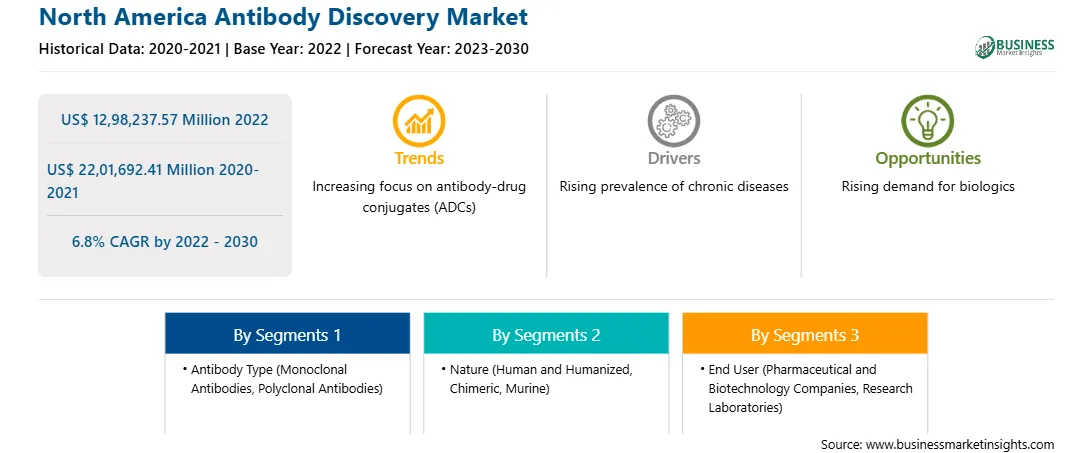

The North America antibody discovery market was valued at US$ 12,98,237.57 million in 2022 and is expected to reach US$ 22,01,692.41 million by 2030; it is estimated to register a CAGR of 6.8% from 2022 to 2030.

Antibodies, including monoclonal and polyclonal, find applications in academic, research, and pharmaceutical institutes and organizations, wherein they are used in several R&D activities related to drug and biomarker development, and other therapeutic and clinical diagnostics product development. Small and medium-sized companies focus on raising their R&D investments every year. In April 2020, the US federal government assigned US$ 3.5 billion to the Biomedical Advanced Research and Development Authority (BARDA) under its Coronavirus Aid, Relief, and Economic Security (CARES) Act to provide financial support for the manufacturing, production, and procurement of vaccines, diagnostics, therapeutics, and small molecule active pharmaceutical ingredients (APIs), among others. Further, Bio-Rad, a pharmaceutical company, provides 10,000 antibodies, along with antigens, reagents, and buffers, to develop in vitro diagnostic tests. Therefore, the increasing investments by pharmaceutical companies in research and development activities related to antibody discovery to develop better treatment options for various diseases propels the antibody discovery market growth.

The North America antibody discovery market is segmented into the US, Canada, and Mexico. Market growth in the region is determined by an increase in the prevalence of cancer, the strong presence of the antibody research industry, and technological advancements in the R&D sector. According to the American Cancer Society, ~1.8 million new cancer cases were diagnosed and ~606,520 deaths related to cancer were recorded in the US in 2020. This bolsters the need for therapeutic antibodies, thereby fueling the antibody discovery market growth. An upsurge in funding further enables the development of new technologies, pooling of resources and expertise across countries and organizations, and conducting research work into existing antibody treatments. This has led to a better understanding of the immune system, and the development of effective and targeted antibodies. Additionally, the increased funding allows scientists to conduct large-scale clinical trials that are mandatory to evaluate the effectiveness of a particular antibody.

Strategic insights for the North America Antibody Discovery provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 12,98,237.57 Million |

| Market Size by 2030 | US$ 22,01,692.41 Million |

| Global CAGR (2022 - 2030) | 6.8% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Antibody Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America Antibody Discovery refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The North America antibody discovery market is categorized into antibody type, nature, services, end user, and country.

Based on antibody type, the North America antibody discovery market is segmented into monoclonal antibodies, polyclonal antibodies, and others. The monoclonal antibodies segment held the largest North America antibody discovery market share in 2022.

In terms of nature, the North America antibody discovery market is segmented into human and humanized, chimeric, and murine. The human and humanized segment held the largest North America antibody discovery market share in 2022.

By services, the North America antibody discovery market is divided into phage display, hybridoma, transgenic animal, single cell, and yeast display. The phage display segment held the largest North America antibody discovery market share in 2022.

Based on end user, the North America antibody discovery market is categorized into pharmaceutical and biotechnology companies, research laboratories, and others. The pharmaceutical and biotechnology companies segment held the largest North America antibody discovery market share in 2022.

Based on country, the North America antibody discovery market is categorized into the US, Canada, and Mexico. The US dominated the North America antibody discovery market share in 2022.

Charles River Laboratories International Inc, Creative Biolabs Inc, Evotec SE, Bruker Cellular Analysis Inc, BioDuro LLC, Sartorius AG, Aragen Life Sciences Ltd, Twist Bioscience Corp, NanoCellect Biomedical Inc, and Biocytogen Pharmaceuticals Beijing Co Ltd. are some of the leading companies operating in the North America antibody discovery market.

The North America Antibody Discovery Market is valued at US$ 12,98,237.57 Million in 2022, it is projected to reach US$ 22,01,692.41 Million by 2030.

As per our report North America Antibody Discovery Market, the market size is valued at US$ 12,98,237.57 Million in 2022, projecting it to reach US$ 22,01,692.41 Million by 2030. This translates to a CAGR of approximately 6.8% during the forecast period.

The North America Antibody Discovery Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Antibody Discovery Market report:

The North America Antibody Discovery Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Antibody Discovery Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Antibody Discovery Market value chain can benefit from the information contained in a comprehensive market report.