Government regulations are formulating policies to enhance the air quality of industrial and commercial environments, further strengthening the demand for air purifiers across various applications. For instance, the Clean Air Act (CAA), EPA sets limits on certain air pollutants, including how much can be in the air anywhere in the US. The rising number of initiatives by governments in many countries on reducing air pollutants, which help improve the air quality, is further boosting the market. For instance, in July 2022, the Canadian government introduced a clean air delivery rate (CADR) policy. The CADR describes how well the air purification machine reduces tobacco smoke, dust, and pollen. The higher the number, the more particles the air purifier can remove.

The US, Canada, and Mexico are among the major economies in North America. Rising air pollution and the prevalence of airborne diseases in the region increased product demand. The continuous contribution of tech giants in technological advancements created a stir in the competitive market across the region, thereby integrating advanced technologies in their respective business processes for better future growth. North American countries, especially the US and Canada, are technologically advanced and comprise numerous industries. Various states, such as California, Chicago, Illinois, Ohio, Oklahoma, and Mississippi, implemented lockdown measures to curb the COVID-19 pandemic. As a result, sales of home appliances such as air purification, water purification, kitchen appliances, and water purification are growing. Growing awareness of healthy living also contributed to the increase in product sales in the region. Comprehensive emission reduction strategies from the Air Quality Guideline EPA, the US Clean Air Act, and Environment Canada, including establishing National Air Quality Standards by the US, offer new opportunities for air purification manufacturers. The increasing installation of comprehensive ambient air quality monitoring systems, the development and implementation of regulatory measures, and the organization of air quality management programs to raise public awareness will drive the demand for the air purification market in North America in the coming years. In the United States, acceptance of products is rapidly increasing to minimize such health problems caused by poor air quality. Stringent air quality standards, guidelines, and regulations in the United States are expected to have a positive impact on the market.

Strategic insights for the North America Air Purification provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

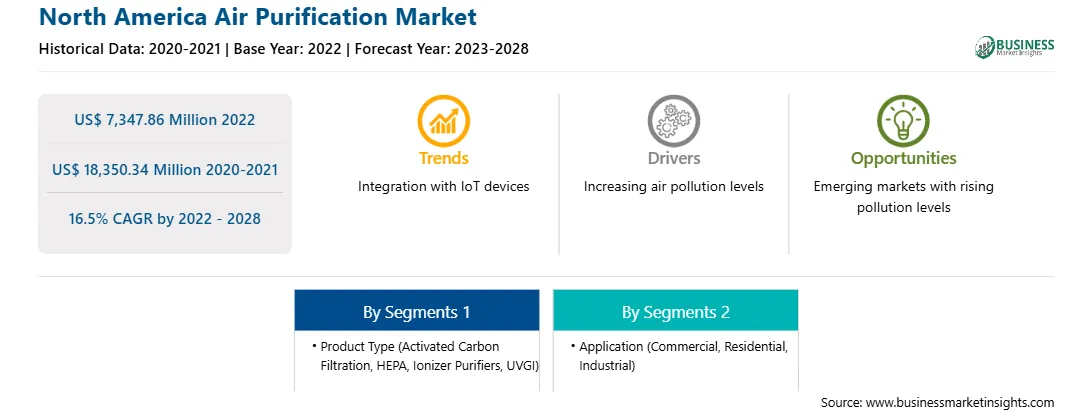

| Market size in 2022 | US$ 7,347.86 Million |

| Market Size by 2028 | US$ 18,350.34 Million |

| Global CAGR (2022 - 2028) | 16.5% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2028 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America Air Purification refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The North America air purification market is segmented into product, application, and country. Based on product, the market is segmented into activated carbon filtration, HEPA, ionizer purifiers, UVGI, and others. The HEPA segment held the largest market share in 2022.

Whirlpool Corporation; Camfil; DAIKIN INDUSTRIES, Ltd.; Honeywell International Inc.; Koninklijke Philips N. V; LG Electronics; Panasonic Corporation; Unilever PLC; ActivePure Technologies, LLC.; and IQAir are the leading companies operating in the air purification market in the region.

The North America Air Purification Market is valued at US$ 7,347.86 Million in 2022, it is projected to reach US$ 18,350.34 Million by 2028.

As per our report North America Air Purification Market, the market size is valued at US$ 7,347.86 Million in 2022, projecting it to reach US$ 18,350.34 Million by 2028. This translates to a CAGR of approximately 16.5% during the forecast period.

The North America Air Purification Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Air Purification Market report:

The North America Air Purification Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Air Purification Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Air Purification Market value chain can benefit from the information contained in a comprehensive market report.