Aircraft wires and cables are used for numerous aircraft applications, such as lighting, flight control system, power transfer, data transfer, and avionics. The stranded cables used are versatile and have a greater degree of flexibility. The wires and cables used in aircraft are produced in diverse configurations with variable lays, materials, and diameters to suit different applications. Over the years, the aircraft fleet has significantly increased and has resulted in the mounting installation of electrical and electronic equipment. Further, the growth in the safety of the aircraft is expected to propel the demand for aircraft wires and cables. The rapid expansion of the aviation sector and the growing adoption of advanced technologies for the smooth functioning of aircraft supplement the growth of the market significantly. Besides, the presence of robust aircraft manufacturers, such as Boeing and Airbus, and growing disposable incomes in developing countries and are among the factors driving the demand for these aircraft wires and cables. The growing defense expenditure across significant economies, such as the US and Canada is expected to drive the North America aircraft wires and cables market in the coming years. Increasing technological developments, growing investments in research and development (R&D) by aircraft original equipment manufacturers (OEMs), and rising demand for air transportation are propelling the growth of the aerospace & defense sector, which is subsequently driving the North America aircraft wires & cables market growth. Also, deliveries and orders of aircraft rising is the major factor driving the North America aircraft wire & cable market.

The ongoing COVID-19 is having a very devastating impact over the North America region. North America is one of the most important regions for adopting and developing new technologies due to favorable government policies to boost innovation, a huge industrial base, and high purchasing power, especially in developed countries such as the US and Canada. Due to COVID-19, several aircraft manufacturers in the region faced challenges, which includes shutdowns of production sites and disruptions in the workplace, raw materials, and goods. For instance, in the second quarter of 2020, Boeing suspended its operations in Philadelphia, Puget Sound, South Carolina, and numerous other major production sites. The company’s revenues declined by US$ 18,401 million in 2020 compared with 2019, majorly due to less revenues in its commercial airplane and services businesses. Besides, due to global breakdown Boeing delivered 157 aircraft in 2020, which is down from 380 in 2019 and 806 in 2018. Due to disruption in the business of aircraft manufacturers, several wires & cables suppliers also suspended operations during the second quarter of 2020, and they witnessed additional disruptions in 2021. Thus, the North American aircraft wire & cable market has been shattered by the momentary shutdown of the aviation industry, reflecting severely less demand for various types of components, including wires & cables. Due to this, the aircraft wire & cable market players have been witnessing noteworthy less demand; however, as the unlock measures started, and airlines resumed their operations, the procurement rate of wires & cables begun to uprise at a slow pace.

Strategic insights for the North America Aircraft Wire & Cable provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

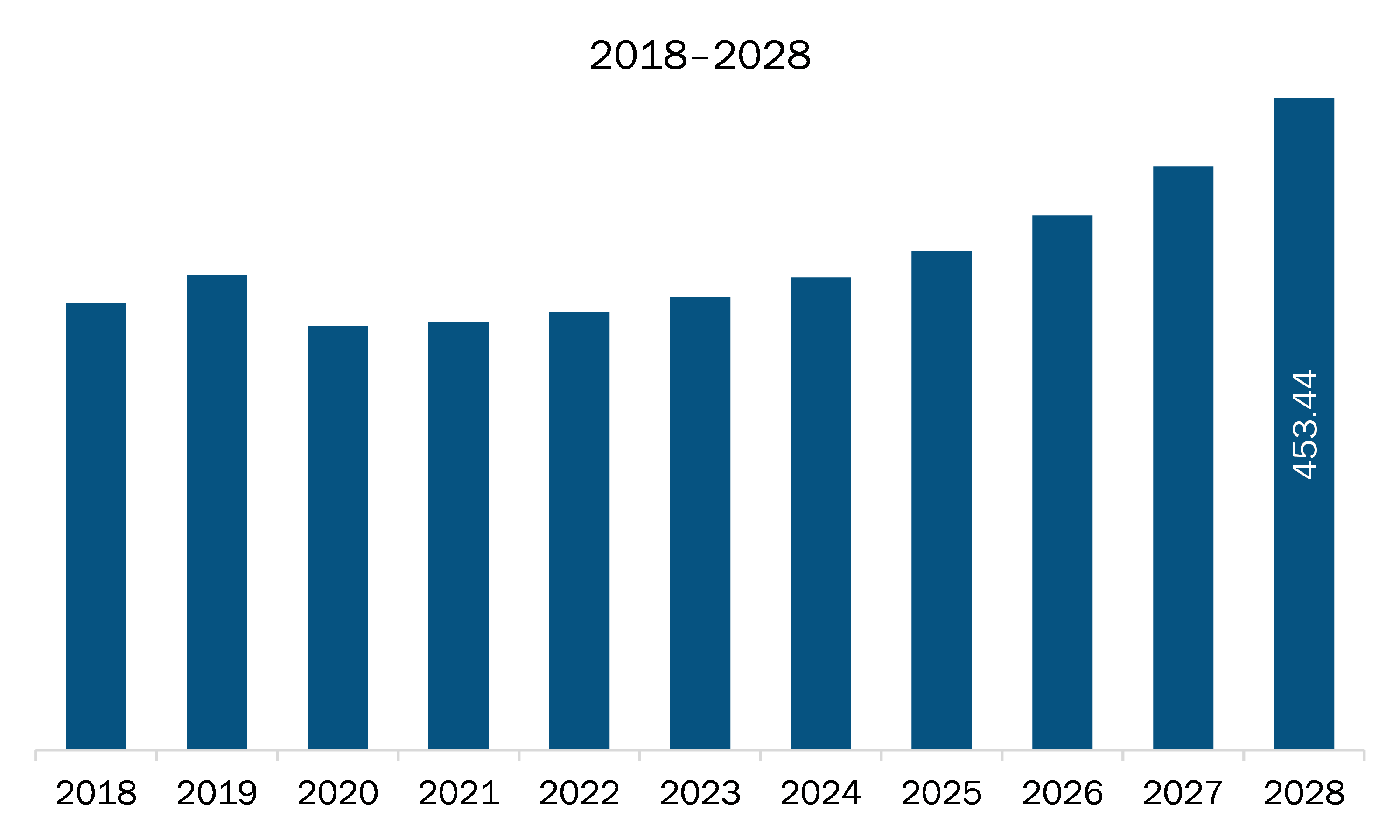

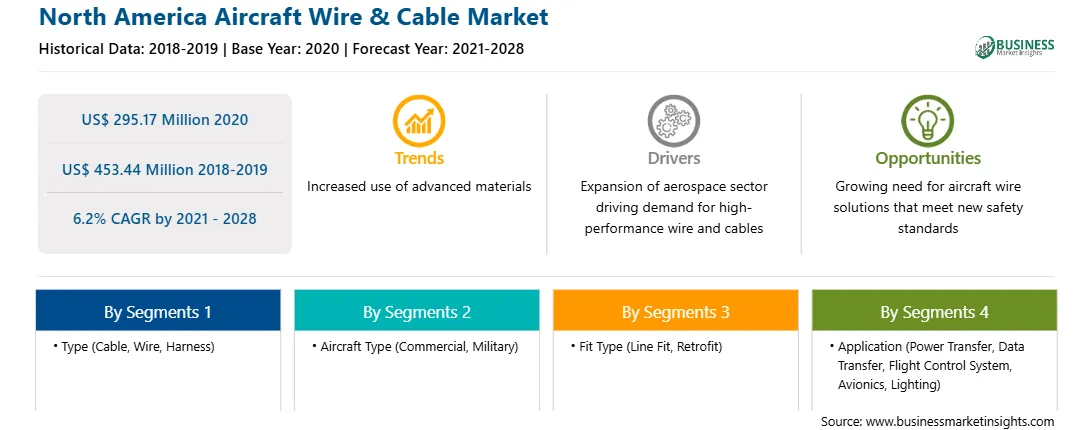

| Market size in 2020 | US$ 295.17 Million |

| Market Size by 2028 | US$ 453.44 Million |

| Global CAGR (2021 - 2028) | 6.2% |

| Historical Data | 2018-2019 |

| Forecast period | 2021-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America Aircraft Wire & Cable refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The aircraft wire & cable market in North America is expected to grow from US$ 295.17 million in 2020 to US$ 453.44 million by 2028; it is estimated to grow at a CAGR of 6.2% from 2021 to 2028. At present, the aircraft wires and cables manufacturers can explore potential business opportunities through conducting extensive research & development (R&D) for developing lightweight cables and wires. The availability of lightweight efficient, mechanically durable wires could provide scope for creating sustainable market offerings and subsequently provide attractive market growth opportunities for the market players operating in the market. The wires and cables encompass most of the weight portion of aircraft power systems and a huge fraction of the entire aircraft weight. By opting for substantially lightweight wires would enhance the fuel economy of an aircraft while also surging the amount of load it could carry. The Battlefield Air Operations Kit (BAO) program, which offers equipment for Battlefield Airmen to perform a wide range of missions, has documented requirements to mitigate the volume and weight of cables to reduce personnel fatigue and any hazards during special operations missions. Thus, governments across the regions are swiftly moving from traditional wires and cables to fiber optics.

The North America aircraft wire & cable market is segmented into type, fit type, aircraft type, and application. Based on type, the North America aircraft wire & cable market is further segmented into harness, wire, and cable. Wire segment held a substantial market share in 2020. Based on fit type, the market is further categorized into line fit and retrofit. Line fit segment held a substantial market share in 2020. Further, the market is segmented based on aircraft type into commercial and military. Commercial segment held a substantial market share in 2020. Based on application, the market is classified into power transfer, data transfer, flight control system, avionics, and lighting. Power transfer segment held a substantial market share in 2020.

A few major primary and secondary sources referred to for preparing this report on the aircraft wire & cable market in North America are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are A.E. Petsche Company; AMETEK Inc.; Amphenol Corporation; Axon Enterprise, Inc.; Carlisle Companies Incorporated; Collins Aerospace, a Raytheon Technologies Corporation Company; Draka; Glenair, Inc.; Harbour Industries, LLC; HUBER+SUHNER; Nexans; PIC Wire & Cable; Radiall; TE Connectivity Ltd.; W. L. Gore and Associates, Inc.

The North America Aircraft Wire & Cable Market is valued at US$ 295.17 Million in 2020, it is projected to reach US$ 453.44 Million by 2028.

As per our report North America Aircraft Wire & Cable Market, the market size is valued at US$ 295.17 Million in 2020, projecting it to reach US$ 453.44 Million by 2028. This translates to a CAGR of approximately 6.2% during the forecast period.

The North America Aircraft Wire & Cable Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Aircraft Wire & Cable Market report:

The North America Aircraft Wire & Cable Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Aircraft Wire & Cable Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Aircraft Wire & Cable Market value chain can benefit from the information contained in a comprehensive market report.