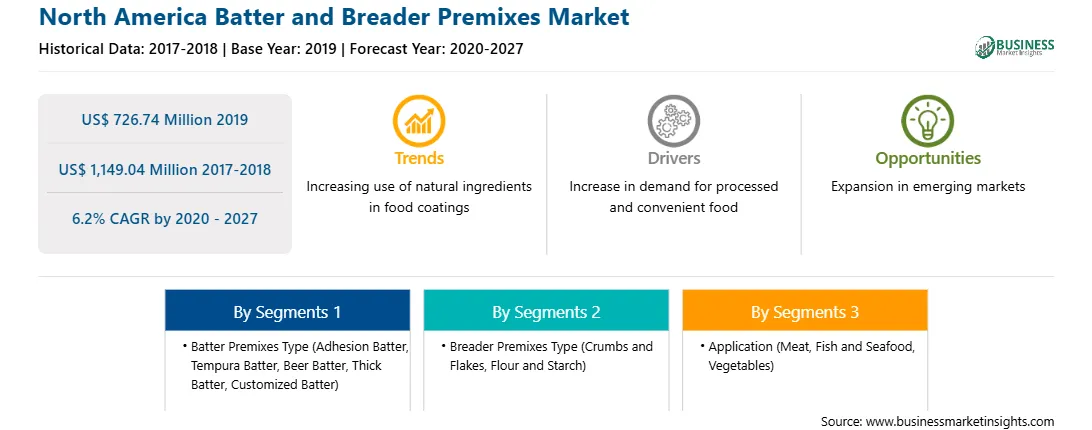

The batter and breader premixes market in North America was valued at US$ 726.74 million in 2019 and is projected to reach US$ 1,149.04 million by 2027; it is expected to grow at a CAGR of 6.2% from 2020 to 2027. The key factor driving the batter and breader premixes market growth is the increasing inclination of the populace toward convenience foods, including processed meat and seafood. Rising health-related awareness preference for convenience food items among the North American population has mainly led to the rising demands for product like batter and breader premixes in this region.

However, volatile prices of raw material may hinder batter and breader premixes growth in North America. Besides, COVID-19 has affected economies and industries in various countries due to travel bans, lockdowns, and business shutdowns. In North America region, the US has the highest number of confirmed coronavirus cases than Canada and Mexico. This is expected to impact the food & beverage industry in the region. Due to the COVID-19 outbreak, the supply chain is expected to get affected and may negatively impact the North America batter and breader premixes market.

The North America batter and breader premixes market is segmented into batter premixes type, breader premixes type, and application. The North America batter and breader premixes market have been divided into five categories on the basis of batter premixes type. These categories are adhesion batter, tempura batter, beer batter, thick batter, and customized batter. In 2019, the adhesion batter segment dominated the market and is the fastest growing segment. The North America batter and breader premixes market based on breader premixes type has been segmented into crumbs and flakes, and flour and starch. The North America batter and breader premixes market was dominated by the crumbs and flakes segment. On the basis of application, the batter and breader premixes market is categorized into meat, fish and seafood, vegetables, and others. The meat segment held a substantial share during the forecast period.

A few major primary and secondary sources referred to for preparing this report on the batter and breader premixes market in North America are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Blendex Company; Bunge North America, Inc.; Coalescence LLC; House- Autry Mills; Kerry Group; Mccormick And Company, Inc.; Newly Weds Foods; Showa Sangyo Co., Ltd. among others.

North America Batter and Breader Premixes Market, by Batter Premixes Type

North America Batter and Breader Premixes Market, by Breader Premixes Type

North America Batter and Breader Premixes Market, by Application

North America Batter and Breader Premixes Market, by Country

The North America Batter and Breader Premixes Market is valued at US$ 726.74 Million in 2019, it is projected to reach US$ 1,149.04 Million by 2027.

As per our report North America Batter and Breader Premixes Market, the market size is valued at US$ 726.74 Million in 2019, projecting it to reach US$ 1,149.04 Million by 2027. This translates to a CAGR of approximately 6.2% during the forecast period.

The North America Batter and Breader Premixes Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Batter and Breader Premixes Market report:

The North America Batter and Breader Premixes Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Batter and Breader Premixes Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Batter and Breader Premixes Market value chain can benefit from the information contained in a comprehensive market report.