North America Air Conditioning Compressor Parts Market

No. of Pages: 105 | Report Code: BMIRE00029379 | Category: Electronics and Semiconductor

No. of Pages: 105 | Report Code: BMIRE00029379 | Category: Electronics and Semiconductor

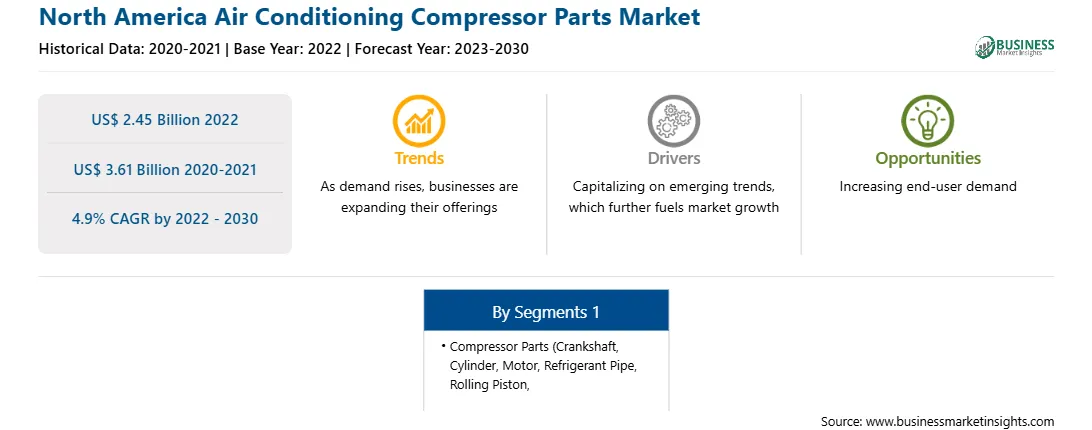

The North America air conditioning compressor parts market size was valued at US$ 2.45 billion in 2022 and is expected to reach US$ 3.61 billion by 2030; it is estimated to record a CAGR of 4.9% from 2022 to 2030.

The US is experiencing increasingly hot summers, which is driving up demand for air conditioning. Additionally, the growing population and increasing urbanization are leading to more people shifting to urban areas where air conditioning is essential. Therefore, many companies are launching air conditioning systems. For instance, in March 2023, Daikin North America LLC launched the VRV. The Daikin VRV system is a commercial multi-split air conditioner that uses variable refrigerant flow control designed by Daikin to give customers the flexibility to maintain individual zone management in each room and floor of a building. This increases the demand for air conditioning compressors and their parts. Thus, the factors mentioned above are expected to positively influence the air conditioning compressor part market in the US.

The scroll compressor manufacturers in North America strive to source components from countries under the North American Free Trade Agreement (NAFTA). However, Asian countries such as China and India have a significant advantage in manufacturing and supplying such parts. Hence, compressor manufacturers in the US and Canada prefer to source the majority of the parts from Asian nations, predominantly China. However, Mexico is also a significant supplier of such parts and finished compressors.

In most cases, the process of importing from foreign manufacturers can be complicated due to complex paperwork and concerns with quality. Additionally, certain set guidelines and extra importation duties are applicable. Moreover, the trade war between the US and China has increased the complexity of sourcing parts for scroll compressor manufacturers in the US. Thus, Mexico's significance as a compressor parts manufacturer has gained prominence in the past few years.

On the other hand, imported air compressor parts are mostly of superior quality owing to adherence to stringent guidelines required for supplying to the US. Additionally, foreign companies mostly produce the components in bulk since they cater worldwide, allowing them to sell at reduced prices. Other trade discounts may also make importing scroll compressor parts from other countries a better option.

To hedge against supply uncertainties, most scroll compressor manufacturers tend to import the parts in bulk. However, the manufacturers refrain from entering into long purchase contracts since the number of suppliers is relatively high, especially from China. Entering into long contracts can result in a business loss since, due to high competitiveness, competing component suppliers often supply the parts at a relatively low-profit margin. Additionally, the switching cost of suppliers is quite low, and thus, long supply contracts are not preferred by scroll compressor manufacturers.

It is noteworthy that all component suppliers need to adhere to the stringent requirements of the compressor manufacturer. Hence, despite low switching costs, manufacturers often prefer to rely on suppliers they work with on a regular basis or have been associated with previously. In such instances, despite higher import duty, quality is given prominence, and hence, the price of the final product to compensate for the higher manufacturing cost. End users of scroll compressors are often brand-sensitive in the US and, hence, are agreeable to pay slightly more for procuring a branded compressor. Thus, the higher import tariff is often passed on to the end user to some extent without compromising the quality of the finished scroll compressor..

Carrier Global Corp, Copeland LP, Honeywell International Inc., Mitsubishi Electric Corp, Mueller Streamline Co., e+a Elektromaschinen und Antriebse AG, Huayi Compressor Barcelona SL, Mayekawa Manufacturing Co Ltd., Parker Hannifin Corp are among the players operating in the Air conditioning compressor parts market. Several other major companies have been analyzed during this research study to get a holistic view of the Air conditioning compressor parts market ecosystem.

Strategic insights for the North America Air Conditioning Compressor Parts provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 2.45 Billion |

| Market Size by 2030 | US$ 3.61 Billion |

| Global CAGR (2022 - 2030) | 4.9% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Compressor Parts

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America Air Conditioning Compressor Parts refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The List of Companies -?North America Air Conditioning Compressor Parts Market

- Carrier Global Corp

- Copeland LP

- Honeywell International Inc

- Mitsubishi Electric Corp

- Mueller Streamline Co

- e+a Elektromaschinen und Antriebse AG

- Huayi Compressor Barcelona SL

- Mayekawa Manufacturing Co Ltd

- Parker Hannifin Corp

- Libra Engineers Pvt Ltd

The North America Air Conditioning Compressor Parts Market is valued at US$ 2.45 Billion in 2022, it is projected to reach US$ 3.61 Billion by 2030.

As per our report North America Air Conditioning Compressor Parts Market, the market size is valued at US$ 2.45 Billion in 2022, projecting it to reach US$ 3.61 Billion by 2030. This translates to a CAGR of approximately 4.9% during the forecast period.

The North America Air Conditioning Compressor Parts Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Air Conditioning Compressor Parts Market report:

The North America Air Conditioning Compressor Parts Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Air Conditioning Compressor Parts Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Air Conditioning Compressor Parts Market value chain can benefit from the information contained in a comprehensive market report.