The North America arrhythmia monitoring devices market is divided into the US, Canada, and Mexico. North America is likely to capture significant share of the global market in 2021. The US is the largest market for Arrhythmia Monitoring Devices at a global level. The market's growth is attributed to increasing product development and growing government support to enhance heart treatment. In addition, the growing incidences of heart disease and its risk have led to the growth of the market indirectly. Cardiac arrhythmias, or irregular heart rhythms, can cause chest pain and fainting, and may lead to sudden cardiac death or stroke. According to the American Heart Association, 835,000 Americans are discharged from hospital care with cardiac arrhythmia diagnoses each year.1 More than 2.2 million Americans experience atrial fibrillation each year, a type of cardiac arrhythmia that is associated with an increased risk for stroke. According to the Centers for Disease Control and Prevention (CDC), in the United States, Heart disease is the leading cause of death for men, women, and people of most racial and ethnic groups. As per the given facts, in every 36 seconds, one person dies from cardiovascular disease, and 1 in every 4 deaths is because of heart disease, i.e., approximately 655,000 Americans die from heart disease each year. Due to the growing risk of heart disease, various initiatives are taking place. For instance, to prevent, manage, and reduce the risk factors associated with heart disease and stroke, CDC’s Division for Heart Disease and Stroke Prevention (DHDSP) supports state, local, and tribal. Along with DHDSP, the Division of Diabetes Translation also supports all 50 states and the District of Columbia to address the serious national health problems of diabetes, heart disease, and stroke.

COVID-19 virus outbreak was first observed in December 2019 in Wuhan (China), and it has spread to ~100 countries across the world, with the World Health Organization (WHO) stating it as a public health emergency. The global impacts of COVID-19 are being felt across several markets. Although the healthcare sector had witnessed SARS, H1N1, and other outbreaks in the last few years, the severity of the COVID-19 has made the situation more complicated due to its mode of transmission. North America witnessed growing number of COVID-19 cases since its outbreak. For instance, according to Worldometer, the number of cases reached to 34,434,803 million with 617,875 deaths reported in the United States as of 23rd June 2021. Similar impact was noticed in Mexico and Canada. As a result, healthcare systems are overburdened, and the delivery of medical care to all patients has become a challenge in the region. Moreover, sudden surge in number of infections led to shortage of emergency health supplies such as ventilators, beds, and oxygen cylinders. In order to manage the outbreak, government took preventive measures including total lockdowns and social distancing policies. In addition, medical device industry is also facing negative impact of this pandemic. As the COVID-19 pandemic continues to unfold, medical device companies are finding difficulties in managing their operations. Many companies offering products for cardiac monitoring have their business operations in the United states and business are adversely being affected by the effects of a widespread outbreak of COVID-19. This has disrupted and restricted company’s ability to distribute products, as well as temporary closures of our facilities or the facilities of our suppliers or customers. Moreover, market players also witnessed disruption in their business operations since March 2020, as US healthcare authorities framed policies about elective cardiac surgeries. Also, to free-up limited space for people being treated for the virus, hospitals have postponed, or cancelled. However, demand for vital sign monitoring devices in the region had substantial impact on the adoption of ECG Monitors. Though, there was disruption in distribution, demand for such products had marginal negative impact on the North America arrhythmia monitoring devices market.

Strategic insights for the North America Arrythmia Monitoring Devices provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

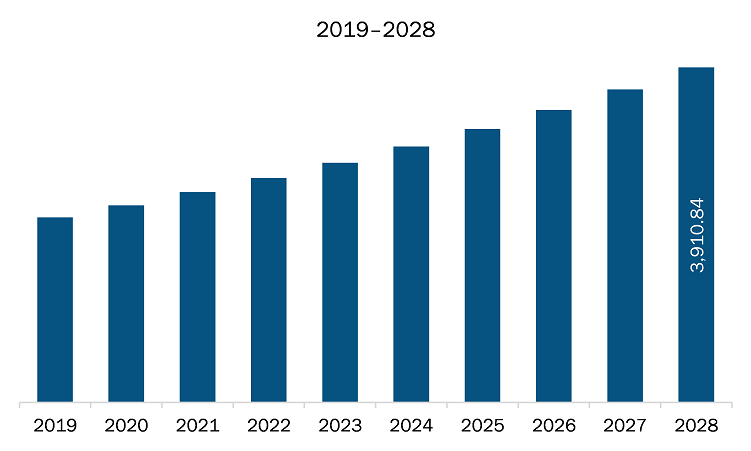

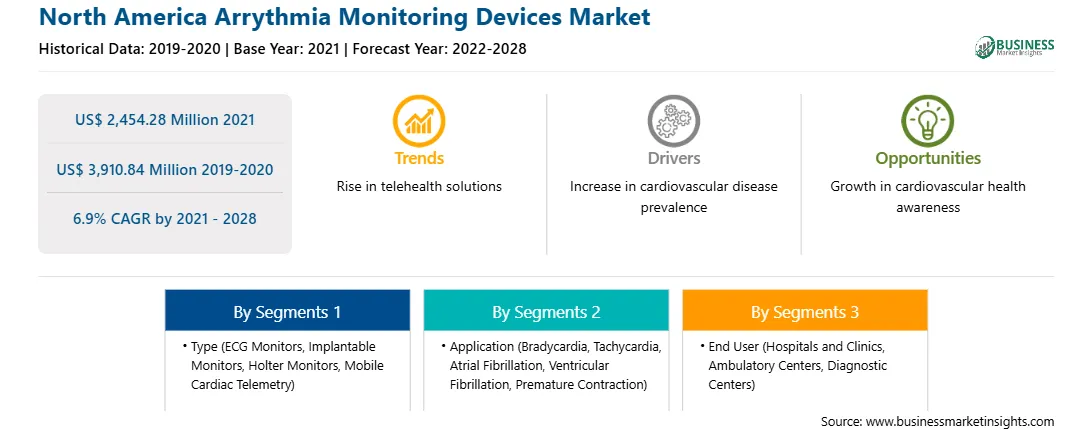

| Market size in 2021 | US$ 2,454.28 Million |

| Market Size by 2028 | US$ 3,910.84 Million |

| Global CAGR (2021 - 2028) | 6.9% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America Arrythmia Monitoring Devices refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The arrythmia monitoring devices market in North America is expected to grow from US$ 2,454.28 million in 2021 to US$ 3,910.84 million by 2028; it is estimated to grow at a CAGR of 6.9% from 2021 to 2028. Market consolidations; Changes or shift in technology-related trends encourage players to develop innovative devices. Recent developments in HIPPA-compliant technology have enabled secured data transmission throughout the monitoring period without delays. Emerging technologies are providing effective alternatives for traditional Holter monitors that create alerts for patients with a high risk of cardiac arrhythmia. Hence, continuous remote monitoring capabilities of these devices facilitating long-term, uninterrupted cardiac rhythm management are adding to their popularity. The mobile cardiac telemetry (MCT) system is an innovative product that assist in monitoring heart conditions of cardiac patients. Patients carry the tiny sensor and monitor throughout the day, and whenever, a cardiac event occurs, MCT sends the data to a central system for analysis and reaction. The system generates a report and shares it with the patient's physician, along with graphs and trends, for further actions. The abilities of MCT systems to analyze every heartbeat with little interference to the patient's normal days and to initiate an immediate emergency response as needed make them one of the most attractive choices cardiac monitoring. This is bolstering the growth of the arrythmia monitoring devices market.

In terms of type, the holter monitors segment accounted for the largest share of the North America arrythmia monitoring devices market in 2020. In terms of application, the atrial fibrillation segment held a larger market share of the arrythmia monitoring devices market in 2020. Further, the hospitals and clinics segment held a larger share of the market based on end user in 2020.

A few major primary and secondary sources referred to for preparing this report on arrythmia monitoring devices market in North America are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Abbott

The North America Arrythmia Monitoring Devices Market is valued at US$ 2,454.28 Million in 2021, it is projected to reach US$ 3,910.84 Million by 2028.

As per our report North America Arrythmia Monitoring Devices Market, the market size is valued at US$ 2,454.28 Million in 2021, projecting it to reach US$ 3,910.84 Million by 2028. This translates to a CAGR of approximately 6.9% during the forecast period.

The North America Arrythmia Monitoring Devices Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Arrythmia Monitoring Devices Market report:

The North America Arrythmia Monitoring Devices Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Arrythmia Monitoring Devices Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Arrythmia Monitoring Devices Market value chain can benefit from the information contained in a comprehensive market report.