North America constitutes countries such as the US, Canada, and Mexico. The region’s technological advancements have led to a highly competitive market. The companies operating in the North America automotive piston market are enhancing the overall business processes. North America has leveraged developed automotive industry. Therefore, it is one of the most significant passenger and commercial vehicle production nations across the world. According to OICA in 2018, 2019, and 2020, the production of passenger and commercial vehicles were 17,436,070, 16,783,398, and 13,375,622 units, respectively. The region has a presence of various automotive manufacturers, such as Ford Motor Company, Tesla, BMW, Porsche, Daimler, Toyota, Honda, Nissan, Renault, RAM, VW, Hyundai, Fiat Chrysler Automobiles, and General Motors Company. Also, the governments of the countries in North America are taking initiatives for the development of the automotive sector. For instance, the Department of Energy (DoE) administered the Advanced Technology Vehicle Manufacturing Loan Program worth US$ 25 billion. Such factors are driving the North American automotive piston market. The North American automotive industry outlook examines the region's expanding demand for passenger cars, commercial vehicles, and two-wheelers, as well as OEM investments in the region. North America is likely to witness a rapid increase in commercial vehicles in the coming years. The industry is growing due to government regulations requiring automobiles to be fuel-efficient and light in weight. The EPA and NHTSA have proposed that the Safer Affordable Fuel-Efficient (SAFE) cars regulation be adopted from 2021 to 2026 in the US. The rule could set corporate average fuel economy and greenhouse gas emissions limits for passenger and light commercial vehicles. Furthermore, the growing emphasis on reducing hazardous gas emissions, the increasing level of road congestion coupled with the high fuel proficiency of these vehicles, and its cost-effective feature are key aspects propelling demand for two-wheeler vehicles in North American. A few notable players operating in the North America two-wheeler market are Harley-Davidson, Inc.; Honda Motor Co., Ltd.; Kawasaki Heavy Industries, Ltd.; Polaris Industries, Inc.; Yamaha Motor Co., Ltd.; Suzuki Motor Corporation; KTM AG; and BMW AG. Further, the US and Canada are the well-developed economies analyzed in the study of North America automotive piston market. The automotive industry in the US is dominated by commercial vehicles such as vans, pick-up trucks, and buses. Also, the country presents the largest market for luxury vehicles. Thus, the growing automobile market drives the demand for various types of automotive pistons, which, in turn, propels the market growth in the country. Immense ICE vehicle production is the major factor driving the growth of the North America automotive piston market.

The United States has witnessed the most severe impact of COVID-19 in 2020. The automotive manufacturers as well as automotive component manufacturers in the region are affected due to nationwide lockdowns and travel restrictions, shut down of production facilities, and shortage of employees. The massive outbreak of the virus has created both a health crisis and an economic crisis in the United States. It has led to major disruptions in the automotive industry, impacting everything from supply chain and manufacturing to product sales. The pandemic has directly and indirectly impacted the industry’s short

Strategic insights for the North America Automotive Piston provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

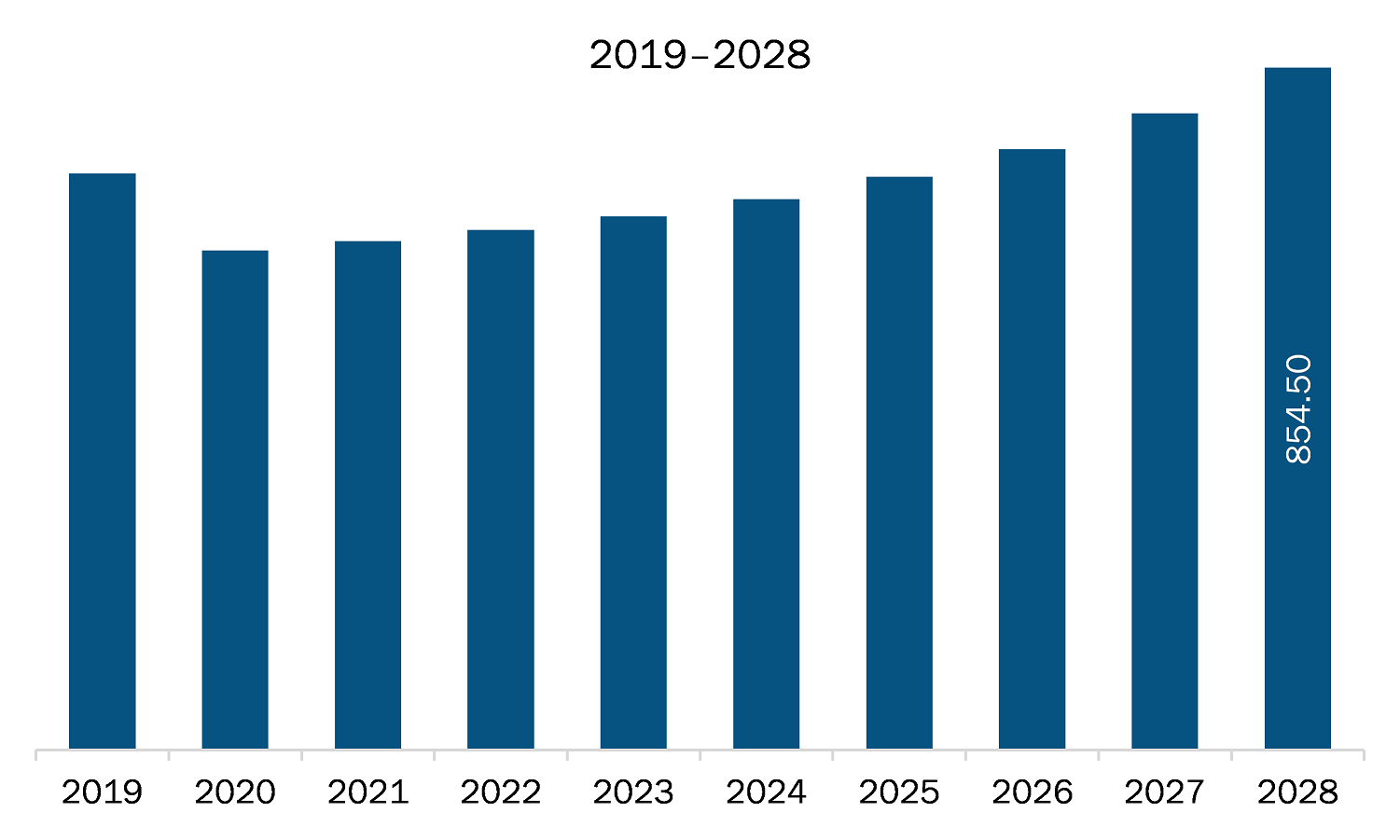

| Market size in 2021 | US$ 637.38 Million |

| Market Size by 2028 | US$ 854.50 Million |

| Global CAGR (2021 - 2028) | 4.3% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Material Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America Automotive Piston refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The automotive piston market in North America is expected to grow from US$ 637.38 million in 2021 to US$ 854.50 million by 2028; it is estimated to grow at a CAGR of 4.3% from 2021 to 2028. High wear and tear of engine components due to the rise in the overall operating life of vehicles is bolstering the sales of automotive pistons. Technological advancements and automation are allowing manufacturing companies to achieve greater productivity and profitability. The market players are engaged in making transportation more efficient, environmentally friendly, and more comfortable by continuously optimizing the combustion engine as well as by exploring the use of alternative fuels. OEMs are focusing on delivering greater vehicle efficiency and productivity. Mahle and Federal-Mogul, among others, are shifting from cast aluminum to lightweight and high-strength forged steel pistons that are more resilient to higher pressure and temperature values. Moreover, steel pistons are compatible with shorter and lighter engine block, and they consume less fuel than aluminum pistons. Modern aluminum pistons have an iron or steel insert to support the top ring. Therefore, companies have started large-scale production of steel pistons for mid-range power density diesel engines, which is anticipated to bring about new opportunities in the automotive piston market, especially in the leading-edge turbo-diesel applications.

The North America automotive piston market is segmented on the bases of material type, coating type, vehicle type, and piston type, and country. Based on material type, the market is segmented into steel and aluminum. The aluminum segment dominated the market in 2020 and steel segment is expected to be the fastest growing during the forecast period. On the basis of coating type, the automotive piston market is segmented into thermal barrier piston coating, dry film lubricant piston coating, and oil shedding piston coating. The thermal barrier piston coating segment dominated the market in 2020 and dry film piston coating segment is expected to be the fastest growing during the forecast period. On the basis of vehicle type, the automotive piston market, by vehicle type, is segmented into two wheelers, passenger vehicles, and commercial vehicles. The commercial vehicles segment dominated the market in is expected to be the fastest growing during the forecast period. On the basis of piston type, the automotive piston market is segmented into flat-top piston, dome piston, and dish piston. The flat-top piston segment dominated the market in 2020 and dome piston segment is expected to be the fastest growing during the forecast period.

A few major primary and secondary sources referred to for preparing this report on the automotive market in North America are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Arias Pistons; Hitachi Astemo Americas, Inc.; MAHLE GmbH; QUFU JINHUANG PISTON CO., LTD; Rheinmetall Automotive AG; RIKEN CORPORATION; Shandong Binzhou Bohai Piston Co., Ltd; and Tenneco Inc. are among others.

The North America Automotive Piston Market is valued at US$ 637.38 Million in 2021, it is projected to reach US$ 854.50 Million by 2028.

As per our report North America Automotive Piston Market, the market size is valued at US$ 637.38 Million in 2021, projecting it to reach US$ 854.50 Million by 2028. This translates to a CAGR of approximately 4.3% during the forecast period.

The North America Automotive Piston Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Automotive Piston Market report:

The North America Automotive Piston Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Automotive Piston Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Automotive Piston Market value chain can benefit from the information contained in a comprehensive market report.