Growing Aquaculture Industry is Driving the North America Aquaculture Vaccines Market

According to the data in a report titled "The State of World Fisheries and Aquaculture” published by the Food and Agriculture Organization of the United Nations in 2022, global consumption of aquatic foods, excluding algae, has increased by more than five times the quantity consumed nearly 60 years ago. Aquatic food consumption across the world increased from 28 million tonnes in 1961 to ~158 million tonnes in 2019. The consumption increased at an average annual rate of 3.0 % from 1961, compared with a population growth rate of 1.6 %. Per capita consumption is rising due to increasing supplies, changing consumer preferences, and growing income. In 2019, the Food and Agriculture Organization of the United Nations estimated the per capita consumption of aquatic foods for 227 countries. Regarding population, the countries consuming less than the world average accounted for 54 % of the world population in 2019. The rising consumption of aquatic animals is expediting the growth of the aquaculture industry. Aquaculture vaccines lower the chance of infection and increase the yield of products. Therefore, the growing aquaculture industry fuels the growth of the aquaculture vaccines market.

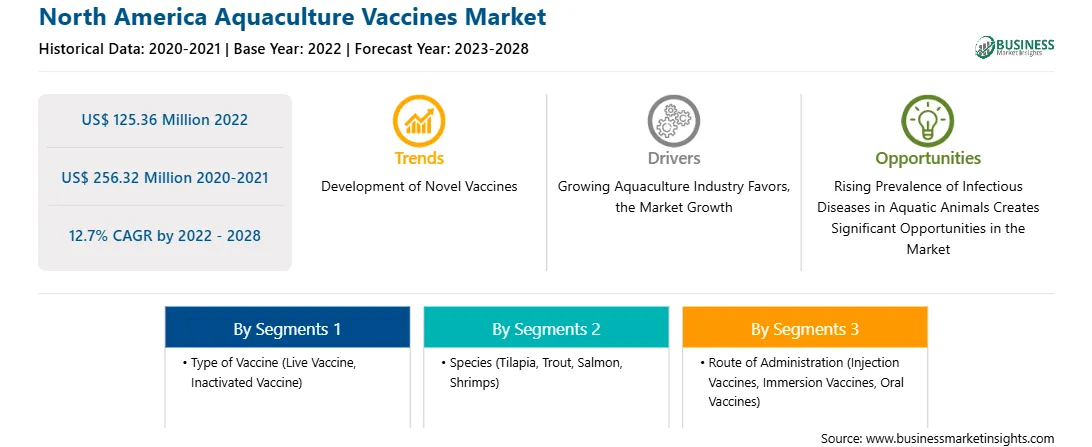

North America Aquaculture Vaccines Market Overview

The North America aquaculture vaccines market is segmented into the US, Canada, and Mexico. The market growth in this region is attributed due to the growing aquaculture industry and surging demand for aquatic animal-derived food products. The US aquaculture vaccines market holds a significant share in North America. The market growth is due to increasing aquaculture production, high prevalence of infectious diseases in the aquaculture sector, and rising development and launch of new aquaculture vaccines. According to The OECD Review of Fisheries 2020, in 2018, the US produced 5.2 million tonnes of fish, valued at US$ 7063.5 million. 83% from fisheries, and 17% of this value came from aquaculture. Between 2008 and 2018, the production quantity increased by 7%, while its value raised by 29%. Further, In July 2020, Zoetis acquired Fish Vet Group from Benchmark Holdings, PLC, as a strategic addition to its Pharma business which develops and commercializes fish vaccines and offers services in vaccination and diagnostics for aquaculture. Adding Fish Vet Group grows the geographic reach and improves the diagnostics expertise and testing services, including environmental testing, that Pharmaq’s reference lab Pharmaq Analytiq can now offer fish farmers in major aquaculture markets. Thus, the growing developments by various market players in the US aquaculture industry, along with the aforementioned factors, will boost the market for aquaculture vaccines in the US.

Strategic insights for the North America Aquaculture Vaccines provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 125.36 Million |

| Market Size by 2028 | US$ 256.32 Million |

| Global CAGR (2022 - 2028) | 12.7% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2028 |

| Segments Covered |

By Type of Vaccine

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America Aquaculture Vaccines refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

North America Aquaculture Vaccines Market Segmentation

The North America aquaculture vaccines market is segmented into type of vaccine, species, route of administration, and country.

Based on type of vaccine the North America aquaculture vaccines market, is segmented into live vaccines, inactivated vaccines, other vaccines. The inactivated vaccines segment held the largest market share in in 2022.

Based on species, the North America aquaculture vaccines market is divided into tilapia, trout, salmon, shrimps, and others. The salmon segment held the largest share of the market in 2022.

Based on route of administration the North America aquaculture vaccines market, is segmented into injection vaccines, immersions vaccines, and oral vaccines. The injection vaccines segment held the largest share of the market in 2022.

Based on country, the North America aquaculture vaccines market is segmented into the US, Canada, and Mexico. The US dominated the aquaculture vaccines market share in 2022.

AquaTactics Fish Health; HIPRA SA; Merck & Co Inc.; Zoetis Inc.; Phibro Animal Health Corp; and Elanco Animal Health Inc. are the leading companies operating in the North America aquaculture vaccines market.

The North America Aquaculture Vaccines Market is valued at US$ 125.36 Million in 2022, it is projected to reach US$ 256.32 Million by 2028.

As per our report North America Aquaculture Vaccines Market, the market size is valued at US$ 125.36 Million in 2022, projecting it to reach US$ 256.32 Million by 2028. This translates to a CAGR of approximately 12.7% during the forecast period.

The North America Aquaculture Vaccines Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Aquaculture Vaccines Market report:

The North America Aquaculture Vaccines Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Aquaculture Vaccines Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Aquaculture Vaccines Market value chain can benefit from the information contained in a comprehensive market report.