North America Advanced Planning and Scheduling (APS) Software Market

No. of Pages: 100 | Report Code: TIPRE00022152 | Category: Technology, Media and Telecommunications

No. of Pages: 100 | Report Code: TIPRE00022152 | Category: Technology, Media and Telecommunications

Online sales in the US and Canada are constantly mounting and reflecting an unstoppable attitude toward its growth over the next decade. In the region, the US has a highly skilled workforce in the retail & consumer goods products arena. As per the International Trade Administration (ITA), in 2019, the consumer goods market in the US was the largest in the globe, registering US$ 635 billion. Since the market in the US is broad and open, the consumer is receptive to both domestic and imported brands. With the strong APS software, the retail & consumer goods industry can enhance the synchronization of the manufacturing processes by gaining insights, which enables them to improve further and surge utilization, thus reducing wastage. According to the Centre for Environment and Development (CED), the food & beverage industry in the US plays a crucial role in the economy, accounting for ~5% of the GDP, 10% of the total US employment, and 10% of the consumers’ disposable personal income (DPI). In 2017, the industry had total sales of US$ 1.4 trillion, and it meets the growing needs of 320 million American consumers and other consumers overseas by handling food supplies. The sector has been more stable based on employment and labor income than other manufacturing industries due to the steady demand for food and the competitive prices of raw commodities. Food & beverage industry poses several production scheduling challenges such as limited intermediate storage, spoilage issues, cross-contamination, and constraints created by conveyance equipment. Thus, to avoid such challenges, the planning and scheduling in the industry are crucial. APS software allows the industry to make informed decisions for simplifying their business processes, resulting in increased output and higher revenues. Thus, the above factors propel the market growth in the region.

In case of COVID-19, North America is highly affected, especially the US. North America is one of the most important regions for the adoption and growth of new technologies due to favorable government policies to boost innovation, the presence of a huge industrial base, and high purchasing power, especially in developed countries such as the US and Canada. Hence, any impact on the growth of industries is expected to affect the region's economic growth negatively. The US is one of the prominent markets for APS software. The huge increase in the number of confirmed cases and rising reported deaths in the country has affected numerous industries, including manufacturing. The factory and business shutdowns across the US, Canada, and Mexico negatively impact the adoption of the APS software. Several industries in the region work on APS software to manage their complex production process. However, due to the closed business of various industries the market for APS software slightly affected in 2020. Moreover, APS vendors continued their operations remotely to offer the best services to their end-users. The impact of COVID-19 is short-term; it is likely to decrease in the coming months.

Strategic insights for the North America Advanced Planning and Scheduling (APS) Software provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

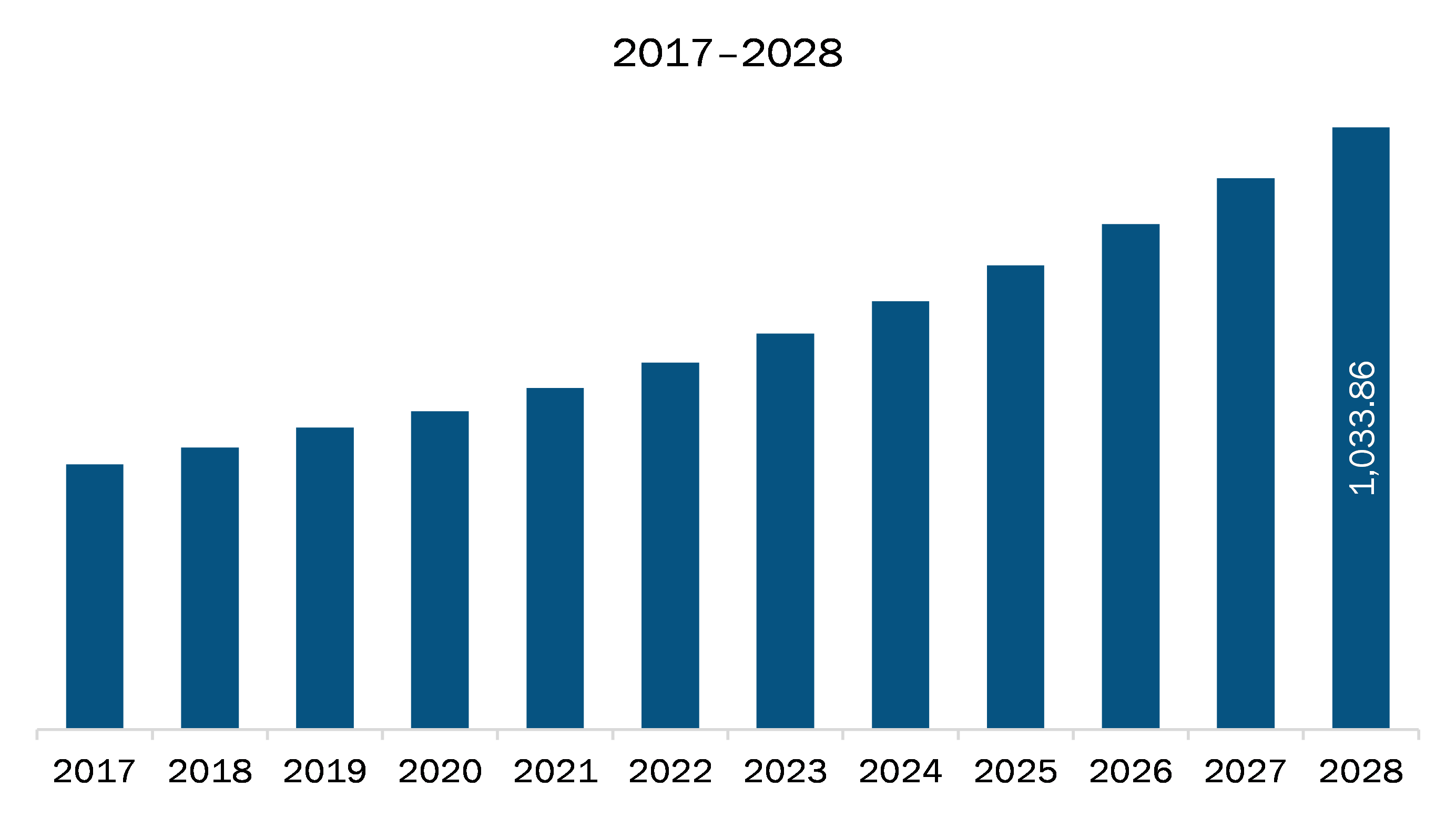

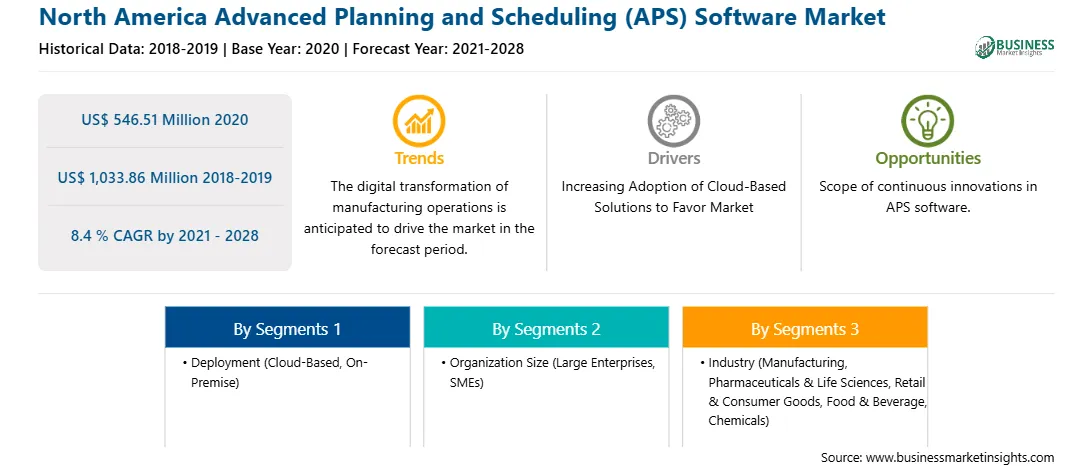

| Market size in 2020 | US$ 546.51 Million |

| Market Size by 2028 | US$ 1,033.86 Million |

| Global CAGR (2021 - 2028) | 8.4 % |

| Historical Data | 2018-2019 |

| Forecast period | 2021-2028 |

| Segments Covered |

By Deployment

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America Advanced Planning and Scheduling (APS) Software refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The North America advanced planning and scheduling (APS) software market is expected to grow from US$ 546.51 million in 2020 to US$ 1,033.86 million by 2028; it is estimated to grow at a CAGR of 8.4 % from 2021 to 2028. Scope for continuous developments in APS software will drive the market. Vendors operating in the North America APS software market need to continuously innovate and offer comprehensive solutions. This can be achieved by increasing investments in research and development (R&D) and spending on mergers and acquisitions (M&A). With M&A vendors can extend their offering and enhance their technological capabilities. They can also expand their APS software suite by adding features that allow their integration with the legacy solutions, including MES and ERP. For example, company across North America such as Cybetech’s Cyberplan APS software can easily be integrated with all key ERPs including SAP, JDE, Sage, Oracle, Panthera. In most of the cases, end users prefer APS software that can be integrated with their existing ERP systems without any hassle. Therefore, vendors such as Dassault Systems Acumatica Inc., Siemens, and Plex Systems are now considering offering APS solutions with integration capability. Competition in the North America APS software market is increasing with the rise in number of vendors entering into the market. To differentiate themselves from their competitors, the vendors are likely to consider adding more functionalities in their software products. Vendors must try to anticipate future trend beforehand. For instance, artificial advanced analytics is becoming a potential point of focus for many North America APS software market players. Offering end-to-end suite would further help manufacturers through increased efficiency and reduced complexity.

In terms of deployment, the on-premise segment accounted for the largest share of the North America advanced planning and scheduling (APS) software market in 2020. In terms of organization size, the large enterprises segment held a larger market share of the North America advanced planning and scheduling (APS) software market in 2020. Further, the manufacturing segment held a larger share of the North America advanced planning and scheduling (APS) software market based on industry in 2020.

A few major primary and secondary sources referred to for preparing this report on the North America advanced planning and scheduling (APS) software market are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are ACUMATICA, INC; ASPROVA CORPORATION; CYBERTEC; Dassault Systèmes SE; GLOBAL SHOP SOLUTIONS; INFORM SOFTWARE; PLEX SYSTEMS; Siemens AG; and THE ACCESS GROUP.

The North America Advanced Planning and Scheduling (APS) Software Market is valued at US$ 546.51 Million in 2020, it is projected to reach US$ 1,033.86 Million by 2028.

As per our report North America Advanced Planning and Scheduling (APS) Software Market, the market size is valued at US$ 546.51 Million in 2020, projecting it to reach US$ 1,033.86 Million by 2028. This translates to a CAGR of approximately 8.4 % during the forecast period.

The North America Advanced Planning and Scheduling (APS) Software Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Advanced Planning and Scheduling (APS) Software Market report:

The North America Advanced Planning and Scheduling (APS) Software Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Advanced Planning and Scheduling (APS) Software Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Advanced Planning and Scheduling (APS) Software Market value chain can benefit from the information contained in a comprehensive market report.