North America heavily invests in commercial and defense sectors to address the increasing demand for aircraft fleet for international travel as well as strengthening the defense. Additionally, as North America attracts numerous technological developments, the aircraft actuators market is growing rapidly in the region. With increasing number of aircraft in military and commercial sectors, the demand for aircraft actuators is also rising to ensure improved performance of flight control systems. The majority of the countries in the region are adopting advanced technologies to improve aircraft efficiency during undesirable environmental conditions. North America has a presence of leading aircraft actuator manufacturing companies and service providers, leading to strong competition in the market. Rising competition in the region has encouraged market players to provide integration of advanced systems—such as electro-mechanical, hydraulic, and electro-hydraulic actuators—through continuous development at competitive pricing. The aviation industry is enhancing aircraft actuators to improve flight control systems. For instance, in January 2021, Curtiss-Wright started the assembly of flight control system actuators developed for all-electric commuter aircraft program of Eviation Aircraft. The company is producing new flight control system actuators at its facility in Shelby, North Carolina to support the electric revolution in the aviation industry. Also, companies are developing a wide range of actuators to support new actuation systems. For instance, in July 2020, Collins Aerospace Systems, a US-based company, developed a new actuation system such as elevons actuation system, a moveable leading edge actuation system, rudder actuation system, and a horizontal stabilizer actuation system for Aerion, a supersonic aircraft company. These all-actuation systems are equipped with advanced actuators developed to support new AS2 supersonic business jets. According to the Air Transport Action Group, North America region held around 850 commercial airports with almost 1 billion passengers in 2018. Aviation industry in the region is well matured and it is creating more demand for aircraft. This, in turn, is supporting the growth of the aircraft actuators market. Small aircraft and business jets are mounting the demand for aircraft actuators. Also, companies are adopting acquisition strategies to enhance the actuator product portfolio for the market to attract potential customers. For instance, in July 2018, Héroux-Devtek Inc., a manufacturer of aerospace products, acquired the all the shares of Beaver Aerospace & Defense Inc. for US$ 23.5 million. Through this, the company extended its existing aerospace and product offerings, such as actuation systems and ball screws

The US is the worst-hit country in North America, with thousands of infected individuals facing severe health conditions across the country. The continuous growth of infected individuals has led the government to impose lockdown across the nation's borders during Q2 and Q3. The majority of the manufacturing plants either were temporarily shut or operated with minimum staff; the aircraft OEMs and aircraft components and associated product manufacturers witnessed disruption in supply chain; these are some of the North American countries' critical issues. Since the US has a larger density of aircraft manufacturers and aircraft associated technology and system manufacturers, followed by Canada and Mexico. The outbreak of the virus has severely affected the production of each. The lower number of manufacturing staff has resulted in lesser production quantity. From the aircraft OEM’s perspective, Boeing, the aviation giant in the region, has witnessed a significant fall in orders and production, which is one of the key restraining factors for the aircraft actuators market. Apart from Boeing, several other aircraft OEMs such as Bombardier, Textron, and Gulfstream, among others, also experienced tremors of COVID – 19 on their orders and production lines. From the supply side, the region has higher numbers of aircraft actuators market players. The restricted workforce, disruption in the supply chain, and limited volumes of orders have sternly shaken the aircraft actuators market players in the region. Due to COVID-19 pandemic impact, in September 2020, Airbus and Boeing delivered 57 commercial jets as compared to 71 deliveries, respectively, in the same month last year. In 2020, Boeing delivered 98, as compared to 204 shipments in the last year. The North American, aircraft manufacturing has been shattered by the momentary shutdown of aviation industry, which has been reflecting severely less demand for various types of systems and technologies including actuation system. Owing to this, the aircraft actuators market players have been witnessing noteworthy less demand; however, as the unlock measures started and airlines resumed their operations, the procurement rate of aircraft actuators begun to up rise at a slow pace.

Strategic insights for the North America Aircraft Actuators provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

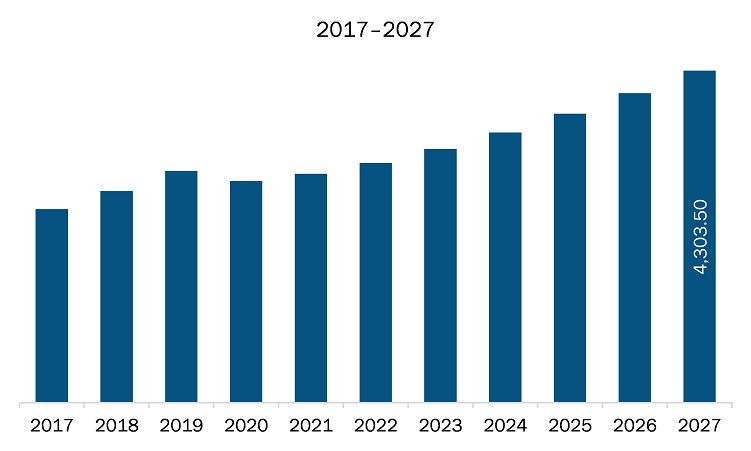

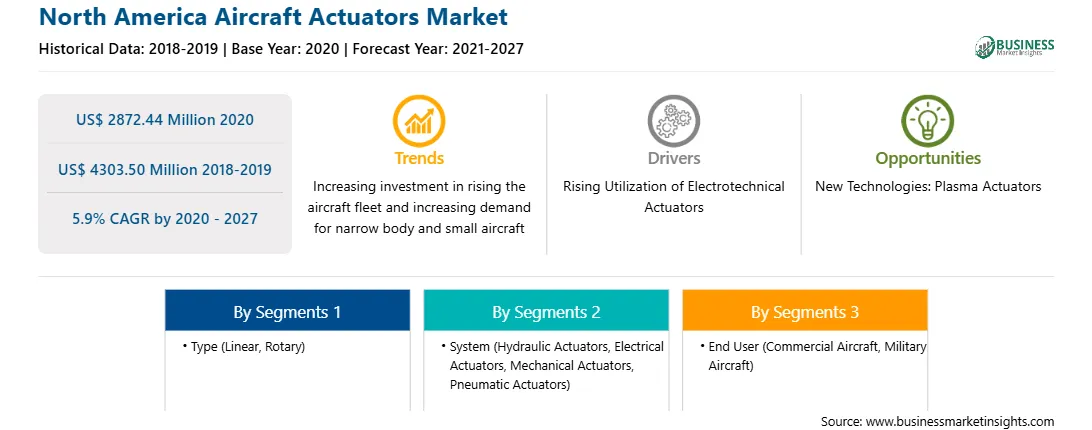

| Market size in 2020 | US$ 2872.44 Million |

| Market Size by 2027 | US$ 4303.50 Million |

| Global CAGR (2020 - 2027) | 5.9% |

| Historical Data | 2018-2019 |

| Forecast period | 2021-2027 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America Aircraft Actuators refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The aircraft actuators market in North America is expected to grow US$ 2872.44 million in 2020 to US$ 4303.50 million by 2027; it is estimated to grow at a CAGR of 5.9% from 2020 to 2027. Rising Demand for Narrow-body and Small Aircraft The aviation industry is witnessing a demand for narrow body and small aircraft having range up to 3,000nm from the developing economies and developed nations. Lightweight design and fuel efficiency are the prominent factors driving the demand for narrow body and small aircraft. To develop such aircraft, manufacturers are procuring a significant number of electromechanical actuators, which are lighter and smaller. As electromechanical actuators do not have any leakages of oil or air, it reduces the maintenance cost. The inclination of airlines toward long-range narrow body is on an upward trend as the majority of the commercial aviation sector players are eyeing on lowering the operational cost and increasing the fleet size. The delivery volumes of narrow-body aircraft fleet—such as Airbus A320 series and Boeing B737 series—were 626 and 580 in 2018, and 642 and 127 in 2019.This is bolstering the growth of the aircraft actuators market.

In terms of type, the Linear segment accounted for the largest share of the North America aircraft actuators market in 2019. In terms of type, the Linear segment held a larger market share of the aircraft actuators market in 2019. Further, the Commercial Aircraft segment held a larger share of the market based on end user in 2019.

A few major primary and secondary sources referred to for preparing this report on the aircraft actuators market in North America are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Collins Aerospace; Raytheon Technologies Company; Curtiss-Wright Corporation; Eaton Corporation plc, Honeywell International Inc; Meggitt PLC, Moog Inc.; Nook Industries, Inc; Parker-Hannifin Corporation; TransDigm Group Incorporated; Woodward, Inc.

The North America Aircraft Actuators Market is valued at US$ 2872.44 Million in 2020, it is projected to reach US$ 4303.50 Million by 2027.

As per our report North America Aircraft Actuators Market, the market size is valued at US$ 2872.44 Million in 2020, projecting it to reach US$ 4303.50 Million by 2027. This translates to a CAGR of approximately 5.9% during the forecast period.

The North America Aircraft Actuators Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Aircraft Actuators Market report:

The North America Aircraft Actuators Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Aircraft Actuators Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Aircraft Actuators Market value chain can benefit from the information contained in a comprehensive market report.