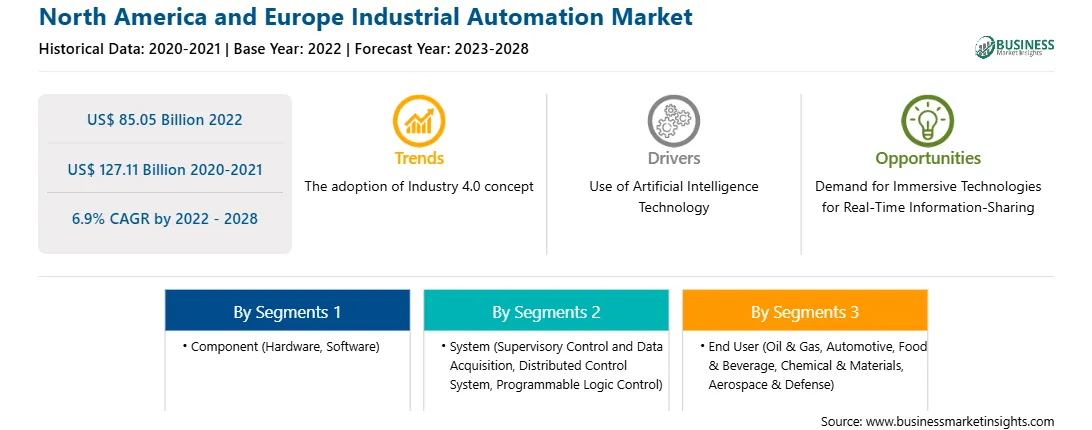

North America and Europe Industrial Automation Market

No. of Pages: 231 | Report Code: BMIRE00027316 | Category: Electronics and Semiconductor

No. of Pages: 231 | Report Code: BMIRE00027316 | Category: Electronics and Semiconductor

Industrial automation uses control systems, such as robots, computers, and information technologies, to handle various machinery in an industry to replace human intervention. Depending on the operations involved, the industrial automation systems are majorly classified into two types—process plant automation and manufacturing automation. Industrial automation offers high product quality, reliability, and production rate while reducing production and design costs by deploying new, innovative, and integrated technologies and services. They possess various features, such as high productivity, quality, flexibility, and information accuracy, which are likely to increase the uptake of automation in the industrial sector during the forecast period. Also, the surge in the uptake of automation solutions in the oil & gas, manufacturing, chemicals & materials, pharmaceuticals, and other industries is driving the industrial automation market growth.

The North America and Europe industrial automation market is mainly driven by the rising demand for automation across end use industries such as food & beverage, construction, and e-commerce industry. Inventory sold by e-commerce sellers is stored in warehouses; to reduce the time for sorting and stocking of these products, automated storage and retrieval systems (ASRS) seems to be one of the best tools. The purchasing pattern of consumers is moving toward online shopping. For instance, more than 60% of the population in the US is engaged in online shopping. Further, customers expect faster delivery time owing to which e-commerce players are adopting automation in their processes. The fluctuations in demand of stock-keeping units (SKUs) create complexities in picking operations, which slows down the fulfillment process.

Several e-commerce giants have also increased their investment in automating their warehouse facilities over the years. In August 2022, The Kroger Co. announced the expansion of its customer fulfillment center (CFC) network, supported by Ocado Group’s technology. Two new CFCs are automated by utilizing technology from Ocado Group. The first such automated CFC was opened in April 2021. Additionally, new products and technologies are being launched regularly for supporting the growing automation of warehouses. In June 2022, Amazon announced the launch of new fleet of robots and automated systems. An autonomous robot, named Proteus, and robotic system titled Cardinal, was announced by Amazon. As per the company, Proteus allows for full autonomy of the warehouse floor and can operate in a manner that augments simple, safe interaction between technology and people. These factors are expected to boost the industrial automation market growth during the forecast period.

Further, the growth in the adoption of industrial robots for different applications such as production, labelling, packaging, and loading/unloading operations is another major factor catalyzing the industrial automation market size across the North America and Europe regions. The demand for industrial robots is increasing due to the growth in the adoption of automated technologies across different industrial facilities that are enabling to enhance the overall operational efficiency of facilities. Many industries including food & beverage, retail, e-commerce, consumer electronics, and others have been constantly pushing the adoption of industrial robotic technologies for automating their respective facility operations and catalyzing the industrial automation market size across North America and European regions.

The North America and Europe industrial automation market, by system, is segmented into supervisory control and data acquisition (SCADA), distributed control system, programmable logic control, and others. The others segment dominated the industrial automation market in 2021. The segment includes industrial automation systems such as Enterprise Resource Planning (ERP), Product Lifecycle Management (PLM), and Manufacturing Execution Systems (MES). ERP for industrial automation is used to accelerate business growth. Using multiple software to manage different departmental activities, many companies are switching to a single integrated solution, thereby increasing the deployment of ERP in the industrial sector. Product lifecycle management (PLM) is a term that describes how manufacturers connect computer-aided design (CAD) with engineering and manufacturing requirements to speed product development cycles, manage quality and cost, and track products through distribution and end of life. Manufacturing Execution Systems (MES) are software solutions that ensure quality and efficiency are built into the manufacturing process and are proactively and systematically enforced. Manufacturing Execution Systems connect multiple plants, sites, and vendors’ live production information and integrate easily with equipment, controllers, and enterprise business applications.

The supervisory control and data acquisition (SCADA) segment is the second-largest segment and is likely to gain prominence during the forecast period in the industrial automation market. SCADA combines software and hardware elements that allow industrial organizations to control and monitor industrial processes locally or remotely. They also gather real-time process data through sensors, valves, pumps, motors, and more through human-machine interface (HMI) software and record events into a log file. The growing adoption of Industry 4.0 solutions, high demand for industrial mobility solutions for efficient management of process industry, and the use of software platforms such as IoT and artificial intelligence in the industrial sector drive the demand for SCADA in industrial automation market. Such instances have been catalyzing the industrial automation market growth for SCADA segment.

ABB Ltd.; Bosch Rexroth AG; Emerson Electric Co.; Hitachi Ltd.; Honeywell International, Inc.; Mitsubishi Electric Corporation; Omron Corporation; Rockwell Automation, Inc.; Schneider Electric SE; and Siemens AG are some of the key industrial automation market players in North America and Europe. Various other companies are also introducing new technologies and offerings, helping the North America and Europe industrial automation market players expand their business in terms of revenue. Moreover, apart from the above listed industrial automation market players, several other companies were also analyzed to get a holistic view of the industrial automation market.

Strategic insights for the North America and Europe Industrial Automation provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 85.05 Billion |

| Market Size by 2028 | US$ 127.11 Billion |

| Global CAGR (2022 - 2028) | 6.9% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2028 |

| Segments Covered |

By Component

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America and Europe Industrial Automation refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The North America and Europe Industrial Automation Market is valued at US$ 85.05 Billion in 2022, it is projected to reach US$ 127.11 Billion by 2028.

As per our report North America and Europe Industrial Automation Market, the market size is valued at US$ 85.05 Billion in 2022, projecting it to reach US$ 127.11 Billion by 2028. This translates to a CAGR of approximately 6.9% during the forecast period.

The North America and Europe Industrial Automation Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America and Europe Industrial Automation Market report:

The North America and Europe Industrial Automation Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America and Europe Industrial Automation Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America and Europe Industrial Automation Market value chain can benefit from the information contained in a comprehensive market report.