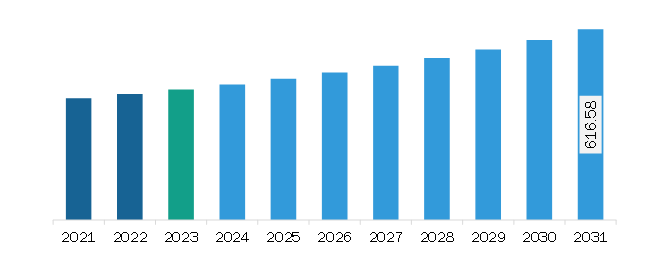

The North America aerial firefighting market was valued at US$ 421.93 million in 2023 and is expected to reach US$ 616.58 million by 2031; it is estimated to register a CAGR of 4.9% from 2023 to 2031.

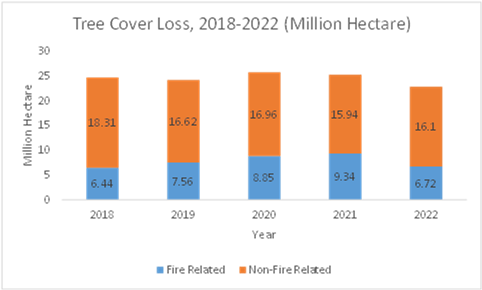

The number of forest fire instances across the globe is growing owing to climate change and rapid urbanization. According to the World Resources Institute, the rise in tree cover loss associated with wildfires across the globe from 2018 to 2021 is shown in the figure below:

Strategic insights for the North America Aerial Firefighting provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 421.93 Million |

| Market Size by 2031 | US$ 616.58 Million |

| Global CAGR (2023 - 2031) | 4.9% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2031 |

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America Aerial Firefighting refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

In 2021, the forest fires caused 9.34 million hectares of tree cover loss globally, which represented ~33% of the overall tree cover loss. In addition, the period of fire seasons across the world continues to extend year by year, which resulted in the overlap of seasons across different regions. This has led to difficulties for the countries to share the resources and assistance to other countries experiencing wildfires. According to the NFPA journal, the forecasted expenditure on firefighting owing to the global climate-change-induced forest fires is expected to rise from US$ 2 billion in 2020 and reach between US$ 5 billion and US$ 30 billion annually by 2050. Hence, the growing number of forest fire instances as mentioned above drives the demand for aerial firefighting services to combat forest fires from further spread which in turn is anticipated to fuel the market growth in the coming years.

The rising number of wildfires in the US, Canada, and Mexico is expected to drive the aerial firefighting market growth in the region from 2023 to 2031. Wildland fire aviation in North America involves a variety of aircraft and missions. Helicopters are primarily used for dropping huge volumes of water, crew transport, reconnaissance, infrared surveillance, and resource delivery to the fire line. Fixed wing aircraft include smokejumper transport aircraft, tactical air platforms, single-engine air tankers (SEATs), large tankers, and large transport aircraft. All aircraft, whether fixed wing or rotary wing, play a critical role in supporting firefighters on the ground. Currently, Erickson, Coulson, and others operate helicopters and fixed-wing aircraft in North America. Key players operating in the North America aerial firefighting market include Coulson Aviation (USA) Inc., Conair Group Inc., Neptune Aviation Services Inc., 10 Tanker, Erickson Inc, Billings Flying Service, and Dauntless Air Inc.

Strategic insights for the North America Aerial Firefighting provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 421.93 Million |

| Market Size by 2031 | US$ 616.58 Million |

| Global CAGR (2023 - 2031) | 4.9% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2031 |

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America Aerial Firefighting refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The North America aerial firefighting market is categorized into end use, aircraft type, and country.

By end use, the North America aerial firefighting market is segmented into forest firefighting, urban firefighting, and others. The forest firefighting segment held the largest share of the North America aerial firefighting market share in 2023.

In terms of aircraft type, the North America aerial firefighting market is bifurcated into fixed wing and rotary wing. The rotary wing segment held a larger share of the North America aerial firefighting market share in 2023.

Based on country, the North America aerial firefighting market is segmented into the US, Canada, and Mexico. The US segment held the largest share of North America aerial firefighting market in 2023.

TANKER, Babcock International Group Plc, Billings Flying Service, Conair Group Inc., Coulson Aviation (USA) Inc., Dauntless Air Inc, Erickson Inc, and Neptune Aviation Services are the some of the leading companies operating in the North America aerial firefighting market.

The North America Aerial Firefighting Market is valued at US$ 421.93 Million in 2023, it is projected to reach US$ 616.58 Million by 2031.

As per our report North America Aerial Firefighting Market, the market size is valued at US$ 421.93 Million in 2023, projecting it to reach US$ 616.58 Million by 2031. This translates to a CAGR of approximately 4.9% during the forecast period.

The North America Aerial Firefighting Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Aerial Firefighting Market report:

The North America Aerial Firefighting Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Aerial Firefighting Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Aerial Firefighting Market value chain can benefit from the information contained in a comprehensive market report.