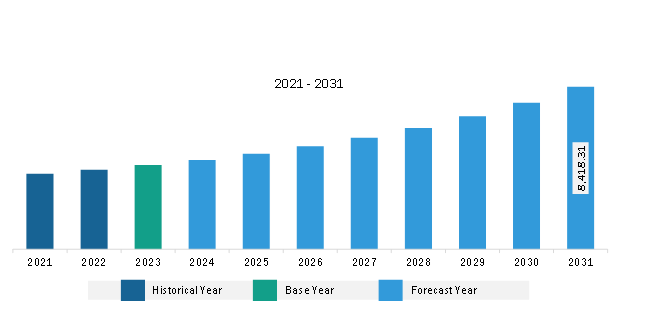

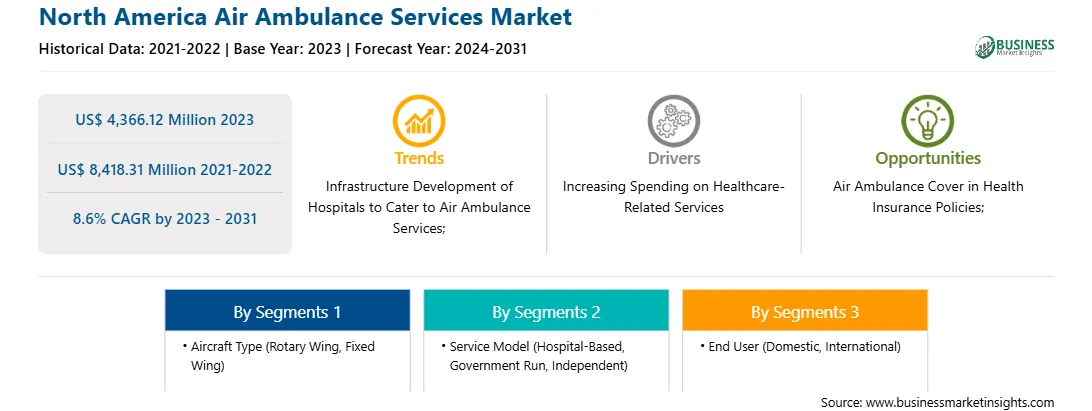

The North America air ambulance services market was valued at US$ 4,366.12 million in 2023 and is expected to reach US$ 8,418.31 million by 2031; it is estimated to record a CAGR of 8.6% from 2023 to 2031.

The healthcare sector is growing rapidly owing to its growing coverage, improved services, and rising expenditure by public and private players. In addition, with the increasing awareness and focus on well-being and health-related concerns, the majority of the population is increasing their spending on healthcare-related services. Rising household income and increasing awareness about health and wellness have resulted in a growing demand for medical and healthcare services, including better treatment facilities, multi-specialty hospitals, advanced medical equipment and devices, and patient pick-up and drop services using air ambulance services. Patients are now focusing more on premium healthcare facilities in terms of transportation and overall services. Customers in higher income groups emphasized faster pick-up facilities in times of emergency and opted for air ambulance facilities offered by hospitals or independent trauma care centers. For instance, the US has one of the highest costs of healthcare in the world. In 2022, US healthcare spending reached ~US$ 4.5 trillion, which averages to ~US$ 13,493 per person. According to a study published by the American Medical Association, in 2021, the majority of the population was spending on private health insurance policies, which accounted for almost 28.5% of the overall healthcare expenditure. High-range healthcare policies cover all the client's expenses and allow patients to opt for premium services, including ambulance services. The growing demand for air ambulance services among customers positively impacts the market growth.

The growing healthcare infrastructure in terms of building new multi-specialty hospitals and care centers, along with a rising focus on healthcare facilities such as emergency medical assistance services, is anticipated to boost the growth of the air ambulance services market in North America.

The mounting prevalence of chronic diseases such as cardiovascular diseases, cancer, and stroke and the growing consumer preference for emergency medical services for improved and immediate medical attention are boosting the demand for air ambulance services in North America. Moreover, the region has the presence of air ambulance service providers such as Air Methods, Global Medical Response, and PHI Air Medical. In 2023, Bell Textron Inc. announced that Life Flight Network had procured two additional Bell 407GXi helicopters and planned to obtain an additional Bell 429. In 2022, Tropic Ocean Airways and REVA partnered to provide comprehensive air medical service for patients in the Caribbean and other remote locations. Hospitals such as Barnes-Jewish Hospital, Brigham and Women's Hospital, Cedars-Sinai Medical Center, and Cleveland Clinic are collaborating with air ambulance service providers to offer enhanced emergency medical care support to their patients, driving the demand for air ambulance services in North America

Strategic insights for the North America Air Ambulance Services provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the North America Air Ambulance Services refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

North America Air Ambulance Services Strategic Insights

North America Air Ambulance Services Report Scope

Report Attribute

Details

Market size in 2023

US$ 4,366.12 Million

Market Size by 2031

US$ 8,418.31 Million

Global CAGR (2023 - 2031)

8.6%

Historical Data

2021-2022

Forecast period

2024-2031

Segments Covered

By Aircraft Type

By Service Model

By End User

Regions and Countries Covered

North America

Market leaders and key company profiles

North America Air Ambulance Services Regional Insights

The North America air ambulance services market is categorized into aircraft type, service model, end user, and country.

Based on aircraft type, the North America air ambulance services market is bifurcated into rotary wing and fixed wing. The rotary wing segment held a larger market share in 2023.

In terms of service model, the North America air ambulance services market is categorized into hospital-based, government run, and independent. The hospital-based segment held the largest market share in 2023.

In terms of end user the North America air ambulance services market is bifurcated into domestic and international. The domestic segment held a larger market share in 2023.

By country, the North America air ambulance services market is segmented into the Us, Canada, and Mexico. The US dominated the North America air ambulance services market share in 2023.

Air Methods, Babcock International Group Plc, Medical Air Service, and PHI Air Medical are among the leading companies operating in the North America air ambulance services market.

The North America Air Ambulance Services Market is valued at US$ 4,366.12 Million in 2023, it is projected to reach US$ 8,418.31 Million by 2031.

As per our report North America Air Ambulance Services Market, the market size is valued at US$ 4,366.12 Million in 2023, projecting it to reach US$ 8,418.31 Million by 2031. This translates to a CAGR of approximately 8.6% during the forecast period.

The North America Air Ambulance Services Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Air Ambulance Services Market report:

The North America Air Ambulance Services Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Air Ambulance Services Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Air Ambulance Services Market value chain can benefit from the information contained in a comprehensive market report.