The demand for composite testing is significantly increasing, owing to the growing requirement for composite material from automotive and aerospace industries. Composites find application in the transport industry and the interior and exterior structural applications in aircraft, owing to their higher strength, superior performance, excellent resistance to rupture, corrosion, and wear. They are mostly adopted across industries such as automotive, aerospace, construction, chemical, medical, energy, and materials. Increasing demand for lightweight components in the automotive industry, growing application of composites material in manufacturing aircraft, and increasing investment in wind energy are the key drivers for the North America and Europe composite testing market.

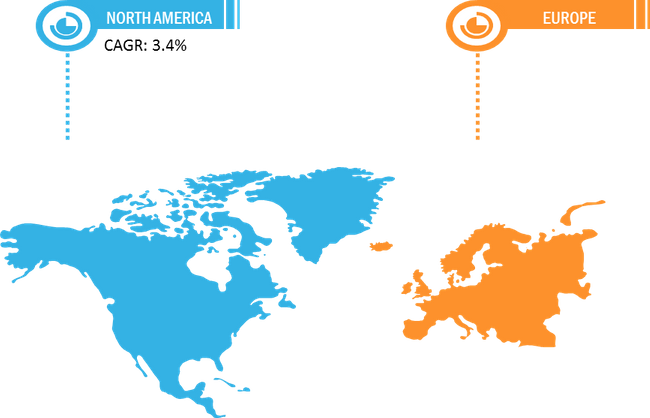

The composite testing market in North America is expected to grow at the highest CAGR during the forecast period. The US and Canada are the most prominent economies in this region. The constant increase in automobile production is fueling the demand for composite materials, which is further driving the market in this region. The surge in demand for electric vehicles further boosts the application of composites testing in the region as electric vehicles’ components are undergoing intense materials testing to develop lightweight electric vehicles. Several OEMs have announced their plans to invest significantly in electric vehicles. More than ten of the largest OEMs globally have declared electrification targets for 2030 and beyond. In addition, in June 2021, the US Department of Energy (DoE) had announced funding of US$ 200 million over the next five years for batteries, electric vehicles, and connected vehicles projects to support electric vehicles innovation. The Europe composites testing market is primarily spread across Germany, France, the UK, Italy, Spain, Russia, and the Rest of Europe. France and Russia have the most prominent aircraft manufacturing hub across Europe, marked by the presence of prominent aircraft manufacturers such as Airbus, Dassault Aviation, Leonardo, and Thales Group. As the aerospace industry extensively conducts various composite testing to develop lightweight aircraft components and parts, the high manufacturing rate of aircraft is significantly driving the composites testing market in Europe.

With the spread of COVID-19 across the globe, most countries declared a health emergency and stopped unessential movements, thereby impacting the supply chain of goods. The pandemic has dramatically affected economies and industries in various countries, owing to business shutdowns, travel restrictions, and lockdowns. Disruptions in the production and supply chain in automotive and aerospace sectors have harmed the composites testing market. For instance, as per the International Organization of Motor Vehicle Manufacturers, in Europe, in 2020, the vehicle production declined abruptly by 21.6%, and in America, it dropped by 22.1%. Thus, the declining production in the automotive industry has negatively hampered the composite testing market in 2020. Hence, it is estimated that it will take a year to achieve the normal business across industries, influencing the market dynamics for the composite testing market in North America and Europe.

Strategic insights for the North America and Europe Composite Testing provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

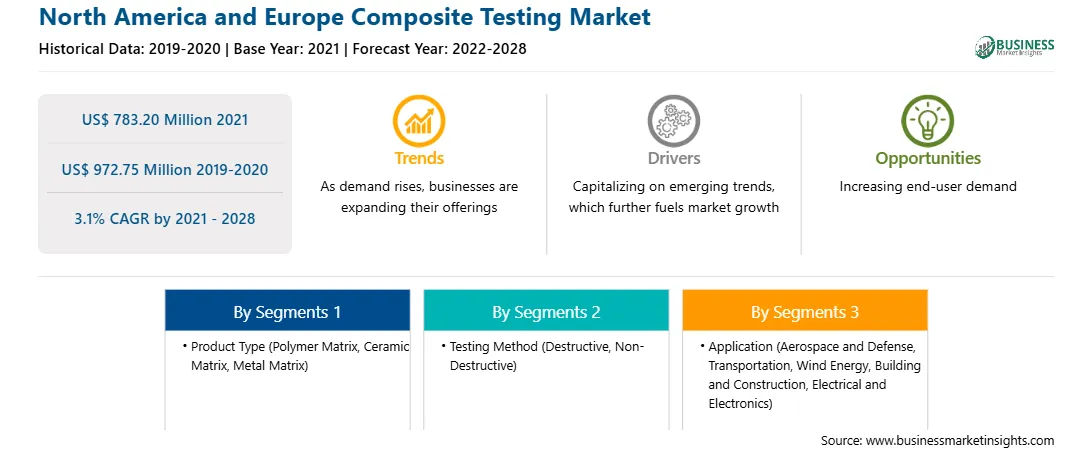

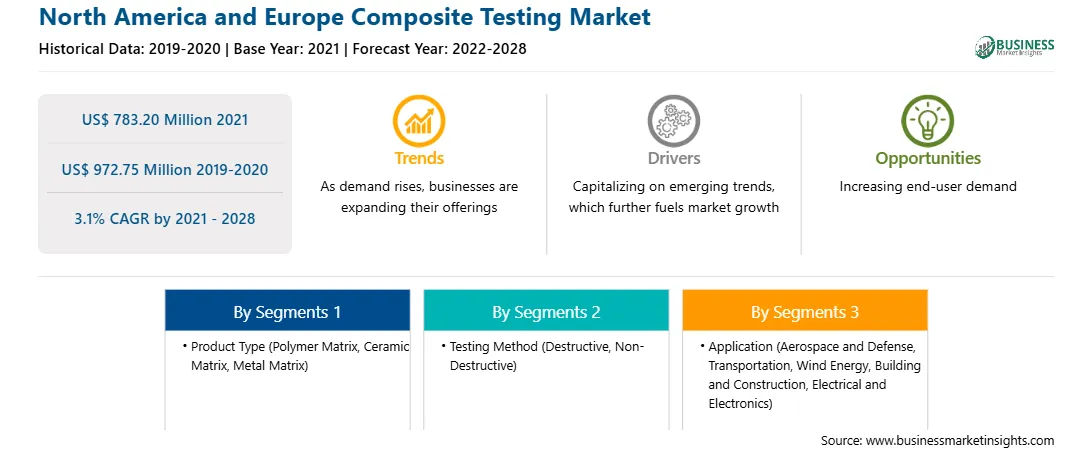

| Market size in 2021 | US$ 783.20 Million |

| Market Size by 2028 | US$ 972.75 Million |

| Global CAGR (2021 - 2028) | 3.1% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America and Europe Composite Testing refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

Composite material is quite prevalent in the manufacturing of electric vehicles due to its lightweight and excellent strength-to-weight ratios. The usage of lightweight materials such as fiber-reinforced composites has become more prevalent as electric vehicle manufacturers strive to reduce vehicle weight to improve performance, lower fuel and oil consumption, and reduce emissions. The US government is focusing on an ambitious climate change strategy that includes increasing investments in clean energy and switching from internal combustion engine (ICE) vehicles to battery electric vehicles (EVs). For instance, in September 2021, Ford, an American multinational automobile manufacturer had announced an investment worth US$ 11.4 billion in electric vehicle plants for constructing the biggest manufacturing plant in Tennessee and two battery parks in Kentucky. Hence, associated advantages of adopting EV, together with lucrative initiatives, escalate the EV production, resulting in high demand for composites and their testing.

The European energy market is shifting its dependency on a renewable energy source that is cheap to harness and carbon-emission-free. Composite materials are used for electrical insulation and mechanical support in hydro, turbo-generator, wind, and solar power generation equipment. The composite material used in power generation can withstand high-temperature, and can be molded into the desired shapes. According to the European Commission, under the EU Offshore Renewable Energy Strategy, huge investments are required in offshore grid connections, growing from 12 GW in 2020 to 60 GW in 2030 and 300 GW by 2050. Thus, the advantages of composite material in the power generation industry, coupled with the rise in investment in wind energy, are bolstering the demand for composite testing, which helps drive the market.

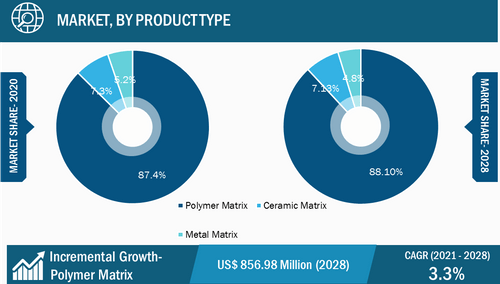

Based on product type, the composite testing market is categorized into polymer matrix, ceramic matrix, and metal matrix. The polymer matrix segment accounted for the largest market share in 2020 and is expected to register the highest CAGR during the forecast period. Polymer matrix composites are extensively used in automotive, aerospace, and marine applications such as tires, aircraft interiors, belts, hoses, and fiberglass boats. Besides, polymer matrix composites find wide applications in medical devices, personal protective equipment, industrial equipment, sporting goods, bullet-proof vests, and packaging and other armor parts’ construction, as well as other applications. The ceramic matrix composites are used to manufacture brake discs as an alternative to steel brake discs. It is also used in many industries due to its high temperature and corrosion resistance, lightweight, and high chemical stability.

Strategic insights for the North America and Europe Composite Testing provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 783.20 Million |

| Market Size by 2028 | US$ 972.75 Million |

| Global CAGR (2021 - 2028) | 3.1% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America and Europe Composite Testing refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

Based on testing method, the composite testing market is segmented into destructive and non-destructive. The destructive testing is accomplished by forcing the material to fail under various load factors. The destructive testing method comprises tensile strength test, fracture toughness, bend testing, fatigue testing, impact testing, compression testing, and charpy impact testing. Thus, the destructive testing method finds applications in several industries, which helps achieve a greater share. The non-destructive testing (NDT) segment is expected to proliferate its market share due to the rising critical safety testing in aircraft primary structures and interior and exterior structures of transport vehicles. In addition, the high growth of the aerospace, defense, and transportation industries, coupled with the increase in the application of various composites in aircraft, is driving the non-destructive composites testing segment.

Based on application, the composite testing market is segmented into aerospace and defense, transportation, wind energy, building and construction, electrical and electronics, and others. In the aerospace and defense industries, composite materials have played a significant role in reducing weight. Various kind of composite testing is available for the aerospace industry, such as areal weight testing, compressive property testing, bend testing, constituent content by volume or mass testing, dynamic mechanical analysis (DMA), and many more. Composite materials are most widely used in structures in the transportation industry because of their high stiffness and strength-to-weight ratios, which help reduce vehicle weight and increase fuel efficiency. Thus, the wide scope application of composite materials across various industries is augmenting the composite testing market growth.

The key players operating in the composite testing market include Element Materials Technology; INTERTEK GROUP PLC; Henkel AG & Company, KGAA; Applus+; Instron Corporation; Mistras Group; Westmoreland Mechanical Testing And Research, Inc.; Matrix Composites, Inc.; Etim Composites; and Composites Testing Laboratory Ltd. The key companies adopt strategies such as mergers and acquisitions and research and development to expand their customer base and gain significant share in the North America and Europe market, allowing them to maintain their brand name.

The North America and Europe Composite Testing Market is valued at US$ 783.20 Million in 2021, it is projected to reach US$ 972.75 Million by 2028.

As per our report North America and Europe Composite Testing Market, the market size is valued at US$ 783.20 Million in 2021, projecting it to reach US$ 972.75 Million by 2028. This translates to a CAGR of approximately 3.1% during the forecast period.

The North America and Europe Composite Testing Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America and Europe Composite Testing Market report:

The North America and Europe Composite Testing Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America and Europe Composite Testing Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America and Europe Composite Testing Market value chain can benefit from the information contained in a comprehensive market report.