North America Automated Test Equipment Market

No. of Pages: 97 | Report Code: BMIRE00030260 | Category: Electronics and Semiconductor

No. of Pages: 97 | Report Code: BMIRE00030260 | Category: Electronics and Semiconductor

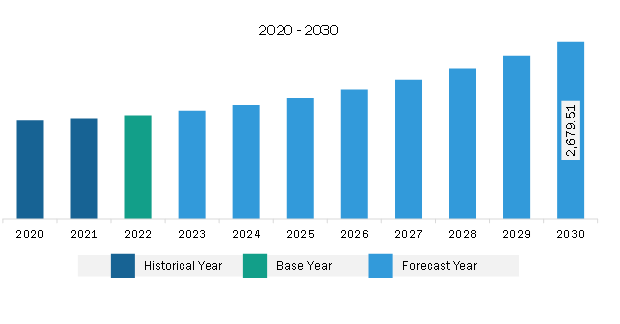

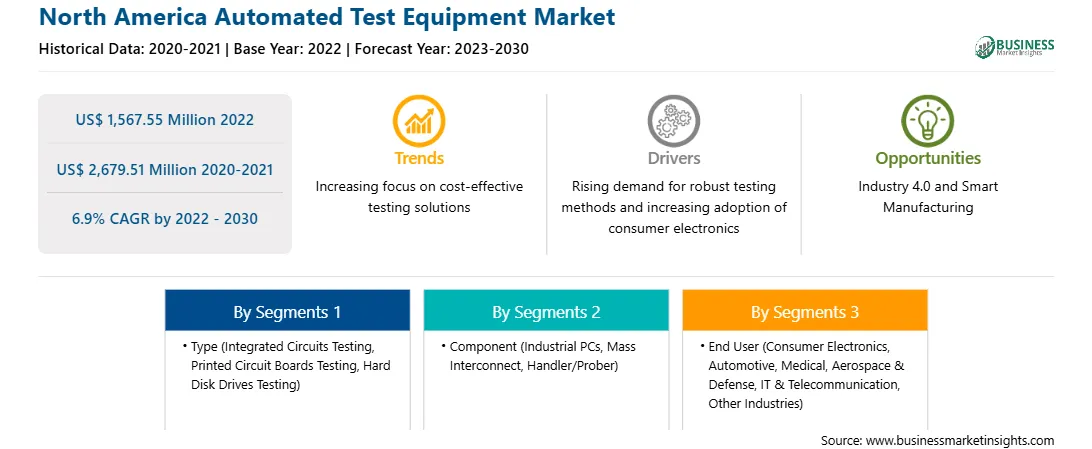

The North America automated test equipment market was valued at US$ 1,567.55 million in 2022 and is expected to reach US$ 2,679.51 million by 2030; it is estimated to register a CAGR of 6.9% from 2022 to 2030.

Increasing Automation in Manufacturing Sector Fuels North America Automated Test Equipment Market

The evolution of electronic and semiconductor technologies is paving the way for automation in the manufacturing sector. In recent years, automation has been highly adopted in the manufacturing sector for transforming manufacturing employment, factory floor operations, and the overall dynamics of the manufacturing sector. The growing adoption of several advanced technologies, such as artificial intelligence, robotics, and machine learning, allows machines to match or outpace humans in manufacturing activities, such as the cognitive activities that are required at various levels of manufacturing. Automation in the manufacturing processes increases productivity by up to more than 40% and removes 45% of repetitive work while integrated on the lean assembly line. Further, the evolution of Industry 4.0 is another trend driving the manufacturing sector. According to the GSM Association, the industry 4.0 trend is expected to grow at 46% during 2023-2025, associated with the rapid deployment of advanced technologies, which is driving the market. The evolution of Industry 4.0 or the Industrial Internet of Things (IIoT) that would utilize automated guided vehicles and the powers of collaborative robots is further boosting productivity in the manufacturing sector.

Semiconductor fabrications are increasing the adoption of automation in the manufacturing sector worldwide. The growing use of the Internet among customers is transforming and automating the entire value chain, from software to service to semiconductor devices. The emergence of IoT across the globe increases its adoption in the semiconductor industry. The industry is expected to play a crucial role in driving the North America automated test equipment market.

IoT-connected products, devices, and applications need ultra-small chips, wireless connectivity options, and low power consumption. The growing adoption of numerous IoT sensor-based products such as smart glasses, smartphones, and smartwatches is creating demand for MEMS/NEMS sensor platforms that have power advantages with lower technology nodes. These platforms increase functionality on a single small form-factor die.

The manufacturing sector is witnessing error-free and streamlined procedures using Robotic Process Automation (RPA). Manufacturing companies are replacing the production units from human sources with industry robots for the products to assemble, quality checks, and packaging to be done. The integration of RPA into the manufacturing sector for automatic activities such as preparing bills of materials, data migration, administration and reporting, ERP automation, logistics data automation, customer support, and service desk, and Web-integrated RPA is fueling the automated test equipment market growth. Manufacturing facilities have been incorporating greater levels of automation, owing to which the demand for new technologies is growing rapidly. Consumer electronics, automobiles, healthcare, and defense industries are the most prominent industry verticals that have become productive by integrating automation into the manufacturing assembly lines to streamline operations. These industries are anticipated to drive the demand for automatic test equipment as it results in lesser and quicker inspection of the semiconductor devices used for automation.

North America Automated Test Equipment Market Overview

The manufacturing industry plays a vital role in the growth of the North American economy. The US, Canada, and Mexico are the prime countries in the region. The availability of efficient infrastructure in developed countries (the US and Canada) enables manufacturing companies to explore the limits of science, technology, and commerce. According to the National Association of Manufacturers (NAM), the US has the second-largest manufacturing industry in the world, which accounted for ~US$ 2.9 trillion as of September 2023. As per a survey by Spex Precision Machine Technologies Inc., the manufacturing industry accounts for 11% of the US economy as of 2023. Moreover, this industry is expected to grow rapidly in the coming years owing to increased productivity due to the availability of modern technologies and decreasing gas prices. Rising labor costs in emerging markets and better protection available for intellectual properties are other important factors benefiting the manufacturing businesses in the US. The manufacturing industry dynamics in North America, specifically in the US, have been the most influential trends globally over the past few years. A few of the major manufacturing industries in North America include aerospace, automotive, telecommunications, and electronics. Thus, the well-established manufacturing industry generates a high demand for automated test equipment in the region.

The manufacturing industry in Canada is becoming more profitable with the rising demand for coal, metal, and oil products among consumers. The country is experiencing a declining dollar value and availability of cheaper power, which benefits manufacturing businesses. In Mexico, the manufacturing industry is noticing significant growth due to efforts made by governments to attract foreign direct investments (FDIs). Furthermore, the country's proximity to the US and ability to achieve cost-competitiveness due to NAFTA benefit this industry. The automotive industry in Mexico is experiencing a paradigm shift, with many huge automobile companies constructing their plants in the country. A few of the companies that recently opened their plants in the country include Kia Motors, Mercedes-Benz, Nissan, Audi, General Motors, and others. Axium Packaging Inc. and Ford are also planning to construct their new plants in the country and start operations by 2026.

North America Automated Test Equipment Market Revenue and Forecast to 2030 (US$ Million)

Strategic insights for the North America Automated Test Equipment provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 1,567.55 Million |

| Market Size by 2030 | US$ 2,679.51 Million |

| Global CAGR (2022 - 2030) | 6.9% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America Automated Test Equipment refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

1. Advantest Corp

2. Anritsu Corp

3. Astronics Corporation

4. Averna Technologies Inc

5. Chroma ATE Inc.

6. National Instruments Corp

7. SPEA S.p.A.

8. Teradyne Inc

9. Test Research, Inc.

The North America Automated Test Equipment Market is valued at US$ 1,567.55 Million in 2022, it is projected to reach US$ 2,679.51 Million by 2030.

As per our report North America Automated Test Equipment Market, the market size is valued at US$ 1,567.55 Million in 2022, projecting it to reach US$ 2,679.51 Million by 2030. This translates to a CAGR of approximately 6.9% during the forecast period.

The North America Automated Test Equipment Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Automated Test Equipment Market report:

The North America Automated Test Equipment Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Automated Test Equipment Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Automated Test Equipment Market value chain can benefit from the information contained in a comprehensive market report.