Market Introduction

The North America aramid fiber market for automotive hoses is a highly fragmented market with the presence of considerable regional and local players providing numerous solutions for companies investing in the market arena. The automotive industry uses a different type of materials such as iron, aluminum, plastic, steel, and glass to build cars and other vehicles. Aramid fibers are extensively used as a substitute for fiber glass and steel due to their lightweight, high tensile strength, and superior corrosion resistance in automotive hoses manufacturing. Manufacturers in the automotive industry are constantly looking to stay competitive by bringing innovative products to market. Safety aspects, excellent performance, and the need for sustainability, pressure the automotive industry to develop high-quality products. Today, automotive hoses have to perform well despite increasingly difficult conditions. For example, under-hood hose systems must withstand increasingly harsh operating conditions. Consequently, the hose reinforcing yarns must have superior strength, as well as chemical, thermal, and dimensional stability. Therefore, aramid fibers are widely used in the automotive sector, as they help improve the safety, performance, and durability of automotive components, including automotive hoses and automotive belts, for a variety of vehicles. In addition, using aramid fiber gives various benefits such as extended product lifetime, improved product performance, and others.

Due to COVID-19 outbreak, supply chains, manufacturing processes, and research and development activities in the automotive industry are adversely affected. For instance, the car industry in the US remained vulnerable during the outbreak pandemic. Vehicle sales fell over 20% year-on-year in August, hitting 1.33 thousand vehicles. Total sales from January to August 2020 were roughly 8.8 thousand units, a 23% decrease compared to last year. However, with the opening of several growth markets, vaccination developments, and initiatives taken by various governments to support economic and industrial growth in North America, the demand for the aramid fiber is anticipated to grow at a steady pace in the coming years.

Strategic insights for the North America Aramid Fiber provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the North America Aramid Fiber refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

North America Aramid Fiber Strategic Insights

North America Aramid Fiber Report Scope

Report Attribute

Details

Market size in 2021

US$ 30,370.48 thousand

Market Size by 2028

US$ 49,265.28 thousand

Global CAGR (2021 - 2028)

7.2%

Historical Data

2019-2020

Forecast period

2022-2028

Segments Covered

By Type

Regions and Countries Covered

North America

Market leaders and key company profiles

North America Aramid Fiber Regional Insights

Market Overview and Dynamics

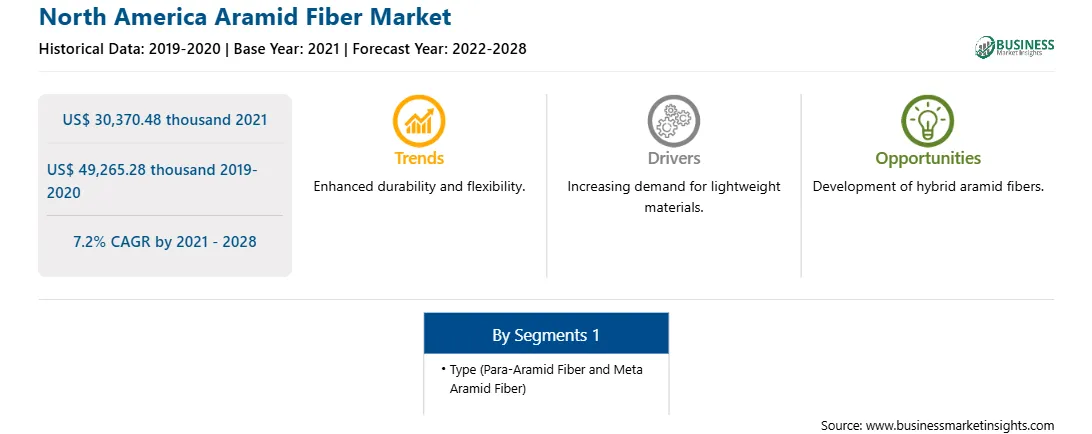

The aramid fiber market for automotive hoses in North America is expected to grow from US$ 30,370.48 thousand in 2021 to US$ 49,265.28 thousand by 2028; it is estimated to grow at a CAGR of 7.2% from 2021 to 2028. Electric vehicles require different kinds of hoses and fluid transmission assemblies than traditional internal combustion engine vehicles. Large battery electric vehicles generate a lot of heat, and many manufacturers use composite tubes to enclose the batteries and prevent their heat management. Electric vehicles tubes are typically much longer and narrower than traditional automotive tubes and electric vehicles also require many of the same hoses, pipe fittings, and assemblies as traditional vehicles, such as the air conditioning and brake lines. They also require special considerations to ensure appropriate performance in the operation of an electric vehicle. For instance, air conditioning hose assemblies can also be used in electric vehicles to carry refrigerant and lubricant between the components of the electric vehicle. These systems typically utilize both a pressure and return line. Further, increasing adoption of aramid fiber in electric vehicles, owing to several requirements by the automotive companies, such as replacing conventional substrates materials with synthetic substrates and increasing focus on environmental concerns. Aramid fibers are known for their temperature resistance, strength, reinforcement, and other properties that can help improve filters, belts, gaskets, and other automotive components. Thus, the rising adoption of electric vehicles is expected to provide lucrative opportunities for automotive hoses manufacturers in the market.

Key Market Segments

Based on type, the para-aramid fiber segment accounted for the largest share of the North America aramid fiber market for automotive hoses in 2020.

Major Sources and Companies Listed

A few major primary and secondary sources referred to for preparing this report on the North America aramid fiber market for automotive hoses are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report include DuPont de Nemours, Inc.; Teijin Limited; Aramid Hpm, LLC; Continental AG; Kolon Industries Inc.; YOKOHAMA RUBBER CO., LTD.; Beaver Manufacturing Company; Artel Rubber Company; Gates Corporation; Norres and Huvis Corp..

Reasons to buy report

North America Aramid Fiber Market for Automotive Hoses Segmentation

North America Aramid Fiber Market for Automotive Hoses – By Country

North America Aramid Fiber Market for Automotive Hoses – Company Profiles

The North America Aramid Fiber Market is valued at US$ 30,370.48 thousand in 2021, it is projected to reach US$ 49,265.28 thousand by 2028.

As per our report North America Aramid Fiber Market, the market size is valued at US$ 30,370.48 thousand in 2021, projecting it to reach US$ 49,265.28 thousand by 2028. This translates to a CAGR of approximately 7.2% during the forecast period.

The North America Aramid Fiber Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Aramid Fiber Market report:

The North America Aramid Fiber Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Aramid Fiber Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Aramid Fiber Market value chain can benefit from the information contained in a comprehensive market report.