North America Backshell Market Forecast to 2028 - COVID-19 Impact and Regional Analysis By Type (Circular Backshell and Rectangular Backshell), Material (Aluminum, Nickel, Stainless Steel, and Others), Military Standards (AS85049, MIL-DTL-38999, MIL-DTL-83723, MIL-DTL-5015, MIL-DTL-26482, and Others), and Application (Ground, Naval, and Air)

Market Introduction

The aerospace and defense industry in the US is one of the leading industries globally in terms of infrastructure and production activities. The total sales of the industry in 2019 accounted for US$ 909 billion, thereby recording a 6.7% increase compared to 2018. US$ 399 billion of the total sales were attributed by the companies that support both aerospace and defense sectors such as manufacturers of bolts, wires, hoses, and electronics amongst others. Thus, the total industry sales left a significant impact on the American economy contributing to 1.8% of the total US GDP. Additionally, in 2019, the exports from the US civil aviation industry and defense aviation accounted for US$ 126.5 billion and 21.6 billion, respectively. North America has a rich presence of companies, such as Boeing, Lockheed Martin Corporation, and Bombardier, who are engaged in the manufacturing of civil and defense aircraft. These companies are significantly investing in the manufacturing of aircrafts every year and in building new manufacturing facilities across the region. For instance, in January 2019, Airbus started the construction of its A220 passenger aircraft manufacturing site in Alabama, US. Similarly, in April 2021, the US Army started upgrading its FLRAA (Future Long-Range Assault Aircraft) and FARA (Future Attack Reconnaissance Aircraft) aircraft to survive battle damage, environmental shocks, and operational strains. Moreover, the region homes military ground vehicle manufacturers such as Oshkosh Defense, LLC; General Dynamics Corporation; and AM GENERAL LLC who further demand backshells for their production process. Thus, the rising expenditure by the above-mentioned companies on the production of respective aircraft and vehicles is positively impacting the growth of the backshell market in the region.

Due to favorable government policies to encourage innovation, the presence of a large industrial base, and high purchasing power, North America is one of the most important regions for adopting and developing new technologies, particularly in developed countries such as the United States and Canada. As a result, any influence on industry growth is projected to have a negative influence on the region's economic growth. Businesses in the region have been significantly impacted by COVID-19 in four key areas: supply chain/operations, personnel, 2020 investments, and product offering. Due to the extreme measures adopted during the pandemic, overhead expenditures, including expenditure for sales, research & development (R&D), and administration of various providers, declined unfavorably.

Get more information on this report :

Market Overview and Dynamics

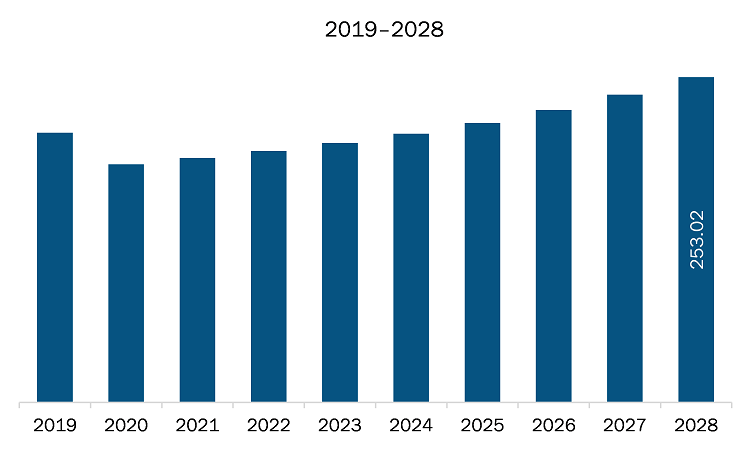

The backshell market in North America is expected to grow from US$ 190.09 million in 2021 to US$ 253.02 million by 2028; it is estimated to grow at a CAGR of 4.2% from 2021 to 2028. As world warfare continues to emerge in different ways, various nations plan and undertake measures to improve and recapitalize their defense status. Threats are continually evolving, i.e., from the conventional land-based force on force to hybrid warfare. To address security threats and tackle terrorism, governments of several nations have already started to increase their defense budgets. The US is among the leading countries that are increasing their defense budget year on year. A substantial amount of military budget is getting allocated for the procurement of advanced military carrier and combat aircraft, vehicles, and naval vessels. The AS85049 Series, MIL-DTL-38999, MIL-DTL-83723, MIL-DTL-5015, and MIL-DTL-26482 are a few major military-grade connectors that are widely used across the components of advanced military carrier and combat aircraft, vehicles, and naval vessels. To safeguard the connectors, several backshells with a similar military grade to the above-mentioned connectors are being produced by various manufacturers. This is catalyzing the growth of the backshell market in the current scenario. From the production perspective of military aircraft, military ground vehicles, and naval ships, the production volume is surging at a decent rate, which is supporting the growth of the backshell markets.

Key Market Segments

In terms of type, the circular segment held a larger share in 2020. Based on material, the stainless steel segment held the largest share in 2020. Based on military standard, the AS85049 series segment held the largest share in 2020. Based on application, the ground segment held the largest share in 2020.

Major Sources and Companies Listed

A few major primary and secondary sources referred to for preparing this report on the backshell market in North America are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Amphenol Corporation; Collins Aerospace; TE Connectivity; Souriau Sunbank; Arrow Electronics, Inc.; Glenair, Inc.; Curtiss-Wright Corporation; PEI-Genesis.com; and Isodyne Inc. among others.

Reasons to buy report

- To understand the North America backshell market landscape and identify market segments that are most likely to guarantee a strong return

- Stay ahead of the race by comprehending the ever-changing competitive landscape for North America backshell market

- Efficiently plan M&A and partnership deals in North America backshell market by identifying market segments with the most promising probable sales

- Helps to take knowledgeable business decisions from perceptive and comprehensive analysis of market performance of various segment form North America backshell market

- Obtain market revenue forecast for market by various segments from 2021-2028 in North America region.

North America Backshell Market Segmentation

North America Backshell Market – By Type

- Circular

- Rectangular

North America Backshell Market – By Material

- Aluminum

- Nickel

- Stainless Steel

- Others

North America Backshell Market – By Military Standard

- AS85049 Series

- MIL-DTL-38999

- MIL-DTL-83723

- MIL-DTL-5015

- MIL-DTL-26482

- Others

North America Backshell Market – By Application

- Ground

- Naval

- Air

- Commercial Aircraft

- Military Aircraft

North America Backshell Market – By Country

- US

- Canada

- Mexico

North America Backshell Market – Companies Mentioned

- Amphenol Corporation

- Collins Aerospace

- TE Connectivity

- Souriau Sunbank (EATON)

- Arrow Electronics, Inc.

- Glenair, Inc.

- Curtiss-Wright Corporation

- Isodyne Inc.

- PEI-Genesis.com

1. Introduction

1.1 Study Scope

1.2 The Insight Partners Research Report Guidance

1.3 Market Segmentation

2. Key Takeaways

3. Research Methodology

3.1 Coverage

3.2 Secondary Research

3.3 Primary Research

4. North America Backshell – Market Landscape

4.1 Market Overview

4.2 Porter’s Five Forces Analysis

4.2.1 Bargaining Power of Buyers

4.2.2 Bargaining Power of Suppliers

4.2.3 Threat to New Entrants

4.2.4 Threat to Substitutes

4.2.5 Competitive Rivalry

4.3 Ecosystem Analysis

5. North America Backshell – Market Dynamics

5.1 Market Drivers

5.1.1 Raising Use of Aluminium Backshell

5.1.2 Boosting Military Expenditures

5.2 Market Restraints

5.2.1 Strict Regulations around MIL Spec Backshells

5.3 Market Opportunities

5.3.1 Increasing Development of Commercial Electric Aircraft

5.4 Future Trends

5.4.1 Up-lifting Electrification of Military Ground Vehicles

5.5 Impact Analysis of Drivers and Restraints

6. North America Backshell Market – Market Analysis

6.1 North America Backshell Market Overview

6.2 North America Backshell Market Revenue Forecast and Analysis

7. North America Backshell Market Analysis – by Type

7.1 Overview

7.2 North America: Backshell Market, by Type

7.3 Circular Backshell

7.3.1 Overview

7.3.2 Circular Backshell: Backshell Market Revenue and Forecast to 2028 (US$ Million)

7.4 Rectangular Backshell

7.4.1 Overview

7.4.2 Rectangular Backshell: Backshell Market Revenue and Forecast to 2028 (US$ Million)

8. North America Backshell Market Analysis – by Material

8.1 Overview

8.2 North America: Backshell Market, by Material

8.3 Aluminum

8.3.1 Overview

8.3.2 Aluminum: Backshell Market Revenue and Forecast to 2028 (US$ Million)

8.4 Nickel

8.4.1 Overview

8.4.2 Nickel: Backshell Market Revenue and Forecast to 2028 (US$ Million)

8.5 Stainless Steel

8.5.1 Overview

8.5.2 Stainless Steel: Backshell Market Revenue and Forecast to 2028 (US$ Million)

8.6 Others

8.6.1 Overview

8.6.2 Others: Backshell Market Revenue and Forecast to 2028 (US$ Million)

9. North America Backshell Market Analysis – by Military Standards

9.1 Overview

9.2 North America: Backshell Market, by Military Standards

9.3 AS85049 Series

9.3.1 Overview

9.3.2 AS85049 Series: Backshell Market Revenue and Forecast to 2028 (US$ Million)

9.4 MIL-DTL-38999

9.4.1 Overview

9.4.2 MIL-DTL-38999: Backshell Market Revenue and Forecast to 2028 (US$ Million)

9.5 MIL-DTL-83723

9.5.1 Overview

9.5.2 MIL-DTL-83723: Backshell Market Revenue and Forecast to 2028 (US$ Million)

9.6 MIL-DTL-5015

9.6.1 Overview

9.6.2 MIL-DTL-5015: Backshell Market Revenue and Forecast to 2028 (US$ Million)

9.7 MIL-DTL-26482

9.7.1 Overview

9.7.2 MIL-DTL-26482: Backshell Market Revenue and Forecast to 2028 (US$ Million)

9.8 Others

9.8.1 Overview

9.8.2 Others: Backshell Market Revenue and Forecast to 2028 (US$ Million)

10. North America Backshell Market Analysis – by Application

10.1 Overview

10.2 North America: Backshell Market, by Application

10.3 Ground

10.3.1 Overview

10.3.2 Ground: Backshell Market Revenue and Forecast to 2028 (US$ Million)

10.4 Naval

10.4.1 Overview

10.4.2 Naval: Backshell Market Revenue and Forecast to 2028 (US$ Million)

10.5 Air

10.5.1 Overview

10.5.2 Air: Backshell Market Revenue and Forecast to 2028 (US$ Million)

10.5.3 Commercial Aircraft

10.5.3.1 Overview

10.5.3.2 Commercial Aircraft: Backshell Market Revenue and Forecast to 2028 (US$ Million)

10.5.4 Military Aircraft

10.5.4.1 Overview

10.5.4.2 Military Aircraft: Backshell Market Revenue and Forecast to 2028 (US$ Million)

11. North America Backshell Market – Country Analysis

11.1 Overview

11.1.1 North America: Backshell Market, by Key Country

11.1.2 US: Backshell Market – Revenue and Forecast to 2028 (US$ Million)

11.1.2.1 US: Backshell Market, by Type

11.1.2.2 US: Backshell Market, by Material

11.1.2.3 US: Backshell Market, by Military Standards

11.1.2.4 US: Backshell Market, by Application

11.1.3 Canada: Backshell Market – Revenue and Forecast to 2028 (US$ Million)

11.1.3.1 Canada: Backshell Market, by Type

11.1.3.2 Canada: Backshell Market, by Material

11.1.3.3 Canada: Backshell Market, by Military Standards

11.1.3.4 Canada: Backshell Market, by Application

11.1.4 Mexico: Backshell Market – Revenue and Forecast to 2028 (US$ Million)

11.1.4.1 Mexico: Backshell Market, by Type

11.1.4.2 Mexico: Backshell Market, by Material

11.1.4.3 Mexico: Backshell Market, by Military Standards

11.1.4.4 Mexico: Backshell Market, by Application

12. North America Backshell Market – COVID-19 Impact Analysis

12.1 Overview

13. Industry Landscape

13.1 Overview

13.2 Market Initiative

13.3 New Product Development

13.4 Merger and Acquisition

14. Company Profiles

14.1 Amphenol Corporation

14.1.1 Key Facts

14.1.2 Business Description

14.1.3 Products and Services

14.1.4 Financial Overview

14.1.5 SWOT Analysis

14.1.6 Key Developments

14.2 Collins Aerospace

14.2.1 Key Facts

14.2.2 Business Description

14.2.3 Products and Services

14.2.4 Financial Overview

14.2.5 SWOT Analysis

14.2.6 Key Developments

14.3 Glenair, Inc.

14.3.1 Key Facts

14.3.2 Business Description

14.3.3 Products and Services

14.3.4 Financial Overview

14.3.5 SWOT Analysis

14.3.6 Key Developments

14.4 Curtiss-Wright Corporation

14.4.1 Key Facts

14.4.2 Business Description

14.4.3 Products and Services

14.4.4 Financial Overview

14.4.5 SWOT Analysis

14.4.6 Key Developments

14.5 Arrow Electronics, Inc.

14.5.1 Key Facts

14.5.2 Business Description

14.5.3 Products and Services

14.5.4 Financial Overview

14.5.5 SWOT Analysis

14.5.6 Key Developments

14.6 Isodyne Inc.

14.6.1 Key Facts

14.6.2 Business Description

14.6.3 Products and Services

14.6.4 Financial Overview

14.6.5 SWOT Analysis

14.6.6 Key Developments

14.7 PEI-Genesis.com

14.7.1 Key Facts

14.7.2 Business Description

14.7.3 Products and Services

14.7.4 Financial Overview

14.7.5 SWOT Analysis

14.7.6 Key Developments

14.8 TE Connectivity

14.8.1 Key Facts

14.8.2 Business Description

14.8.3 Products and Services

14.8.4 Financial Overview

14.8.5 SWOT Analysis

14.8.6 Key Developments

14.9 Souriau Sunbank (EATON)

14.9.1 Key Facts

14.9.2 Business Description

14.9.3 Products and Services

14.9.4 Financial Overview

14.9.5 SWOT Analysis

14.9.6 Key Developments

15. Appendix

15.1 About The Insight Partners

15.2 Word Index

LIST OF TABLES

Table 1. North America Backshell Market Revenue and Forecast to 2028 (US$ Million)

Table 2. North America: Backshell Market, by Country – Revenue and Forecast to 2028 (US$ Million)

Table 3. US: Backshell Market, by Type – Revenue and Forecast to 2028 (US$ Million)

Table 4. US: Backshell Market, by Material – Revenue and Forecast to 2028 (US$ Million)

Table 5. US: Backshell Market, by Military Standards – Revenue and Forecast to 2028 (US$ Million)

Table 6. US: Backshell Market, by Application – Revenue and Forecast to 2028 (US$ Million)

Table 7. US: Backshell Market, by Air – Revenue and Forecast to 2028 (US$ Million)

Table 8. Canada: Backshell Market, by Type – Revenue and Forecast to 2028 (US$ Million)

Table 9. Canada: Backshell Market, by Material – Revenue and Forecast to 2028 (US$ Million)

Table 10. Canada: Backshell Market, by Military Standards – Revenue and Forecast to 2028 (US$ Million)

Table 11. Canada: Backshell Market, by Application – Revenue and Forecast to 2028 (US$ Million)

Table 12. Canada: Backshell Market, by Air – Revenue and Forecast to 2028 (US$ Million)

Table 13. Mexico: Backshell Market, by Type – Revenue and Forecast to 2028 (US$ Million)

Table 14. Mexico: Backshell Market, by Material – Revenue and Forecast to 2028 (US$ Million)

Table 15. Mexico: Backshell Market, by Military Standards – Revenue and Forecast to 2028 (US$ Million)

Table 16. Mexico: Backshell Market, by Application – Revenue and Forecast to 2028 (US$ Million)

Table 17. Mexico: Backshell Market, by Air – Revenue and Forecast to 2028 (US$ Million)

Table 18. List of Abbreviation

LIST OF FIGURES

Figure 1. North America Backshell Market Segmentation

Figure 2. North America Backshell Market Segmentation – By Country

Figure 3. North America Backshell Market Overview

Figure 4. North America Backshell Market, by Type

Figure 5. North America Backshell Market, by Application

Figure 6. North America Backshell Market, By Country

Figure 7. Porter’s Five Forces Analysis

Figure 8. Backshell Market: Ecosystem Analysis

Figure 9. North America Backshell Market: Impact Analysis of Drivers and Restraints

Figure 10. North America Backshell Market Revenue Forecast and Analysis (US$ Million)

Figure 11. North America: Backshell Market Revenue Share, by Type (2020 & 2028)

Figure 12. Circular Backshell: Backshell Market Revenue and Forecast to 2028 (US$ Million)

Figure 13. Rectangular Backshell: Backshell Market Revenue and Forecast to 2028 (US$ Million)

Figure 14. North America: Backshell Market Revenue Share, by Material (2020 & 2028)

Figure 15. Aluminum: Backshell Market Revenue and Forecast to 2028 (US$ Million)

Figure 16. Nickel: Backshell Market Revenue and Forecast to 2028 (US$ Million)

Figure 17. Stainless Steel: Backshell Market Revenue and Forecast to 2028 (US$ Million)

Figure 18. Others: Backshell Market Revenue and Forecast to 2028 (US$ Million)

Figure 19. North America: Backshell Market Revenue Share, by Military Standards (2020 & 2028)

Figure 20. AS85049 Series: Backshell Market Revenue and Forecast to 2028 (US$ Million)

Figure 21. MIL-DTL-38999: Backshell Market Revenue and Forecast to 2028 (US$ Million)

Figure 22. MIL-DTL-83723: Backshell Market Revenue and Forecast to 2028 (US$ Million)

Figure 23. MIL-DTL-5015: Backshell Market Revenue and Forecast to 2028 (US$ Million)

Figure 24. MIL-DTL-26482: Backshell Market Revenue and Forecast to 2028 (US$ Million)

Figure 25. Others: Backshell Market Revenue and Forecast to 2028 (US$ Million)

Figure 26. North America: Backshell Market Revenue Share, by Application (2020 & 2028)

Figure 27. Ground: Backshell Market Revenue and Forecast to 2028 (US$ Million)

Figure 28. Naval: Backshell Market Revenue and Forecast to 2028 (US$ Million)

Figure 29. Air: Backshell Market Revenue and Forecast to 2028 (US$ Million)

Figure 30. Commercial Aircraft: Backshell Market Revenue and Forecast to 2028 (US$ Million)

Figure 31. Military Aircraft: Backshell Market Revenue and Forecast to 2028 (US$ Million)

Figure 32. Geographic Overview of North America Backshell Market

Figure 33. North America: Backshell Market Revenue Share, by Key Country (2020 & 2028)

Figure 34. US: Backshell Market – Revenue and Forecast to 2028 (US$ Million)

Figure 35. Canada: Backshell Market – Revenue and Forecast to 2028 (US$ Million)

Figure 36. Mexico: Backshell Market – Revenue and Forecast to 2028 (US$ Million)

Figure 37. Impact of COVID-19 Pandemic on Market in North American Countries

- Amphenol Corporation

- Collins Aerospace

- TE Connectivity

- Souriau Sunbank (EATON)

- Arrow Electronics, Inc.

- Glenair, Inc.

- Curtiss-Wright Corporation

- Isodyne Inc.

- PEI-Genesis.com

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players and segments in the North America backshell market.

- Highlights key business priorities in order to assist companies to realign their business strategies

- The key findings and recommendations highlight crucial progressive industry trends in the North America backshell market, thereby allowing players across the value chain to develop effective long-term strategies

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets

- Scrutinize in-depth North America market trends and outlook coupled with the factors driving the backshell market, as well as those hindering it

- Enhance the decision-making process by understanding the strategies that underpin commercial interest with respect to client products, segmentation, pricing and distribution