North America is the largest aerospace market in the world owing to the presence of various military and commercial aircraft manufactures and MRO service providers. Due to the positive outlook toward the adoption of new technologies coupled with the presence of skilled workforce, favourable economic policies, and high GDP per capita, the North American aerospace industry has flourished. Some of the leading aircraft manufacturer operating in the region include Northrop Grumman, Gulfstream Aerospace, Boing, Textron, Bombardier, and Lockheed Martin. These aircraft OEMs have their various manufacturing facilities in this region and each manufacturing facility produces noteworthy volumes of aircraft models. This factor is driving the growth of the aircraft turbine fuel system market and is also projected to offer growth opportunities for the aircraft turbine fuel system market players.

The US is the worst-hit country in North America by the COVID-19 pandemic. Surge in the number of cases has led several North American governments to impose lockdown in Q2 and Q3 of 2020. Most of the manufacturing plants were temporarily shut or were operating with minimum staff. Moreover, the aircraft OEMs as well as aircraft components and associated product manufacturers witnessed disruptions in supply chains. The US has a larger density of aircraft manufacturers as well as aircraft-associated technology and system manufacturers, followed by Canada and Mexico. The outbreak has severely affected the production operations of these stakeholders. The lower number of manufacturing staff has resulted in lesser production quantity. From the aircraft OEM’s perspective, Boeing, the aviation giant in the region, has witnessed a significant fall in orders and production, which is one of the key factors restraining the aircraft turbine fuel system market. Apart from Boeing, several other aircraft OEMs such as Bombardier, Textron, and Gulfstream also reported under-performance in terms of order inflow and production capacities. Further, the region has higher numbers of aircraft turbine fuel system market players. The restrictions on workforce, disruption in supply chain, and limited volumes of orders have affected the aircraft turbine fuel system market growth in the region.

Strategic insights for the North America Aircraft Turbine Fuel System provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

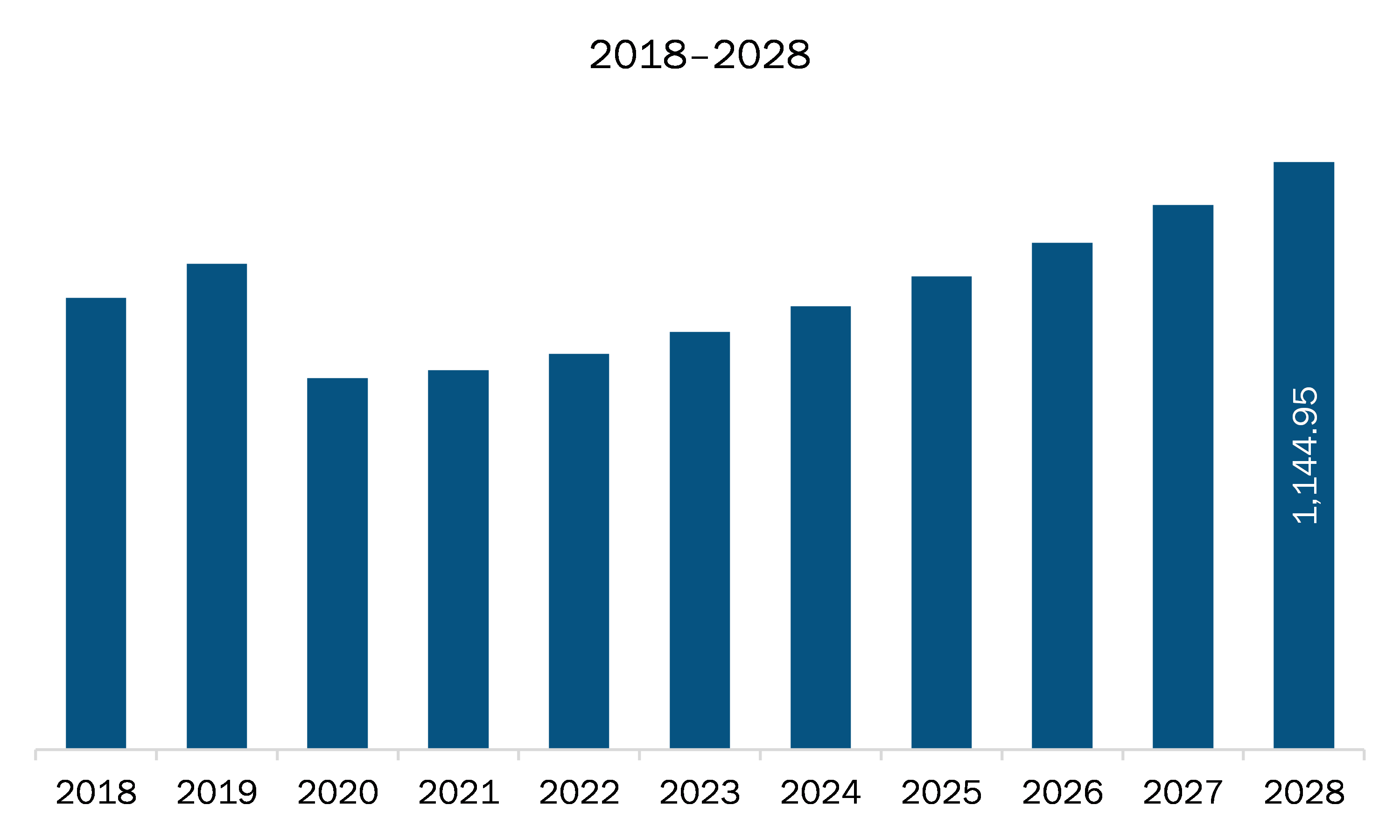

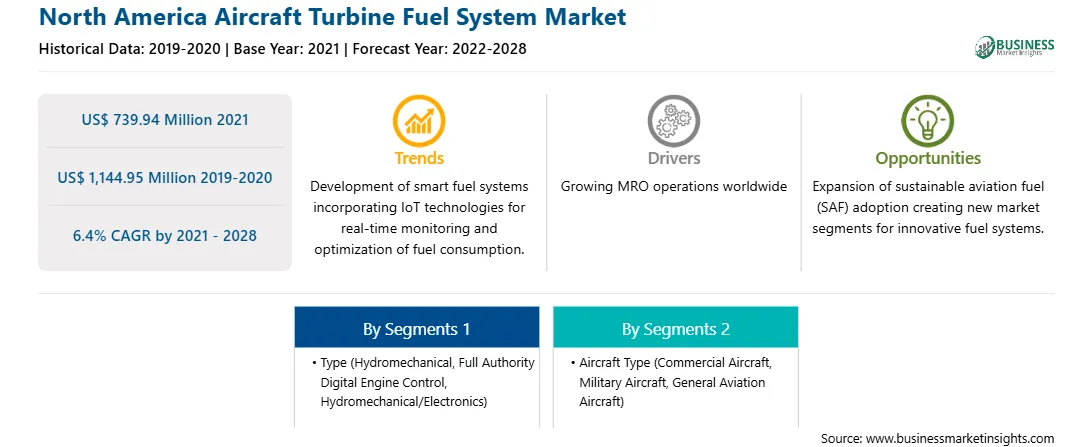

| Market size in 2021 | US$ 739.94 Million |

| Market Size by 2028 | US$ 1,144.95 Million |

| Global CAGR (2021 - 2028) | 6.4% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America Aircraft Turbine Fuel System refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The aircraft turbine fuel system market in North America is expected to grow from US$ 739.94 million in 2021 to US$ 1,144.95 million by 2028; it is estimated to grow at a CAGR of 6.4% from 2021 to 2028. The North America aviation industry players are emphasizing on manufacturing, integration, or mounting of lightweight materials on aircraft. The aviation authorities, aircraft manufacturers, aircraft component manufacturers, MRO service providers, and military forces are seeking lightweight materials for each component to extend the flying range of the aircraft and increase fuel efficiency. As the aircraft turbine fuel system is considered critical components of any aircraft, the demand for lightweight aircraft turbine fuel system is increasing. This factor encourages aircraft turbine fuel system manufacturers to design and develop the lightest possible aircraft turbine fuel system for the modern aircraft fleet. For instance, AeroComposites (AGC) and Technical Fibre Products Ltd (TFP) announced a new lightweight composite solution for aircraft fuel systems. The duo (AeroComposites and Technical Fibre Products Ltd), under joint a development program, has developed electrostatic and lightning compatible composite pipes, which have application in aircraft fuel systems. Newly developed pipes reduce weight up to 200 kg per aircraft. Thus, the development of such lightweight component for aircraft turbine fuel system is anticipated to generate ample growth opportunities for aircraft turbine fuel system market players.

The North America aircraft turbine fuel system market is segmented into type and aircraft type. Based on type, the aircraft turbine fuel system market is segmented into hydromechanical, full authority digital engine control (FADEC), and hydromechanical/electronics. The full authority digital engine control (FADEC) segment held the largest share in 2020 based on type. Based on aircraft type, the North America aircraft turbine fuel system market is segmented as commercial aircraft, military aircraft, and general aviation aircraft. The commercial aircraft segment held the largest share in 2020.

A few major primary and secondary sources referred to for preparing this report on the aircraft turbine fuel system market in North America are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Collins Aerospace; Eaton Corporation plc; Honeywell International Inc.; Mascott Equipment Co.; Parker-Hannifin Corporation; Safran; Triumph Group, Inc.; and

The North America Aircraft Turbine Fuel System Market is valued at US$ 739.94 Million in 2021, it is projected to reach US$ 1,144.95 Million by 2028.

As per our report North America Aircraft Turbine Fuel System Market, the market size is valued at US$ 739.94 Million in 2021, projecting it to reach US$ 1,144.95 Million by 2028. This translates to a CAGR of approximately 6.4% during the forecast period.

The North America Aircraft Turbine Fuel System Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Aircraft Turbine Fuel System Market report:

The North America Aircraft Turbine Fuel System Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Aircraft Turbine Fuel System Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Aircraft Turbine Fuel System Market value chain can benefit from the information contained in a comprehensive market report.