Market Introduction

An increase in the offering of 5G services by network service providers, an increase in network subscribers and adoption of smartphones, rising adoption of 5G technology across industries, and favorable government initiatives to promote the deployment of 5G are a few of the factors attributing toward the North America 5G network and tower deployment market growth. North America is at the forefront of technology advancements and is a hub of a few major companies in variousindustry sectors. Constant adoption of automation and advanced technologies are experienced across major industries such as retail, manufacturing, healthcare, and education, thereby growing the demand for 5G network services to maintain uninterrupted connectivity. With increasing demand for 5G network service, the scope of North America 5G network and tower deployment market will endure to augment.

Strategic insights for the North America 5G Network and Tower Deployment provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the North America 5G Network and Tower Deployment refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

North America 5G Network and Tower Deployment Strategic Insights

North America 5G Network and Tower Deployment Report Scope

Report Attribute

Details

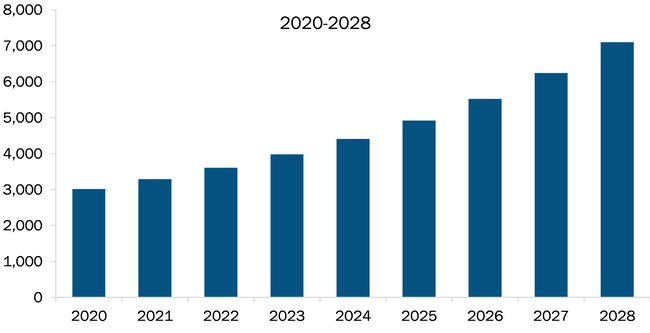

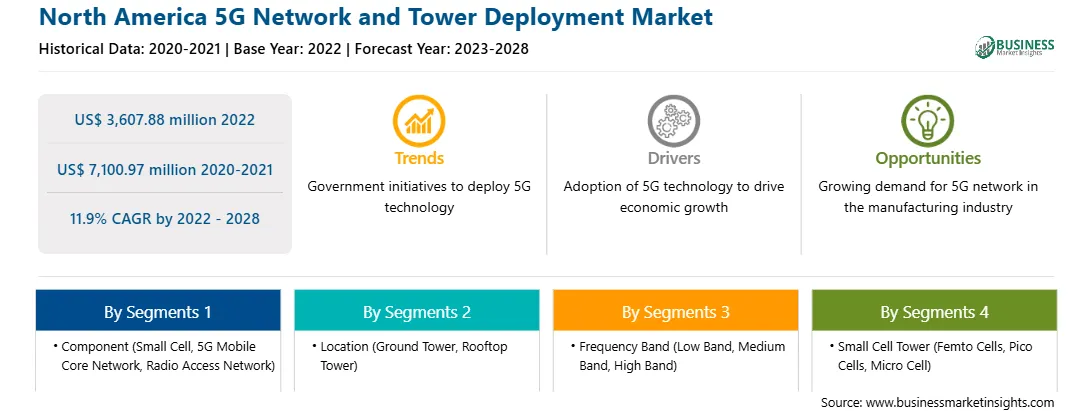

Market size in 2022

US$ 3,607.88 million

Market Size by 2028

US$ 7,100.97 million

Global CAGR (2022 - 2028)

11.9%

Historical Data

2020-2021

Forecast period

2023-2028

Segments Covered

By Component

By Location

By Frequency Band

By Small Cell Tower

Regions and Countries Covered

North America

Market leaders and key company profiles

North America 5G Network and Tower Deployment Regional Insights

Market Overview and Dynamics

North America has experienced a rise in demand for mobile subscribers and the adoption of smartphones to support various applications such as mobile gaming, home broadband, video calling, high-definition movies & TV, mobile health services, augmented shopping experience, and global positioning system (GPS) services. For instance, according to GSMA, North America recorded 84% subscriber penetration in 2021 and 82% smartphone adoption in the same year. Moreover, the adoption of 5G services is enhancing the quality of services over the years. According to the Mobile Economy report published by GSMA in 2022, 5G network technology has enhanced the above-mentioned services and offers a better customer experience.

Thus, the increase in the adoption of network subscribers and smartphones for both residential and commercial purposes and the adoption of 5G technology for enhanced services are driving the North America 5G network and tower deployment market size.

The US accounted for the largest North America 5G network and tower deployment market share in 2021. One of the major reasons for the high contribution of the country is attributed to the presence of numerous 5G network providers, such as Verizon, AT&T, T-Mobile, Comcast, and Dish. For instance, Verizon has offered 5G broadband internet across 900 cities in the US since October 2018. Similarly, AT&T started its 5G services in December 2018. It offers two major 5G services, namely 5G+ in over 40 cities and a low band 5G network in over 14,000 cities and towns across the country. This wide offering of 5G services by these network service providers is contributing to the North America 5G network and tower deployment market growth.

The rapid adoption of technologies such as automation, artificial intelligence, and virtual reality is constantly contributing to the rise in demand for 5G technologies for commercial, residential, and industrial purposes. According to the report published by GSMA on 5G and economic growth impacts on Canada in 2020, the adoption and integration of 5G technology will help the country to generate revenue of US$ 150 billion in the Canadian economy for a period of 20 years (2020-2040), thereby contributing significantly to the economic growth of the country and supporting the post-pandemic recovery across all major industries.

The Mexican government is constantly promoting the circulation of the 5G network across the country through its plans and policies, which is expected to contribute to the growth of the Mexican 5G network and tower deployment market. For instance, in December 2021, AT&T started deploying its 5G services in Mexico and aims to deploy the same across all major Mexican markets in the next 3 years. Thus, the rising government and company initiatives across to deploy 5G technology is expected to contribute to the growth of the North America 5G network and tower deployment market.

Key Market Segments

Based on small cell tower, the North America 5G network and tower deployment market analysis is segmented into femto cells, pico cells, and micro cells. The femto cells segment dominated the market in 2021. It connects locally to mobile and other similar devices through GSM, GPRS, UMTS, or LTE connections. The appearance and operations of femto cell are like a router and are generally set up near network hardware systems for optimal usage. Companies are constantly investing in the development of new femto cell devices, which is contributing to the growth of the segment. For instance, in May 2021, Nokia launched its new femto cell device that supports 5G, capitalizing on the growing interest of operators and enterprises to cater to the private network areas. Similarly, in September 2020, Verizon announced its intentions to deploy Samsung’s indoor 5G millimeter wave small cell to enhance its private network service offerings over the years.

Major Sources and Companies Listed

American Tower Corporation, Crown Castle International Corp, Phoenix Tower International, DISH Network LLC, SBA Communications Corporation, CommScope Inc., Mavenir, Verizon Communications Inc, AT&T Inc., and Qualcomm Technologies Inc. are some of the key North America 5G network and tower deployment market players. Various other companies are also introducing new technologies and offerings, helping the North America 5G network and tower deployment market players to expand their business in terms of revenue.

Reasons to Buy Report

The North America 5G Network and Tower Deployment Market is valued at US$ 3,607.88 million in 2022, it is projected to reach US$ 7,100.97 million by 2028.

As per our report North America 5G Network and Tower Deployment Market, the market size is valued at US$ 3,607.88 million in 2022, projecting it to reach US$ 7,100.97 million by 2028. This translates to a CAGR of approximately 11.9% during the forecast period.

The North America 5G Network and Tower Deployment Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America 5G Network and Tower Deployment Market report:

The North America 5G Network and Tower Deployment Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America 5G Network and Tower Deployment Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America 5G Network and Tower Deployment Market value chain can benefit from the information contained in a comprehensive market report.