The aircraft wheels MRO market in North America is further segmented into the US, Canada, and Mexico. North America has the world’s largest aviation industry. Air travel is a preferred mode of travel in the US and Canada due to high GDP per capita, favorable governments policies, and matured aerospace industry ecosystem, which is a prime factor contributing to the growth of aerospace industry in the region. Maintenance, repair, and overhaul (MRO) are among the complex operations that must comply with stringent and specific criteria specified by airworthiness authorities, which decide whether an aircraft is airworthy. The end users of commercial and military aircraft spend tremendous amounts every year to meet these specifications, which account for a significant portion of their overall operating costs. The aircraft wheels MRO market in North America is expected to be driven by a rise in air passenger traffic; an urge to improve operability and performance; and the need for disassembling, replacing, testing, and repairing aircraft wheels. With the purchase of new aircraft, airlines and defense agencies routinely sign several contracts and agreements with aircraft MRO service providers. According to the International Air Transport Association (IATA), the total number of new passengers will rise over the next 20 years, increasing the need for MRO services for aircraft fleet upgrades. In June 2021, JetBlue Airways announced its partnership with Airbus for a long-term Flight Hour Services component MRO contract. Moreover, Precision Aviation Group, Inc., one of the major MRO service providers, announced the acquisition of Trace Aviation, a widely recognized organization for MRO capabilities on King Air/1900 landing gear assemblies. Furthermore, MRO service providers in North America are continually focusing on the creative integration of technologies such as digital MRO technology, which add to the effectiveness and efficiency of MRO activities. Moreover, the presence of a significant number of regional as well as international aircraft wheel MRO market players is further contributing to the market growth in North America.

The continuous growth of COVID-19 infected individuals led the government to impose lockdown across the North American countries in 2020. Most of the manufacturing plants were temporarily shut or operating with minimum staff; the supply chain of components and parts was disrupted. Since the US has a larger density of aircraft OEMs, component manufacturers, and airports, the outbreak severely affected production and revenue generation. The lower number of manufacturing staff resulted in lesser production quantity. On the other hand, the suspension of air travel resulted in a loss for the airlines, restricting the demand for airline-associated services. This factor stalled the revenue generation stream of the aircraft wheels MRO market.

Strategic insights for the North America Aircraft Wheels MRO provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

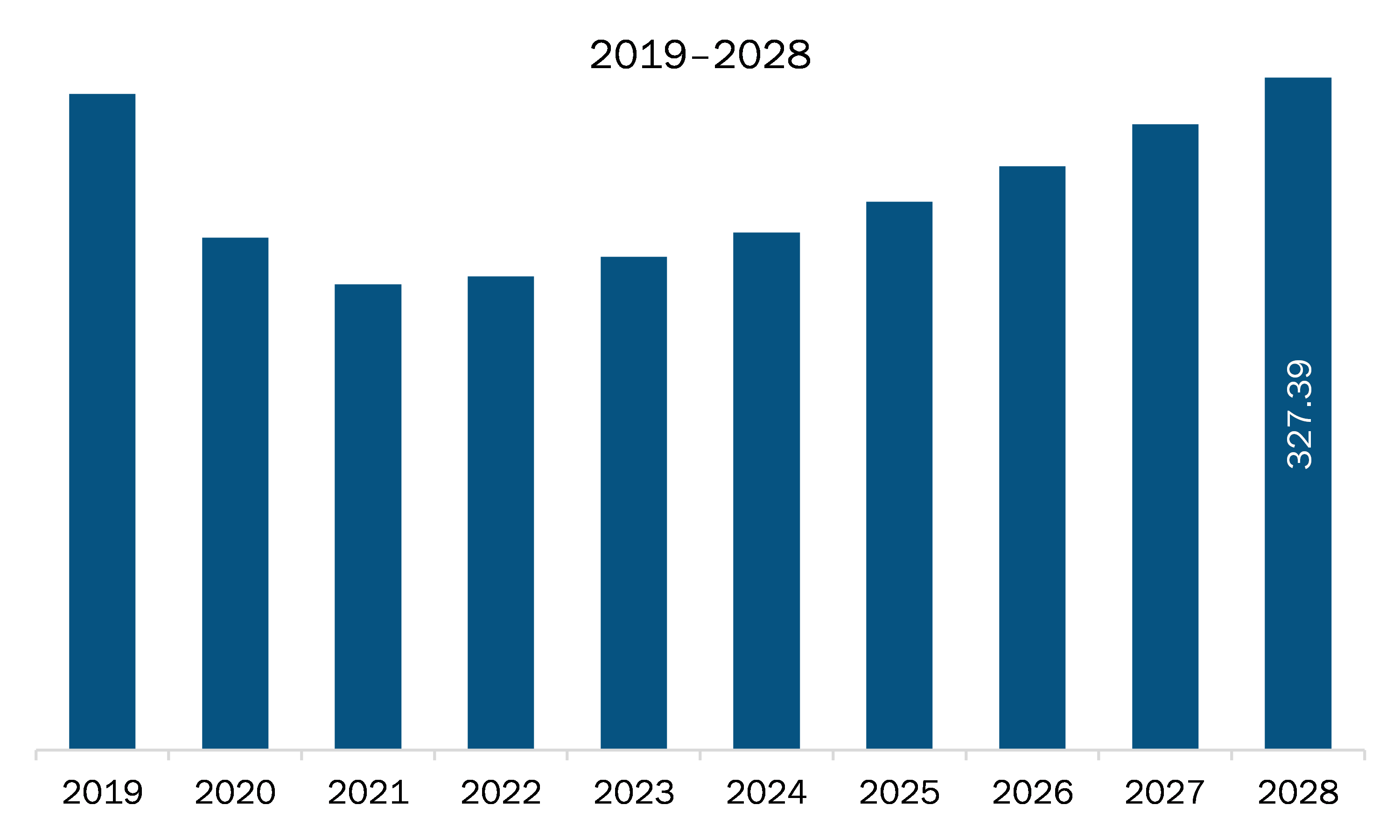

| Market size in 2021 | US$ 226.72 Million |

| Market Size by 2028 | US$ 327.39 Million |

| Global CAGR (2021 - 2028) | 5.4% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Wheel Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America Aircraft Wheels MRO refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The North America aircraft wheels MRO market is expected to grow from US$ 226.72 million in 2021 to US$ 327.39 million by 2028; it is estimated to grow at a CAGR of 5.4% from 2021 to 2028. Surging strategic tie-ups for defense aircraft wheels MRO services is expected to catalyze the North America aircraft wheels MRO market. At present, various armed forces are also significantly increasing military aircraft fleets to strengthen their air defense. Similarly, in April 2021, the US Air Force formed a strategic tie-up with Collins Aerospace for adopting wheels retrofitting services for its 70 B-52s aircraft. The increasing number of strategic tie-ups between aircraft MRO service providing companies and armed forces of various countries are expected to create opportunities for the North America aircraft wheels MRO market growth in coming years. Moreover, growing fleet sizes of military aircraft are further creating lucrative opportunities for MRO servicing players to grow their businesses across North America region.

In terms of wheel type, the main wheel segment accounted for the largest share of the North America aircraft wheels MRO market in 2020. In terms of aircraft type, the narrowbody aircraft segment held a larger market share of the North America aircraft wheels MRO market in 2020. Further, the non-destructive testing segment held a larger share of the North America aircraft wheels MRO market based on technology in 2020.

A few major primary and secondary sources referred to for preparing this report on the North America aircraft wheels MRO market are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are AAR CORP, AeroRepair Corp., AMETEK Inc., Lufthansa Technik, and TP Aerospace.

The North America Aircraft Wheels MRO Market is valued at US$ 226.72 Million in 2021, it is projected to reach US$ 327.39 Million by 2028.

As per our report North America Aircraft Wheels MRO Market, the market size is valued at US$ 226.72 Million in 2021, projecting it to reach US$ 327.39 Million by 2028. This translates to a CAGR of approximately 5.4% during the forecast period.

The North America Aircraft Wheels MRO Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Aircraft Wheels MRO Market report:

The North America Aircraft Wheels MRO Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Aircraft Wheels MRO Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Aircraft Wheels MRO Market value chain can benefit from the information contained in a comprehensive market report.