North America has a developed aviation industry that is highly focused on the development as well as adoption of smart and advanced technologies across its airports. American airports are considered among the busiest in the world; ~50% of the world's busiest airports are in the US. Owing to increased air traffic, airport authorities are constantly focusing on the improvement of their facilities, which also includes the addition of new terminals. In North America, the Airports Council International concentrates on the rehabilitation of aging airport facilities. The Airports Council International reported a US$ 3.6 billion investment in 11 airport projects in the US and Canada. The amount of money invested by airport authorities in the modernization of airports in North America. In April 2021, Minneapolis–Saint Paul International Airport deployed a food serving robot at the airport. In September 2020, San Antonio International Airport deployed LightStrike, a germ-killing robot developed by Xenex Disinfection Services Inc., to assist the sanitation operations at the airport. In October 2020, Philadelphia International Airport deployed a food serving robot named Gita. In November 2016, San Jose Airport deployed three customer service robots. These developments are propelling the airport robots market growth in North America.

In case of COVID-19, North America is highly affected specially the US. The federal government in the country did not impose nationwide lockdown in 2020; however, governors of few states decided to impose lockdown in their respective states. The lockdown hindered the operations of various industries, including manufacturing and IT. However, essential industries such as fast-moving consumer goods (FMCG) and pharmaceutical had to continue their operations. Various big construction projects, including airport modification and expansion were also halted due to COVID-19, specifically in countries like the US and Canada. For instance, Raleigh-Durham International Airport was on pace to expand its Terminal 1 from nine gates to as many as 22 and proceed with a new security checkpoint and a consolidated rental car facility. The projected expansion was halted due to the pandemic. Similarly, an infrastructure project at Vancouver International Airport has been terminated due to the COVID-19 crisis. Due to halt in such big project, (expanded till quarter 3 of the 2020), airport robots manufacturers lost lot of potential clients/project, which impacted their overall cash flow. The impact was not only from the demand side, but it was also from the supply side. Since manufacturing facilities in the region were not operational for months, supply chain was disrupted, procurement of raw material was interrupted. Due to this, OEMs saw prominent challenge in keeping up with the quarterly revenue. But Airport also saw importance of robots and other machinery because of reduction of human touch in covid. However, the analysis states that the financial year 2021 would bring additional demand for airport robots, as airport development project resumes and airport authorities prepare to focus significantly on health and safety of passengers.

Strategic insights for the North America Airport Robots provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

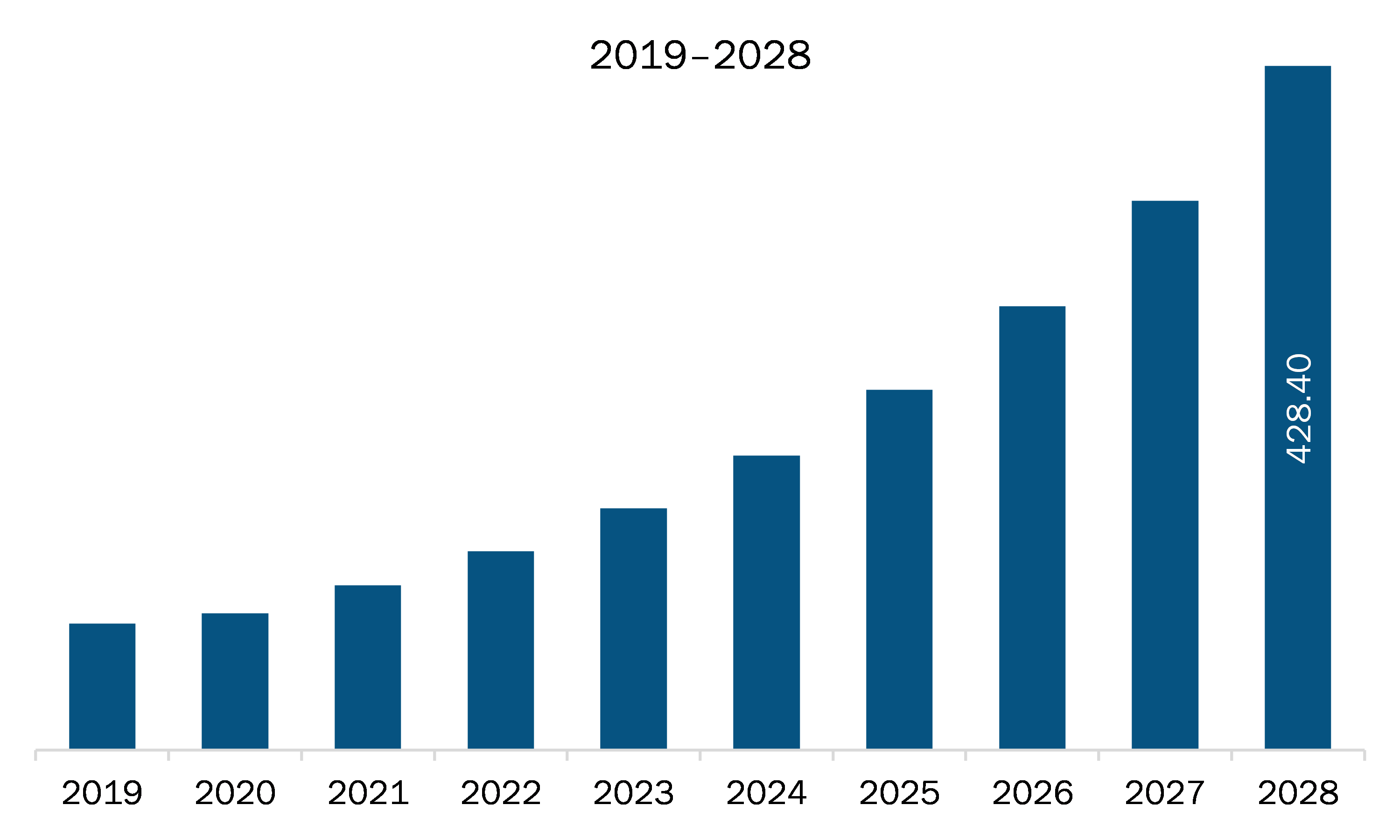

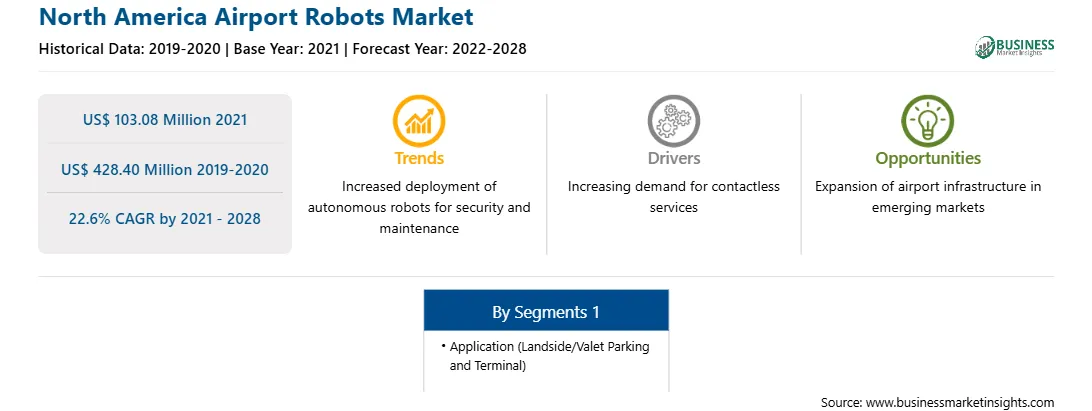

| Market size in 2021 | US$ 103.08 Million |

| Market Size by 2028 | US$ 428.40 Million |

| Global CAGR (2021 - 2028) | 22.6% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Application

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America Airport Robots refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The North America airport robots market is expected to grow from US$ 103.08 million in 2021 to US$ 428.40 million by 2028; it is estimated to grow at a CAGR of 22.6% from 2021 to 2028. Several countries across the region such as Mexico has become a hub of opportunities for various markets, including airport robots market. Government authorities in these countries are planning and investing huge amount in the advancement of technologies to improve the overall infrastructure. Transportation and logistics activities are huge contributors to the development of any country, and therefore, developing countries are extensively focusing on enhancing and improving their transportation and logistics infrastructure, including air, road, and sea transport. Airways is an important mode of transportation; hence, governments of developing countries have planned development and revamping of various mid-size and large airports. Countries such as Mexico is expanding and revamping airports. As a part of expansion and revamping strategy, the airports across the country would also be passing tenders on acquiring technologically advanced equipment including robots for ensuring convenience and providing superior experience to passengers. Hence, the airport robot market players across the North America region have huge opportunities to offer best-in-class, and highly reliable and cost-efficient robots for such new airport projects.

In terms of application, the terminal segment accounted for the largest share of the North America airport robots market in 2020. In terms of terminal, the airport security and cleaning segment held a larger market share of the North America airport robots market in 2020.

A few major primary and secondary sources referred to for preparing this report on the North America airport robots market are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are ABB Ltd., Avidbots Corp., CYBERDYNE INC., LG Electronics, SITA, and SoftBank Robotics.

The North America Airport Robots Market is valued at US$ 103.08 Million in 2021, it is projected to reach US$ 428.40 Million by 2028.

As per our report North America Airport Robots Market, the market size is valued at US$ 103.08 Million in 2021, projecting it to reach US$ 428.40 Million by 2028. This translates to a CAGR of approximately 22.6% during the forecast period.

The North America Airport Robots Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Airport Robots Market report:

The North America Airport Robots Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Airport Robots Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Airport Robots Market value chain can benefit from the information contained in a comprehensive market report.