Anaphylaxis is an allergic reaction that can further lead to a fatal condition known as anaphylactic shock. Anaphylaxis occurs when the patient's body reacts to a foreign substance and produces a high amount of histamine that triggers an inflammatory response. It is a severe, life threatening allergic reaction marked by indications such as swallowing and breathing difficulties, skin itching, and lowering blood pressure.

Thus, the rising incidence of anaphylaxis is expected to create a significant demand for anaphylaxis treatment in the coming years, which is further anticipated to drive the anaphylaxis treatment market.

With the spread of the COVID-19 pandemic, it was discovered that a significant number of people around the world were suffering from chronic respiratory diseases, such as respiratory allergies, such as allergic rhinitis, and sinusitis. For instance, according to a survey conducted by the Asthma and Allergy Foundation of America in June 2020, stated that 2,695 people were made to participate in the study, out of which 57% have asthma, 51% have a family member with asthma, 63% have allergies, and 66% have a family member with allergies, within the survey group. Thus, the impact of COVID-19 is so far considered positive on the market. Allergy and asthma exacerbations are frequently triggered by viral infections, including coronaviruses. Thus, telehealth can be central in delivering allergy/immunology services within a risk-stratified context of the SARS-CoV-2 pandemic. Therefore, both the American Academy of Allergy, Asthma, & Immunology (AAAAI) and the American College of Allergy, Asthma, & Immunology (ACAAI) have been strong advocates to advance telehealth to allow allergy/immunology services to expand and most directly serve patients where they are needed. To provide an approach to triaging allergy/immunology services during the COVID-19 pandemic, a consensus-based ad-hoc expert panel of allergy/immunology specialists from the United States and Canada developed a service and patient prioritization schematic to temporarily adjust allergy/immunology services. Recommendations and feedback were developed iteratively, using an adapted, modified Delphi methodology to achieve consensus. This is likely to favor market growth.

Strategic insights for the North America Anaphylaxis Treatment provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

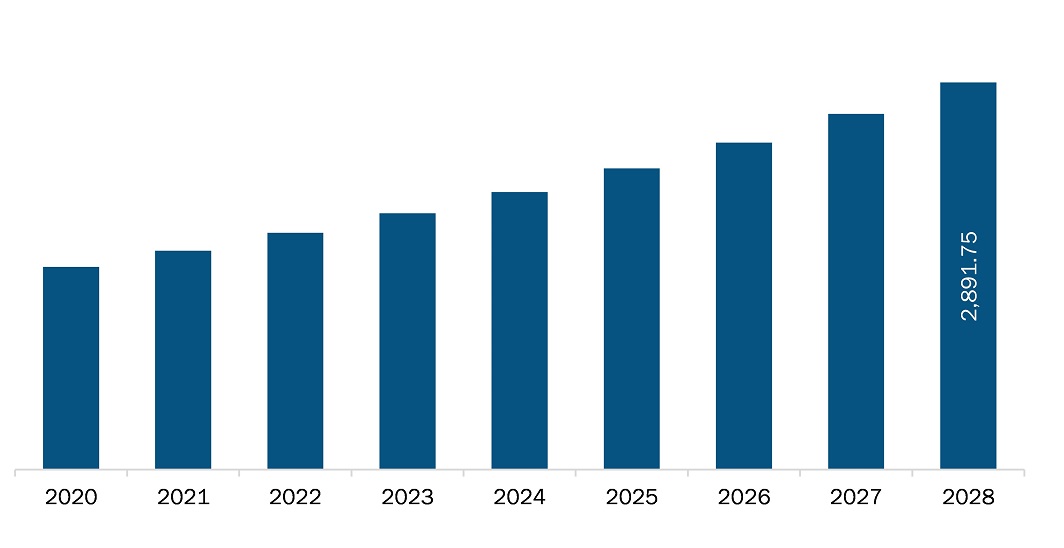

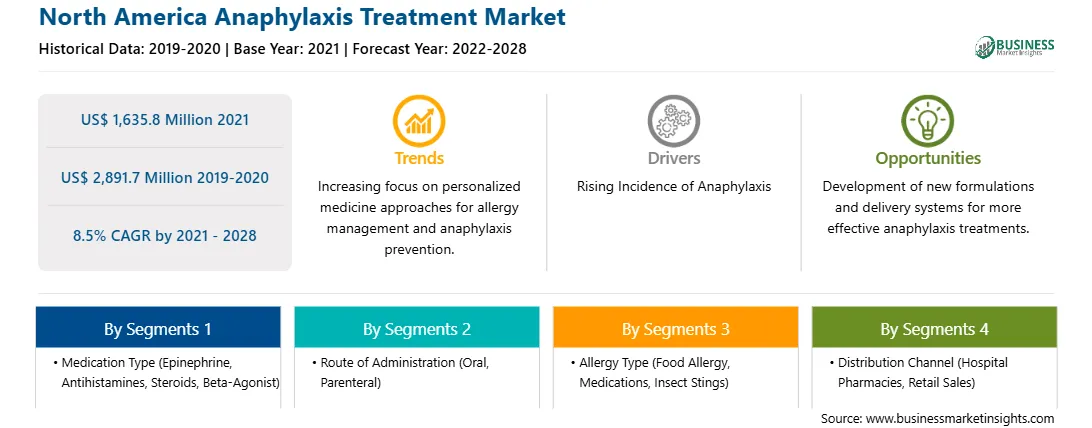

| Market size in 2021 | US$ 1,635.8 Million |

| Market Size by 2028 | US$ 2,891.7 Million |

| Global CAGR (2021 - 2028) | 8.5% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Medication Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America Anaphylaxis Treatment refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The Anaphylaxis treatment market in North America is expected to grow from US$ 1,635.8 million in 2021 to US$ 2,891.7 million by 2028; it is estimated to grow at a CAGR of 8.5% from 2021 to 2028. Epinephrine is the most effective treatment for anaphylaxis; however, various studies indicate underutilization of this drug due to the high cost and low availability of the drugs and unawareness regarding the drug usage and anaphylactic onset. Many organizations are developing generic drugs for the treatment of anaphylaxis. In April 2020, Amphastar Pharmaceuticals made an announcement regarding winning an FDA approved for the new drug application of its epinephrine injection, USP 30mg/30mL (1mg/mL), available in multiple dose vials. This generic drug product is known to be equivalent to Adrenalin (Endo International and Par Pharmaceutical), and it is prescribed as an emergency treatment of allergic reactions (Type 1), including anaphylaxis. However, a limited number of players are operating in this segment. The demand for epinephrine has been on the rise with limited product supply. As per the Pew Charitable Trusts, demand for epinephrine auto-injectors has increased in the last few years, and the number of EpiPen prescriptions in the US grew from ~2.5 million in 2011 to 3.5 million in 2015. The growth can be attributed to the high demand from schools.

In terms of medication type, the epinephrine segment accounted for the largest share of the North America anaphylaxis treatment market in 2020. In terms of route of administration, the parenteral segment accounted for the largest share of the North America anaphylaxis treatment market in 2020. In terms of allergy type, the food allergy segment accounted for the largest share of the North America anaphylaxis treatment market in 2020. In terms of distribution channel, the retail pharmacies segment held a larger market share of the anaphylaxis treatment market in 2020.

A few major primary and secondary sources referred to for preparing this report on the anaphylaxis treatment market in North America are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Amneal Pharmaceuticals Inc., Mylan N.V., Adamis Pharmaceutical Corporation, Abbott, Pfizer Inc., Glaxosmithkline Plc., Merck and Co., Inc., Teva Pharmaceutical Industries Ltd., and ALK-ABELLó.

By Medication Type

By Route of Administration

By Allergy Type

By Distribution Channel

By Country

The North America Anaphylaxis Treatment Market is valued at US$ 1,635.8 Million in 2021, it is projected to reach US$ 2,891.7 Million by 2028.

As per our report North America Anaphylaxis Treatment Market, the market size is valued at US$ 1,635.8 Million in 2021, projecting it to reach US$ 2,891.7 Million by 2028. This translates to a CAGR of approximately 8.5% during the forecast period.

The North America Anaphylaxis Treatment Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Anaphylaxis Treatment Market report:

The North America Anaphylaxis Treatment Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Anaphylaxis Treatment Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Anaphylaxis Treatment Market value chain can benefit from the information contained in a comprehensive market report.