North America Automotive Telematics Market

No. of Pages: 117 | Report Code: BMIRE00030213 | Category: Automotive and Transportation

No. of Pages: 117 | Report Code: BMIRE00030213 | Category: Automotive and Transportation

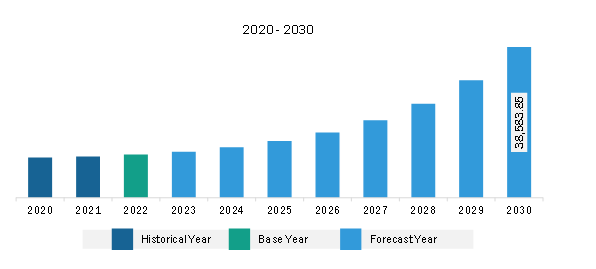

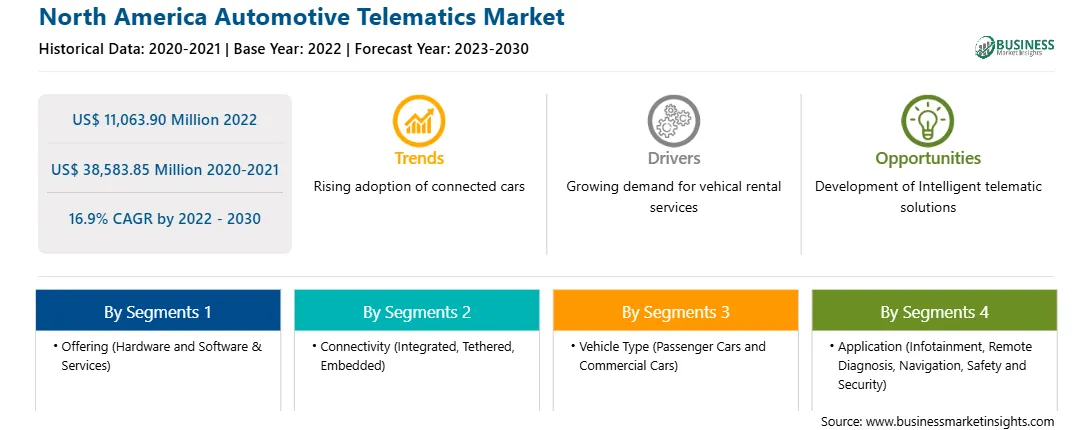

The North America automotive telematics market was valued at US$ 11,063.90 million in 2022 and is expected to reach US$ 38,583.85 million by 2030; it is estimated to register a CAGR of 16.9% from 2022 to 2030.

Rising Automotive Sales and Production Fuel North America Automotive Telematics Market

Automotive telematics is the combination of several hardware and software solutions, including GPS systems, onboard vehicle diagnostics, wireless telematic devices, and other solutions used to transmit the record and vehicle's data. Telematic devices control several parameters, such as location, speed, maintenance requirements, and services. Automotive telematics is a system of monitoring vehicles such as cars, automotive equipment, trucks, and other assets with the help of GPS technologies. Increasing automotive sales and production with built-in advanced telematics systems across the globe is driving market growth.

Automotive manufacturers use connectivity options, including automotive telematic solutions and software, to create a connected vehicle. Carmakers use a combination of GPS devices, accelerometers, gyroscopes, and connected solutions to meet customer requirements for the vehicles. There are several major components used in automotive telematics, which are:

According to the American Automotive Association, the automobile manufacturing sector accounted for 11% of the US GDP in 2022. The automotive manufacturing industry of the US is the eighth largest sector globally, which generates US$ 1 trillion annually to the US economy. The manufacturing sector of motor parts and vehicles represents 3% of the US GDP, according to the Alliance for Auto Innovation Report in 2022. The US car and automobile manufacturing sector was valued at US$ 104.1 billion in 2023. In 2021, nearly 9.2 million US vehicles were produced, an increase of 4.5% compared to 2020.

North America Automotive Telematics Market Overview

In North America, the US significantly contributes to the automobile industry. According to the Alliance for Automotive Innovation Report in 2021, the automotive industry's ecosystem, from automotive component manufacturers to the original vehicle manufacturers, generates over US$ 1 trillion annually for the US economy. The automotive sector in the US contributed 4.9% of its overall GDP, with manufacturing of vehicles and their parts representing 6% of the overall manufacturing in the country. Motor vehicles and parts, including gears, seating systems, doors, and transmission systems, are heavily exported from the US. Automotive vehicles and their components were the second-largest exporting goods in 2021, valued at ~US$ 105 billion.

The rising demand for automotive components by the original vehicle manufacturers worldwide is anticipated to create ample opportunity for the automotive gears market. The original vehicle manufacturers widely use automotive telematics to produce advanced features-based vehicles. The US-based ports have executed over US$ 400 billion in trade volume in vehicles and components. In the US, automakers and their suppliers are the largest part of the manufacturing sector, responsible for 3% of the country's GDP. As per the American Automotive Policy Council, in the last few years, automakers have exported vehicles worth ~US$ 692 billion. FCA Group, Ford, and General Motors are the major producers of vehicles in the US. These major players are providing advanced telematics solutions in their vehicles. Also, these companies are providing advanced features in their top vehicle models in order to meet their customers' demands. Over the past few years, these companies have invested ~US$ 35 billion in their US assembly, telematics solutions, assembly plants, and other infrastructure that connects and supports them. The country is also highly engaged in designing electric vehicles; Ford, FCA Group, and General Motors (GM) invested ~US$ 23 billion for the establishment and expansion of the production plants of the vehicles. These companies are offering in built automotive telematics systems on their premium models. For instance, in October 2022, Continental AG Germany based auto parts manufacturer invested around US$ 209.48 million for the expansion of its plant in Mexico.

The automotive sector in the US is growing rapidly due to capital availability and an increase in exports. Major automakers in the country announced several investments in EVs and AVs. GM announced an investment of US$ 35 billion in the automotive industry by 2025. Owing to the growing number of electric vehicles in the country, the demand for automotive tow bars is also increasing. The growing production of passenger cars and commercial vehicles is also anticipated to propel the demand for automotive telematics in this region.

North America Automotive Telematics Market Revenue and Forecast to 2030 (US$ Million)

Strategic insights for the North America Automotive Telematics provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 11,063.90 Million |

| Market Size by 2030 | US$ 38,583.85 Million |

| Global CAGR (2022 - 2030) | 16.9% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Offering

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America Automotive Telematics refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

1. Verizon Communications Inc

2. Geotab Inc.

3. Omnitracs LLC

4. Samsara Inc

5. Motive Technologies Inc

6. Lytx Inc

7. Zonar Systems Inc

8. ORBCOMM Inc

9. Trimble Inc

10. SkyBitz Inc

11. Valeo SE

12. TomTom NV

13. Denso Corp

14. Luxoft Switzerland AG

15. Harman International Industries Inc

The North America Automotive Telematics Market is valued at US$ 11,063.90 Million in 2022, it is projected to reach US$ 38,583.85 Million by 2030.

As per our report North America Automotive Telematics Market, the market size is valued at US$ 11,063.90 Million in 2022, projecting it to reach US$ 38,583.85 Million by 2030. This translates to a CAGR of approximately 16.9% during the forecast period.

The North America Automotive Telematics Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Automotive Telematics Market report:

The North America Automotive Telematics Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Automotive Telematics Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Automotive Telematics Market value chain can benefit from the information contained in a comprehensive market report.