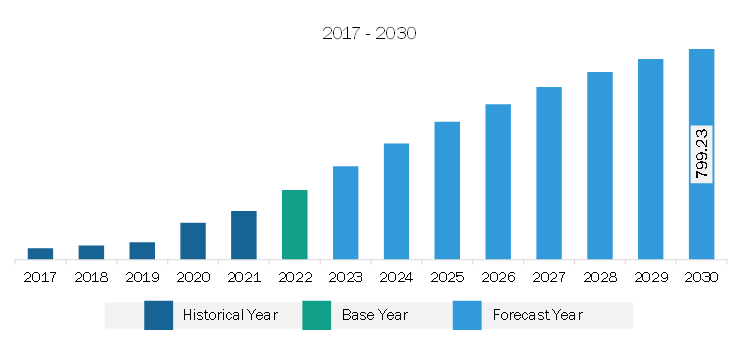

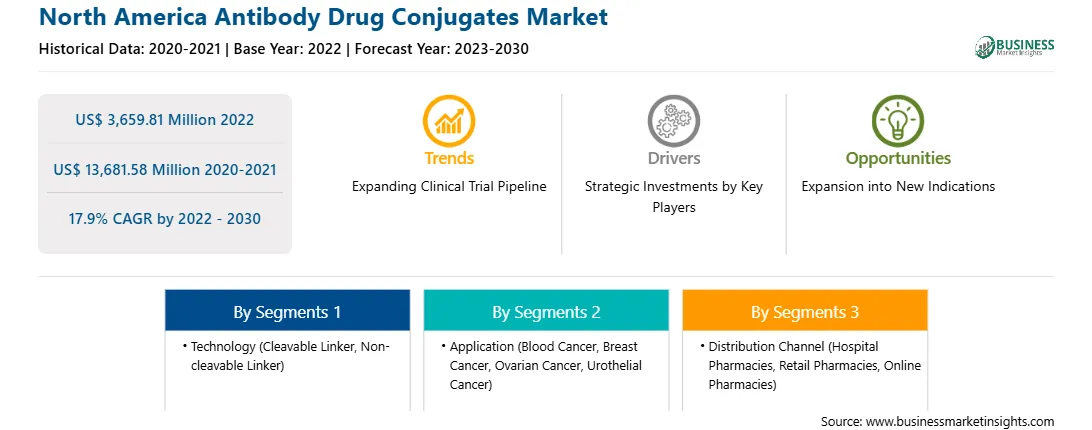

The North America antibody drug conjugates market was valued at US$ 3,659.81 million in 2022 and is expected to reach US$ 13,681.58 million by 2030; it is estimated to grow at a CAGR of 17.9% from 2022 to 2030.

According to an article, ‘An Insight into FDA Approved Antibody-Drug Conjugates for Cancer Therapy,’ published in the National Library of Medicine in September 2021, there were eight approvals for ADC in 2017, and it increased to 11 in September 2021. The FDA has approved a few more ADCs, including Lumoxiti, till the end of November 2022. Worldwide, more than 50 biopharmaceutical companies are involved in developing ADCs. The companies have targeted mainly blood cancer and other cancer types, such as lung, bladder, and gynecological tumors. Additionally, in June 2021, Evercore, a US-based Investment Banking and Evercore ISI, estimated that by 2030, the companies will sell ADCs for over US$ 20 billion annually. The increasing approvals and commercialization of ADCs are leading to significant market growth. Below is a list of FDA-approved ADCs.

Sr. No. | Company | Trade Name | ADC Drug | Cancer Type | Approval Year |

1 | Pfizer/Wyeth | Mylotarg | Gemtuzumab ozogamicin | Relapsed Acute Myelogenous Leukemia (AML) | 2000; 2017 |

2 | Seagen Genetics, Millennium/Takeda | Adcetris | Brentuximab vedotin | Relapsed HL and Relapsed sALCL | 2011 |

3 | Genentech, Roche | Kadcyla | Trastuzumab emtansine | HER2-positive Metastatic Breast Cancer (mBC) | 2013 |

4 | Pfizer/Wyeth | Besponsa | Inotuzumab ozogamicin | Relapsed or Refractory CD22-positive B-cell Precursor Acute Lymphoblastic Leukemia | 2017 |

5 | Astrazeneca | Lumoxiti | Moxetumomab pasudotox | Relapsed or refractory hairy cell leukaemia (HCL) in adults | 2018 |

6 | Genentech, Roche | Polivy | Polatuzumab vedotin-piiq | Relapsed or refractory diffuse large B-cell lymphoma (DLBCL) | 2019 |

7 | Astellas/Seagen Genetics | Padcev | Enfortumab vedotin | Metastatic urothelial cancer in adult who have received a PD-1 or PD-L1 inhibitor, and a Pt-containing therapy | 2019 |

8 | AstraZeneca/Daiichi Sankyo | Enhertu | Trastuzumab deruxtecan | Metastatic HER2-positive breast cancer in adults, received two or more prior anti-HER2 based regimens | 2019 |

9 | Immunomedics | Trodelvy | Sacituzumab govitecan | Metastatic triple-negative breast cancer (mTNBC) in adults, and patients received minimum two prior therapies for patients with relapsed or refractory metastatic disease | 2020 |

10 | GlaxoSmithKline (GSK) | Blenrep | Belantamab mafodotin-blmf | Relapsed or refractory multiple myeloma in adults | 2020, withdrawn on 22 Nov. 2022 in the US. |

11 | ADC Therapeutics | Zynlonta | Loncastuximab tesirine-lpyl | Large B-cell lymphoma | 2021 |

12 | Seagen Inc | Tivdak | Tisotumab vedotin-tftv | Recurrent or metastatic cervical cancer | 2021 |

13 | ImmunoGen | Elahere | Mirvetuximab soravtansine | Platinum-resistant ovarian cancer | 2022 |

The antibody drug conjugates (ADCs) market in North America is analyzed based on the US, Canada, and Mexico. The market growth in the region is attributed to increasing research and development for ADCs, rising product approvals, growing awareness about ADCs, and rising number of mergers, collaborations, and partnerships among the operating players. In addition, significantly growing incidences of cancer are among the other leading factors escalating the demand for ADCs.

Furthermore, growing partnerships among the companies to expand their technologies in different regions enable market growth. In August 2023, ImmunoGen, Inc. and Takeda Pharmaceutical Company Limited collaborated to develop and commercialize ELAHERE, Immunogen’s ADC therapy, in Japan. Under the collaboration agreement, ImmunoGen, Inc. receives upfront and additional payments upon conversion of FDA accelerated approval of ELAHERE to treat platinum-resistant ovarian cancer. If Takeda achieves certain regulatory and commercial milestones and double-digit royalties through the net sales of ELAHERE in Japan, it will pay an additional payment to ImmunoGen, Inc. Nevertheless, Immunogen has retained its exclusive production rights and will supply the product for development and commercialization in Japan. In return, Takeda will be responsible for all regulatory filing and have an exclusive license to develop and commercialize ELAHERE in Japan.

Strategic insights for the North America Antibody Drug Conjugates provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 3,659.81 Million |

| Market Size by 2030 | US$ 13,681.58 Million |

| Global CAGR (2022 - 2030) | 17.9% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Technology

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America Antibody Drug Conjugates refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The North America antibody drug conjugates market is segmented based on technology, application, distribution channel, and country.

Based on technology, the North America antibody drug conjugates market antibody drug conjugates market is bifurcated into cleavable linker and non-cleavable linker. The cleavable linker segment held a larger share in 2022.

Based on application, the North America antibody drug conjugates market antibody drug conjugates market is segmented into blood cancer, breast cancer, ovarian cancer, urothelial cancer, and others. The breast cancer segment held the largest share in 2022.

Based on distribution channel, the North America antibody drug conjugates market antibody drug conjugates market is segmented into hospital pharmacies, retail pharmacies, and online pharmacies. The hospital pharmacies segment held the largest share in 2022.

Based on country, the North America antibody drug conjugates market is categorized into US, Canada, and Mexico. The US dominated the North America antibody drug conjugates market in 2022.

ADC Therapeutics SA, Pfizer Inc, Hoffmann-La Roche Ltd, ImmunoGen, Inc, GSK Plc, Gilead Sciences Inc, AstraZeneca Plc, Astellas Pharma Inc, RemeGen Co Ltd, and Takeda Pharmaceutical Co Ltd are some of the leading companies operating in the North America antibody drug conjugates market.

1. ADC Therapeutics SA

2. Pfizer Inc

3. Hoffmann-La Roche Ltd

4. ImmunoGen Inc

5. GSK Plc

6. Gilead Sciences Inc

7. AstraZeneca Plc

8. Astellas Pharma Inc

9. RemeGen Co Ltd

10. Takeda Pharmaceutical Co Ltd

The North America Antibody Drug Conjugates Market is valued at US$ 3,659.81 Million in 2022, it is projected to reach US$ 13,681.58 Million by 2030.

As per our report North America Antibody Drug Conjugates Market, the market size is valued at US$ 3,659.81 Million in 2022, projecting it to reach US$ 13,681.58 Million by 2030. This translates to a CAGR of approximately 17.9% during the forecast period.

The North America Antibody Drug Conjugates Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Antibody Drug Conjugates Market report:

The North America Antibody Drug Conjugates Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Antibody Drug Conjugates Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Antibody Drug Conjugates Market value chain can benefit from the information contained in a comprehensive market report.