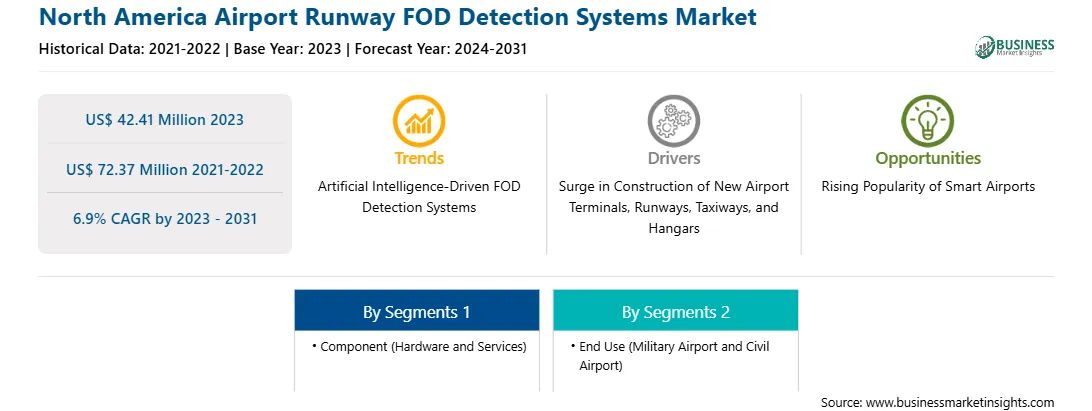

The North America airport runway FOD detection systems market was valued at US$ 42.41 million in 2023 and is expected to reach US$ 72.37 million by 2031; it is estimated to register a CAGR of 6.9% from 2023 to 2031.

The mounting number of global commercial aircraft fleets is one of the major factors generating the demand for new flights, terminals, runways, and hangars across different airports to cater to the growing passenger traffic worldwide. This fuels the investments from airport authorities to upgrade their respective airport premises to cater to a huge fleet of aircraft, which also improves the overall airport’s operational efficiency. The improved efficiency is also attributed to the introduction of low-cost airlines that have supported air passenger traffic worldwide. In March 2023, the Canadian Kelowna City Council announced approval for funding of US$ 90 million for the expansion project of the Kelowna Airport terminal. Several government authorities of different countries have also been planning to construct new airports across their respective countries to enhance the flow of international cargo trade and development of the air travel industry. For instance, in the US, six new airports are currently under construction. Also, in 2022, the Government of India announced its plans to build ~220 airports by the end of 2025.

Thus, the construction of new airport terminals, runways, taxiways, and hangars contributes to the growth of the airport runway FOD detection systems market.

The aviation industry plays an important role in facilitating global connectivity and economic development. The demand for efficient and modern airport facilities has been on the rise across the globe. The aviation sector in North America is witnessing significant expansion and developments, responding to the region's growing air travel demands and economic vitality. Key airports, including Hartsfield-Jackson Atlanta International Airport, Los Angeles International Airport, and Dallas/Fort Worth International Airport, are undergoing modernization projects to accommodate increased passenger traffic. The US has the highest number of airports in the world as well as a significant number of airport technology developers. This makes it easier for airport authorities to procure larger quantities of airport technologies or systems, including FOD detection systems, thereby driving the airport runway FOD detection systems market. The report by Airport Council International (ACI-NA) highlighted that North America's airport infrastructure requires $151.1 billion to maintain or expand from 2023 to 2027.

The Federal Aviation Administration's (FAA) ongoing efforts to develop robust and safe airport and runway infrastructure are encouraging airport authorities to invest in advanced technologies such as FOD detection systems. Therefore, the significant need for modernization of airport and runway technologies by the FAA is another key factor driving the market for airport runway FOD detection systems in North America. Moreover, the Canadian Airports Authority and subsequent airport management always emphasize runway maintenance to prevent runway downtime due to runway accidents. To ensure the constant movement of aircraft fleets to and from the airport, airport administrations are installing FOD detection systems on runways, which is boosting the runway FOD detection systems market in the region. A few of the key players operating in the North America airport runway FOD detection systems market include Pavemetrics Systems; QinetiQ; Thales Group; Varec, Inc.; and XSight Systems Ltd.; among others.

Strategic insights for the North America Airport Runway FOD Detection Systems provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the North America Airport Runway FOD Detection Systems refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.North America Airport Runway FOD Detection Systems Strategic Insights

North America Airport Runway FOD Detection Systems Report Scope

Report Attribute

Details

Market size in 2023

US$ 42.41 Million

Market Size by 2031

US$ 72.37 Million

Global CAGR (2023 - 2031)

6.9%

Historical Data

2021-2022

Forecast period

2024-2031

Segments Covered

By Component

By End Use

Regions and Countries Covered

North America

Market leaders and key company profiles

North America Airport Runway FOD Detection Systems Regional Insights

The North America airport runway FOD detection systems market is categorized into component, end use, and country.

Based on component, the North America airport runway FOD detection systems market is bifurcated into hardware and services. The hardware segment held a larger North America airport runway FOD detection systems market share in 2023.

In terms of end use, the North America airport runway FOD detection systems market is categorized into military airport and civil airport. The civil airport segment held a larger market share in 2023.

By country, the North America airport runway FOD detection systems market is segmented into the US, Canada, and Mexico. The US dominated the North America airport runway FOD detection systems market share in 2023.

Moog Inc; Pavemetrics; Rheinmetall AG; QinetiQ Group Plc; Thales SA; Xsight Systems Ltd.; Trex Aviation Systems; Varec, Inc.; Smiths Detection Group Ltd. (Smiths Group plc); Infologic Pte Ltd.; Skylarklabs, Inc.; and Hitachi Ltd are some of the leading companies operating in North America airport runway FOD detection systems market.

The North America Airport Runway FOD Detection Systems Market is valued at US$ 42.41 Million in 2023, it is projected to reach US$ 72.37 Million by 2031.

As per our report North America Airport Runway FOD Detection Systems Market, the market size is valued at US$ 42.41 Million in 2023, projecting it to reach US$ 72.37 Million by 2031. This translates to a CAGR of approximately 6.9% during the forecast period.

The North America Airport Runway FOD Detection Systems Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Airport Runway FOD Detection Systems Market report:

The North America Airport Runway FOD Detection Systems Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Airport Runway FOD Detection Systems Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Airport Runway FOD Detection Systems Market value chain can benefit from the information contained in a comprehensive market report.