North America dominates the global aircraft wheels and brakes market, owing to the substantial production volume of commercial and military aircraft fleets. Another factor promoting the North American aircraft wheels and brakes market is the continuously growing number of air passengers. According to the International Civil Aviation Organization (ICAO), the total passenger traffic of North America is expected to grow by around 3.1% annually by 2045, which is anticipated to boost aircraft production and increase the demand for aircraft wheels and brakes. Improvements in airport infrastructure, installation of advanced air traffic control and air navigation systems, and better safety and security services are estimated to promote North America’s aviation sector. Government investment in the travel industry and powerful incentives for foreign direct investors to explore economic opportunities in the region’s air transportation sector are likely to augment North America’s aircraft industry and increase the demand for the aircraft wheels and brakes market. Growth in air transport activities, focus on NextGen air transportation systems, and presence of key players that are significantly investing in R&D to develop technologically advanced braking systems are estimated to boost North America’s aircraft wheels and brakes market during the forecast period. The increasing demand for lightweight aircraft in the commercial and military sectors has created a need for lightweight electric brakes. Alaska Airlines, United Airlines, American Airlines, Delta Air Lines, and Southwest Airlines are among the key companies in the North American aviation sector that are investing millions of dollars in the R&D of newer and advanced technologies in partnership with several technology developers. Also, these airlines continuously procure higher volumes of aircraft, which enables the aircraft OEMs to procure a significant volume of wheels and brakes. This is catalyzing the aircraft wheels and brakes market. Significant rise in the assembly of wheels and braking systems in an aircraft and replacement of old components and requirement of maintenance services are bolstering the market growth. There is a high demand for long-lasting wheels and carbon brakes, which is encouraging manufacturers to upgrade the existing systems, thereby enhancing market growth. North American countries have an extensive range of MRO facilities across borders encompassing commercial and military aircraft MRO services. The frequency of landing and take-off has raised the frequency of wheels and brakes MRO across aircraft fleet. Moreover, the region accounts for the largest volume of the existing aircraft fleet. Thus, the frequency of wheels and brakes MRO with the existence of a large aircraft fleet highlights a higher procurement rate of wheels and brakes among the MRO service providers. The MRO sector is witnessing growth in the number of MRO service providers, especially in Canada and Mexico, which is further expected to catalyze the demand for wheels and brakes, thereby boosting the aircraft wheels and brakes market.

In North America, the US witnessed the most severe impact of COVID-19 in 2020. The aircraft wheels and brake manufacturers and service providers in the region are affected due to imposition of nationwide lockdowns and travel restrictions, shutdown of production facilities, and shortage of employees. The massive outbreak created both a health crisis and an economic crisis in the North American countries, especially in the US, which also led to major disruptions in the aerospace industry, impacting supply chains, manufacturing, product sales, and so on. The COVID-19 pandemic has directly and indirectly impacted the industry’s short-term and long-term strategies. The pandemic has caused huge havoc in the airlines industry in North America due to huge net losses and delayed recovery. The aircraft industry in North America was one of the strongest performers in the pre-crisis period, however, IATA reports an estimated loss of ~US$ 45.8 billion in 2020 in the region. Nevertheless, in 2021, following the recovery, the net profit margin of the North American aerospace industry is anticipated to improve to –6.8% from –41.4% in 2020. The presence of large domestic markets is anticipated to drive the improvement. Recovery in demands for passenger, cargo, and military aircraft fleet is anticipated to boost manufacturing and sales of the aircraft wheels and brakes in the coming financial quarters.

Strategic insights for the North America Aircraft Wheels and Brakes provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

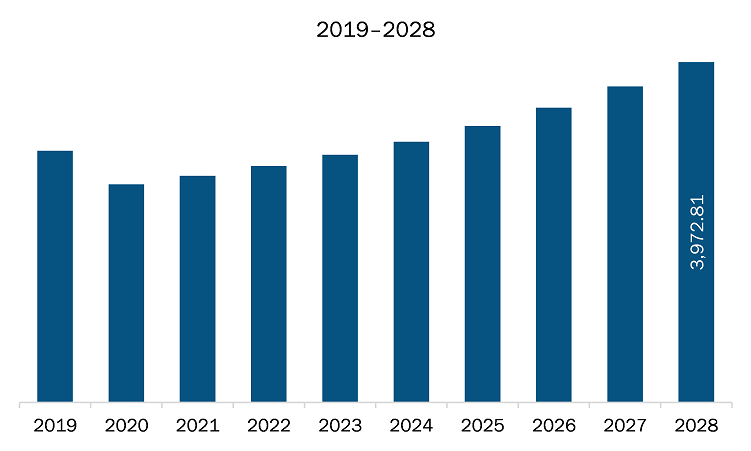

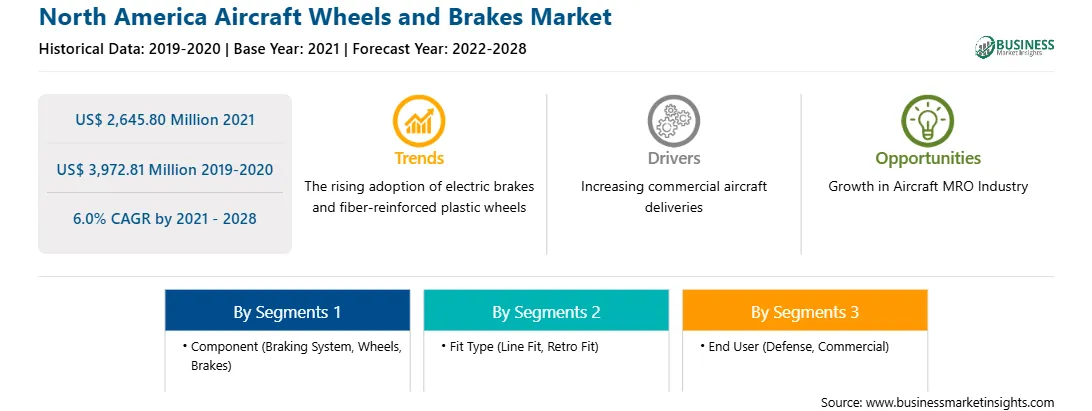

| Market size in 2021 | US$ 2,645.80 Million |

| Market Size by 2028 | US$ 3,972.81 Million |

| Global CAGR (2021 - 2028) | 6.0% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Component

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America Aircraft Wheels and Brakes refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The aircraft wheels and brakes market in North America is expected to grow from US$ 2,645.80

Based on component, the market is segmented into braking systems, wheels, and brakes. In 2020, the brakes segment held the largest share North America aircraft wheels and brakes market. Based on fit type, the market is divided into line fit and retro fit. In 2020, the retro fit segment held the largest share North America aircraft wheels and brakes market. Based on end user, the market is segmented into defense and commercial. In 2020, commercial segment held the largest share North America aircraft wheels and brakes market.

A few major primary and secondary sources referred to for preparing this report on the aircraft wheels and brakes market in North America are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are BERINGER AERO, Collins Aerospace, Crane Aerospace & Electronics, Grove Aircraft Landing Gear System Inc, Honeywell International Inc., JAY-Em Aerospace and Machine, Inc., MATCO Manufacturing Inc, Meggitt PLC, Parker Hannifin Corporation, and Safran among others.

The North America Aircraft Wheels and Brakes Market is valued at US$ 2,645.80 Million in 2021, it is projected to reach US$ 3,972.81 Million by 2028.

As per our report North America Aircraft Wheels and Brakes Market, the market size is valued at US$ 2,645.80 Million in 2021, projecting it to reach US$ 3,972.81 Million by 2028. This translates to a CAGR of approximately 6.0% during the forecast period.

The North America Aircraft Wheels and Brakes Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Aircraft Wheels and Brakes Market report:

The North America Aircraft Wheels and Brakes Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Aircraft Wheels and Brakes Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Aircraft Wheels and Brakes Market value chain can benefit from the information contained in a comprehensive market report.