Airports possess a wide range of assets, including several ground support equipment used for aircraft service between flights. For many years, a growing number of players have launched various tracking solutions used for keeping a track of these assets, thereby enhancing the productivity of ground-handling operations as well as maintenance practices. Generally, airport assets are categorized into motorized (ground service equipment) and non-motorized equipment. Airport asset tracking and management solutions enable operators to have a graphical illustration of ground handling processes as well as obtain status and location of fleet assets historically and in real-time. A rise in the number of flights in North America owing to the increasing number of air passengers is a key factor driving the growth of the North America airport asset tracking market. Airlines and airport authorities are under tremendous pressure to offer enhanced customer service, along with operating efficiently. Thus, to gain cost-competitiveness and save time, airlines are increasingly investing in advanced software, which is expected to boost the North America airport asset tracking market growth in the coming years.

Furthermore, COVID-19 is having a very devastating impact over the North America region. Presently, the US is the worst-affected country due to the COVID-19 outbreak. North America is one of the most important regions for the adoption and growth of new technologies including airport asset tracking owing to favorable government policies to boost innovation, the presence of a high-tech companies, and high purchasing power, especially in developed countries such as the US and Canada. The US is the worst-hit country in North America, with thousands of infected individuals facing severe health conditions across the country. The continuous growth of infected individuals had led the government to impose lockdown across the nation’s borders in last few months. The airport closure for regular passengers has led the airports to experience deflation in revenue. The adoption rate of technological adoption among US airports is decent, and owing to the closure of airports, the demand for airport asset tracking market has shrunken to a drastic level. This is showcasing a negative effect on the airport asset tracking market. However, the impact of COVID-19 is short-term and is likely to decrease by 2022.

Strategic insights for the North America Airport Asset Tracking provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2019 | US$ 73.0 Million |

| Market Size by 2027 | US$ 158.1 Million |

| Global CAGR (2020 - 2027) | 10.7% |

| Historical Data | 2017-2018 |

| Forecast period | 2020-2027 |

| Segments Covered |

By Offering

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America Airport Asset Tracking refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

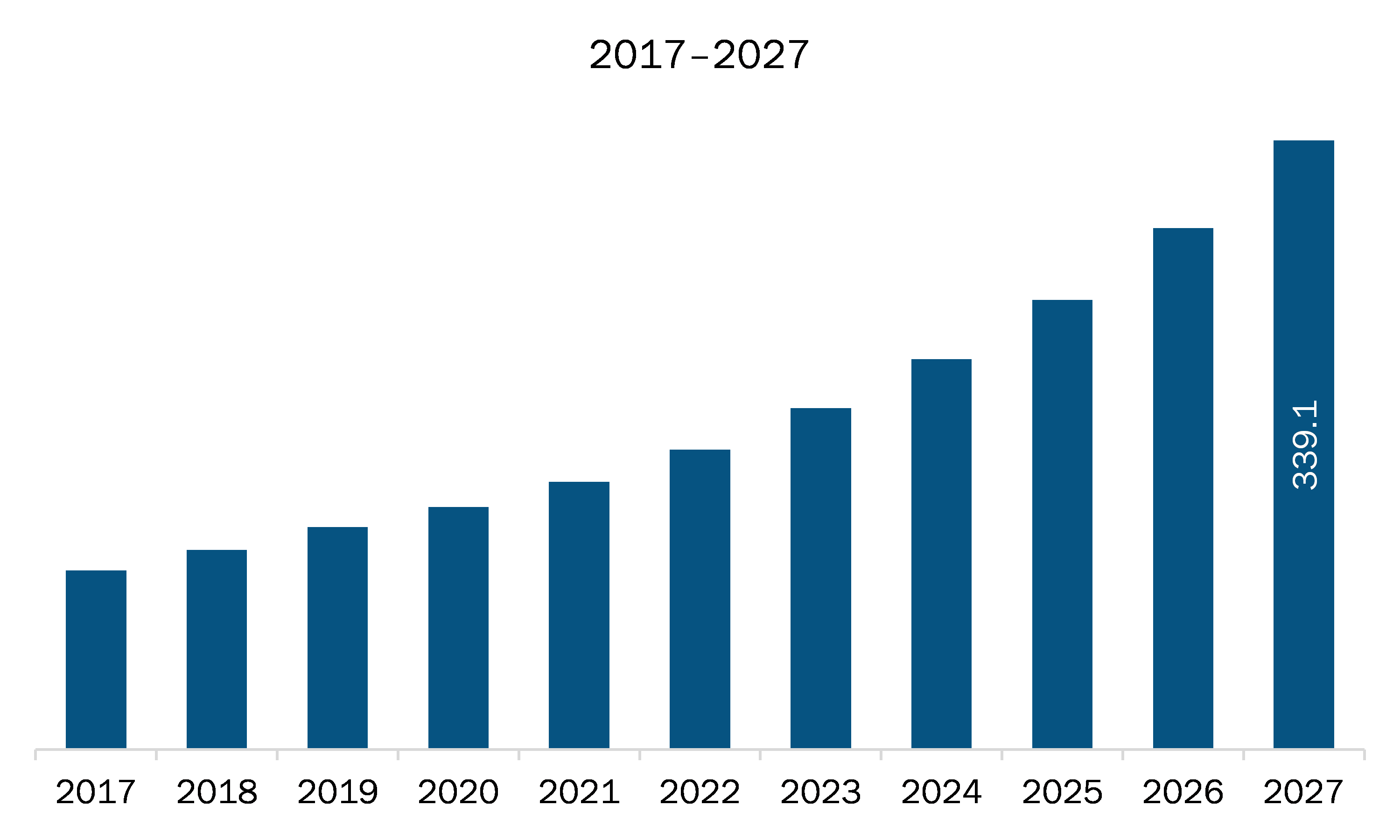

The airport asset tracking market in North America is expected to grow from US$ 73.0 million in 2019 to US$ 158.1 million by 2027; it is estimated to grow at a CAGR of 10.7% from 2020 to 2027. The airport asset tracking market players are known to provide various types of offerings. They offer solutions solely for tracking and managing precise airport assets, solutions for a wide range of tasks in the aviation industry. The market also includes telematics providers catering to other sectors. In the recent past, several partnerships among these players have been witnessed. For instance, in November 2019, Sigfox, an IoT service provider, partnered with a travel firm named Amadeus. The partnership was aimed at offering tracking software for luggage and airplane equipment. In March 2019, Menzies, a ground services provider, partnered with Smarter Asset Management for its Gen3 telematics system. In April 2018, TCR Group, an airport ground support equipment rental company, partnered with Targa Telematics and Sensolus. The partnership was focused on enhancing real-time monitoring of ground support equipment vehicles and motorized assets. In April 2018, Honeywell Aerospace partnered with Pinnacle, a telematics provider, to expand Honeywell’s GoDirect connected services to the ground. The partnership was meant to connect a ramp service of Swissport airport into a unique single solution that provides airlines and ground handlers with in-depth knowledge of vehicle movement in real-time across the airport. Such partnerships amongst ecosystem players offer lucrative growth opportunities for the future growth of the North America airport asset tracking market players.

In terms of offering, the hardware segment accounted for the largest share of the North America airport asset tracking market in 2019. In terms of asset type, the mobile assets segment held a larger market share of the North America airport asset tracking market in 2019.

A few major primary and secondary sources referred to for preparing this report on the airport asset tracking market in North America are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Adveez; Asset Fusion Limited; Ctrack; Geotab Inc.; Radiant RFID, LLC; Steerpath Oy; Unilode Aviation Solutions.

The North America Airport Asset Tracking Market is valued at US$ 73.0 Million in 2019, it is projected to reach US$ 158.1 Million by 2027.

As per our report North America Airport Asset Tracking Market, the market size is valued at US$ 73.0 Million in 2019, projecting it to reach US$ 158.1 Million by 2027. This translates to a CAGR of approximately 10.7% during the forecast period.

The North America Airport Asset Tracking Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Airport Asset Tracking Market report:

The North America Airport Asset Tracking Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Airport Asset Tracking Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Airport Asset Tracking Market value chain can benefit from the information contained in a comprehensive market report.