The US, Canada, and Mexico are major economies in North America. The electrification of transportation has been one of the primary developments of the 21st century. According to Forbes, North America sales of electric vehicles (EVs) increased by 65% from 2017 to 2018, reaching 2.1 million vehicles, and the sales numbers remaining stable in 2019. Governments across the region are introducing various policies and taking initiatives to encourage the use of electric cars. Governments have also started a number of projects in collaboration with private businesses to build charging infrastructure. These activities are contributing to the growth of the North America electric vehicle sector, thus increasing the demand for embedded systems to build these cars.

Rising fuel prices and fossil fuel reserve depletion have prompted a shift to renewable energy sources. Automotive players are manufacturing new electric car models, which are gaining appeal among customers. Furthermore, fleet owners of commercial vehicles are recognizing the cost-savings associated with using electric cars and are replacing their older vehicles with electric vehicles. The reduced operating costs of electric automobiles are a major factor bolstering the North America electric vehicle sector, which is, in turn, boosting the automotive embedded system market.

North America is known for the highest rate of adoption of advanced technologies due to favorable government policies to boost innovation and strengthen infrastructure capabilities. As a result, any factor affecting the performance of industries in the region hinders its economic growth. Currently, the US is the world's worst-affected country due to the COVID-19 outbreak, Government authorities of various states in the country imposed several limitations on industrial, commercial, and public activities in 2020 to control the spread of infection. However, customers have returned to dealership floors as pandemic-related restrictions have relaxed in certain places. For the time being, several platforms, both real and virtual, exist alongside one another, complementing and competing with one another. Tesla, along with other early adopters such as Porsche, Volkswagen, and Volvo, is at the forefront of selling outside of a dealer showroom. Despite the COVID-19 breakdown, the North American automotive sector is catching up, which is a favorable indicator for automotive embedded system makers.

Strategic insights for the North America Automotive Embedded System provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

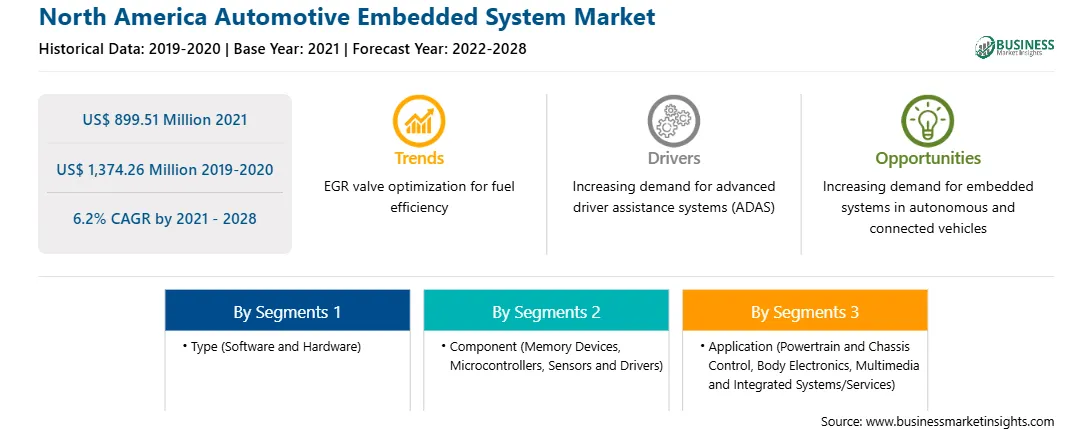

| Market size in 2021 | US$ 899.51 Million |

| Market Size by 2028 | US$ 1,374.26 Million |

| Global CAGR (2021 - 2028) | 6.2% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America Automotive Embedded System refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The North America Automotive Embedded System Market is valued at US$ 899.51 Million in 2021, it is projected to reach US$ 1,374.26 Million by 2028.

As per our report North America Automotive Embedded System Market, the market size is valued at US$ 899.51 Million in 2021, projecting it to reach US$ 1,374.26 Million by 2028. This translates to a CAGR of approximately 6.2% during the forecast period.

The North America Automotive Embedded System Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Automotive Embedded System Market report:

The North America Automotive Embedded System Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Automotive Embedded System Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Automotive Embedded System Market value chain can benefit from the information contained in a comprehensive market report.