Agriculture plays a crucial role in the economic growth of some of the largest nations across North America which include the US, Canada, mexico among many others. With continuously growing population and rising demand of agricultural output to meet the increasing demand, the investments in agriculture technology solutions have been growing at an impressive pace. Agritech refers to a market ecosystem that consist of companies which are using and developing different technologies to enhance their agriculture products or services offerings. These advanced offerings are aimed to increase overall yield, efficiency, cost savings, and profitability of farmers and agriculture companies across the value chain. Some of the key technologies that are penetrating the North America agriculture sector include data analytics, artificial intelligence, internet-of-things, machine learning, automation systems, software as a service solution among many others. In addition to this, the evolving business & revenue models in agriculture sector, market consolidation with bigger players acquiring smaller players to achieve economies of scale and vertical integration, trend of precision farming, and rising investments in agritech start-ups are some of the key factors that are fueling the growth of North America agritech market. Agri inputs, precision agriculture, farm management software, supply chain tech, quality management and traceability are some of the key growth areas that are driving the technology adoption in North America agriculture sector. Also Various countries witnessing rise in agriculture sector is a major factor driving the North America agritech market.

COVID-19 is having a very devastating impact over the North America region. North America is an important market for the growth of agritech products owing to the presence of developed countries such as the US and Canada in this region. The high number of COVID cases have resulted in a negative impact on country’s and region’s economy and there has been a decline business activities and growth of various industries operating in the region. The COVID-19 pandemic has been a major for all the farmers in the region, threatening access to agricultural labor and complexing worldwide supply chains. However, for indoor farming, it has offered an opportunity. In vertical farming, the batches of crops can be watered individually and ignited with the help of smart agriculture products, enabling them to be grown year-round with less resource. Nevertheless, the factory and business shutdowns across the US, Canada, and Mexico negatively impacted the sales of agritech products, such as sensors, agribots, and many more. COVID-19 has had a severe impact on logistics operations, transportation, and trade activity. North America is home to a large number of manufacturing and technology companies. Thus, the coronavirus outbreak's impact is anticipated to be quite severe in the year 2020 and likely in 2021. However, the impact of COVID-19 is short-term; it is likely to decrease in the coming years.

Strategic insights for the North America Agritech provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2019 | US$ 6,731.3 Million |

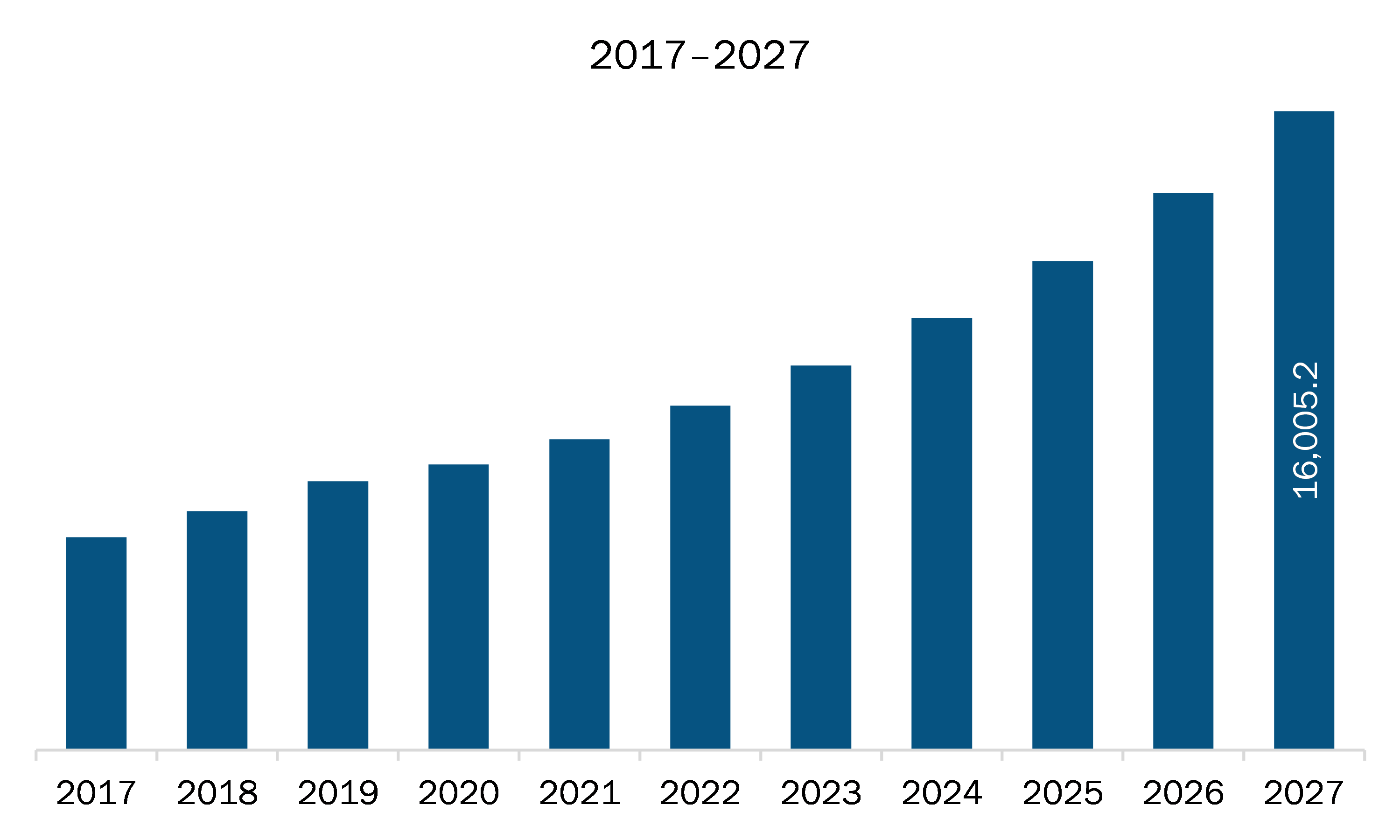

| Market Size by 2027 | US$ 16,005.2 Million |

| Global CAGR (2020 - 2027) | 12.2% |

| Historical Data | 2017-2018 |

| Forecast period | 2020-2027 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America Agritech refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The agritech market in North America is expected to grow from US$ 6,731.3 million in 2019 to US$ 16,005.2 million by 2027; it is estimated to grow at a CAGR of 12.2% from 2020 to 2027. In the era of technological advancements, an enormous amount of data is being generated on an everyday basis. Agriculture is anticipated to evolve as a high-tech sector in the coming years, wherein the performance of interconnected systems would be assisted by artificial intelligence (AI) and Big Data facilities. The resulting systems would converge into a single unit, combining farm machinery and management, starting from seeding to production forecasting. Personnel employing Big Data and analytics must consider concrete and specific characteristics of farming to extract valuable information and take effective decisions accordingly. The AI and Big data technologies uses sensors to record weather conditions, crop efficiency, and soil structure. Both Big Data and AI have a potential to optimize productivity and crop management.

In terms of type, the biotechnology and biochemicals segment accounted for the largest share of the North America agritech market in 2019. Based on application, production and maintenance segment is expected to be the fastest growing segment during the forecast period; which is from 2017 to 2027.

A few major primary and secondary sources referred to for preparing this report on the agritech market in North America are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are AeroFarms; AgBiome, Inc.; ARSR Tech; Ceres Imaging; Conservis; Indigo Ag, Inc.; Pivot Bioare.

The North America Agritech Market is valued at US$ 6,731.3 Million in 2019, it is projected to reach US$ 16,005.2 Million by 2027.

As per our report North America Agritech Market, the market size is valued at US$ 6,731.3 Million in 2019, projecting it to reach US$ 16,005.2 Million by 2027. This translates to a CAGR of approximately 12.2% during the forecast period.

The North America Agritech Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Agritech Market report:

The North America Agritech Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Agritech Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Agritech Market value chain can benefit from the information contained in a comprehensive market report.