The automotive industry is growing rapidly with significant digital transformation in the design and development of a wide range of components, such as infotainment, anti-lock braking systems (ABS), and electronic displays. The ongoing digital transformation across the automotive industry has been triggering the demand for advanced driver-assistance systems (ADAS). The increasing emphasis on road safety, government regulations mandating the use of advanced safety features, and rising demand for luxury vehicles further propel the adoption of ADAS. Thus, various automotive manufacturing giants are focusing on ADAS technology.

The functioning of ADAS systems is based on LiDAR technology, wherein trans-impedance amplifiers (TIA) and comparators play vital roles in receiving signals. TIA is used to detect the reflected signal, and once it has been successfully detected, a comparator indicates that signal. Thus, the increasing adoption of ADAS and manufacturing of ADAS-enabled vehicles drive the amplifier and comparator market growth.

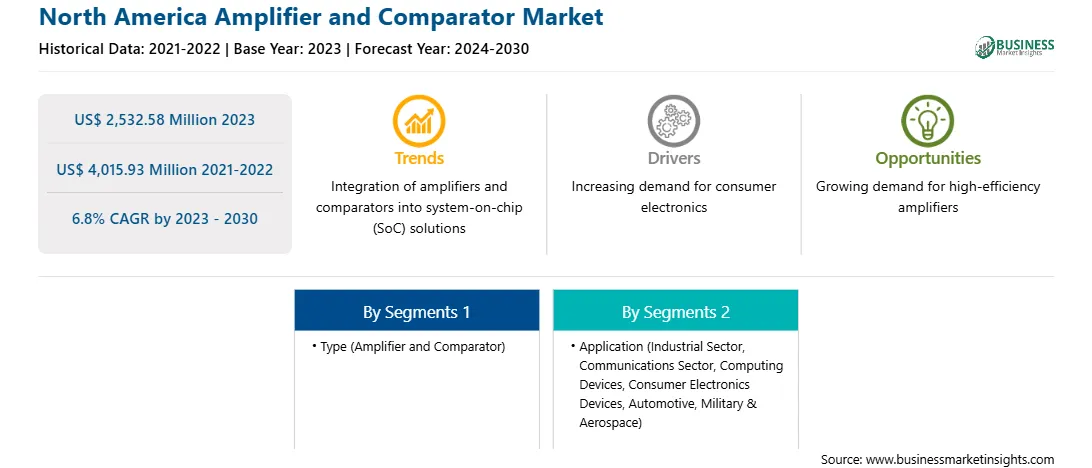

North America Amplifier and Comparator Market Overview

The North America amplifier and comparator market is segmented into the US, Canada, and Mexico. The availability of well-established infrastructure in developed countries, such as the US and Canada, helps manufacturing firms enhance their production capabilities. Across North America, technological advancements have led to high adoption of advanced process control technologies in the manufacturing industry, boosting the region's manufacturing output. According to the National Institute of Standards and Technology, the manufacturing sector in the US was valued at US$ 2.3 trillion and held a 12.0% share of its total GDP in 2021. The US is the second-largest country in the world in terms of manufacturing machinery and equipment production. The growing applications of sensors in various industrial processes are contributing to the growth of the amplifier and comparator market. As a result, the growing industrial sector in North America presents a significant opportunity for amplifiers and comparators. These components are widely used in industrial automation, robotics, process control, and instrumentation applications. The need for precise signal amplification, measurement accuracy, and reliable control systems drives the demand for amplifiers and comparators in industrial settings.

Strategic insights for the North America Amplifier and Comparator provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the North America Amplifier and Comparator refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.North America Amplifier and Comparator Strategic Insights

North America Amplifier and Comparator Report Scope

Report Attribute

Details

Market size in 2023

US$ 2,532.58 Million

Market Size by 2030

US$ 4,015.93 Million

Global CAGR (2023 - 2030)

6.8%

Historical Data

2021-2022

Forecast period

2024-2030

Segments Covered

By Type

By Application

Regions and Countries Covered

North America

Market leaders and key company profiles

North America Amplifier and Comparator Regional Insights

North America Amplifier and Comparator Market Segmentation

The North America amplifier and comparator market is segmented based on type, application, and country. Based on type, the North America amplifier and comparator market is bifurcated into amplifier and comparator. The amplifier segment held a larger market share in 2023.

Based on application, the North America amplifier and comparator market is segmented into industrial sector, communications sector, computing devices, consumer electronics devices, automotive, military & aerospace, and others. The industrial sector segment held the largest market share in 2023.

Based on country, the North America amplifier and comparator market is segmented into the US, Canada, and Mexico. The US dominated the North America amplifier and comparator market share in 2023.

ABLIC Inc; Analog Devices Inc; Broadcom Inc; Microchip Technology Inc; NXP Semiconductors; On Semiconductor; Renesas Electronics Corporation; Skyworks Solutions Inc; STMicroelectronics NV; and Texas Instruments Inc are the leading companies operating in the North America amplifier and comparator market.

The North America Amplifier and Comparator Market is valued at US$ 2,532.58 Million in 2023, it is projected to reach US$ 4,015.93 Million by 2030.

As per our report North America Amplifier and Comparator Market, the market size is valued at US$ 2,532.58 Million in 2023, projecting it to reach US$ 4,015.93 Million by 2030. This translates to a CAGR of approximately 6.8% during the forecast period.

The North America Amplifier and Comparator Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Amplifier and Comparator Market report:

The North America Amplifier and Comparator Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Amplifier and Comparator Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Amplifier and Comparator Market value chain can benefit from the information contained in a comprehensive market report.