Market Introduction

The aerospace fiber optic cables market is showcasing an upward trend over the past couple of years and is anticipated to reflect a similar trend during the forecast period. In comparison to copper cables, the fiber optic cables are light-weighted, smaller in width, and high bandwidth. These advantages are propelling their adoption of fiber optic cables in the aerospace sector.The growth of the aerospace fiber optic cables market is majorly attributed to significant investments towards advanced technologies in the aerospace industry. Over the past few decades, the aviation (commercial and military) industry has grown immensely; the rate of technological transformation has been outstanding, which has stimulated the demand for various products and services. Pertaining to the fact that the fiber optic cables overcome the challenges by its predecessors, and has showcased significant benefits in the military aviation industry, the demand for the same is growing in the commercial aviation industry, which is driving the aerospace fiber optic cables market.

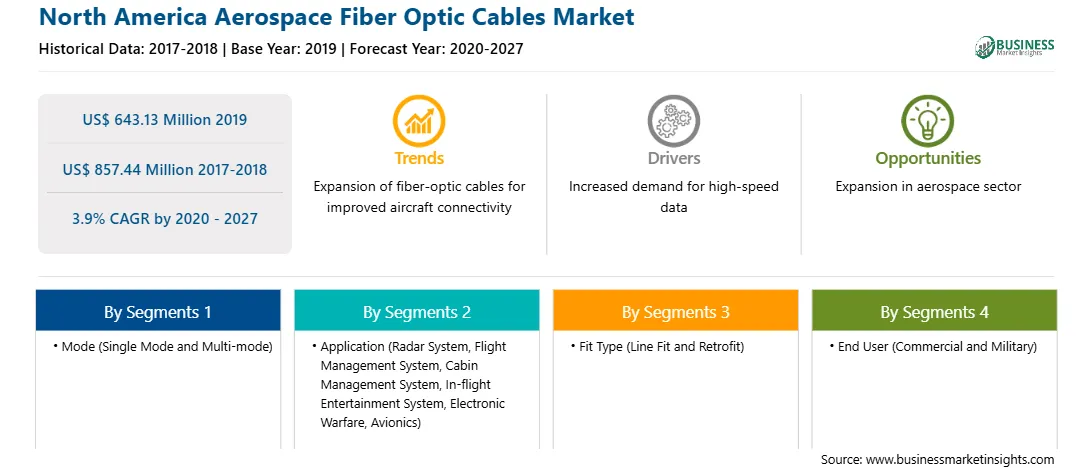

Strategic insights for the North America Aerospace Fiber Optic Cables provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the North America Aerospace Fiber Optic Cables refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.North America Aerospace Fiber Optic Cables Strategic Insights

North America Aerospace Fiber Optic Cables Report Scope

Report Attribute

Details

Market size in 2019

US$ 643.13 Million

Market Size by 2027

US$ 857.44 Million

Global CAGR (2020 - 2027)

3.9%

Historical Data

2017-2018

Forecast period

2020-2027

Segments Covered

By Mode

By Application

By Fit Type

By End User

Regions and Countries Covered

North America

Market leaders and key company profiles

North America Aerospace Fiber Optic Cables Regional Insights

Market Overview and Dynamics

The aerospace fiber optic cables market in North America is expected to grow from US$ 643.13Mn in 2019 to US$ 857.44Mn by 2027; it is estimated to grow at a CAGR of 3.9% from 2020 to 2027.The rising emphasis on reduction of aircraft weight and increasing demand for higher bandwidth over long distance are driving the growth of aerospace fiber optic cablesmarket across the region.However, the discontinuation of the Airbus A380 Program and high cost of maintenanceis a hindering factor to the aerospace fiber optic cables market growth. Further, increasing demand of in-flight entertainment to stimulate the adoption of fiber optic cables, thereby bolstering the growth of the aerospace fiber optic cables market.

Key Market Segments

In terms of mode, themulti-modesegment accounted for the largest share of the North America aerospace fiber optic cables marketin 2019. In terms of application, the avionics segment held a larger market share of theaerospace fiber optic cables marketin 2019. Further, based on fit type, retrofit segment held the largest share of the market. On the basis of end user, the market is bifurcated into military and commercial. The military segment held the largest share of the market.

Major Sources and Companies Listed

A few major primary and secondary sources referred to for preparing this report on the aerospace fiber optic cables marketin North Americaare company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report areAmphenol Corporation, Carlisle Companies Incorporated, Collins Aerospace, Nexans, Prysmian Group, and TE Connectivityamong others.

Reasons to buy report

NORTH AMERICA AEROSPACE FIBER OPTIC CABLES MARKET SEGMENTATION

By Mode

By Application

By Fit Type

By End User

By Country

Company Profiles

The List of Companies - North America Aerospace Fiber Optic Cables Market

The North America Aerospace Fiber Optic Cables Market is valued at US$ 643.13 Million in 2019, it is projected to reach US$ 857.44 Million by 2027.

As per our report North America Aerospace Fiber Optic Cables Market, the market size is valued at US$ 643.13 Million in 2019, projecting it to reach US$ 857.44 Million by 2027. This translates to a CAGR of approximately 3.9% during the forecast period.

The North America Aerospace Fiber Optic Cables Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Aerospace Fiber Optic Cables Market report:

The North America Aerospace Fiber Optic Cables Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Aerospace Fiber Optic Cables Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Aerospace Fiber Optic Cables Market value chain can benefit from the information contained in a comprehensive market report.