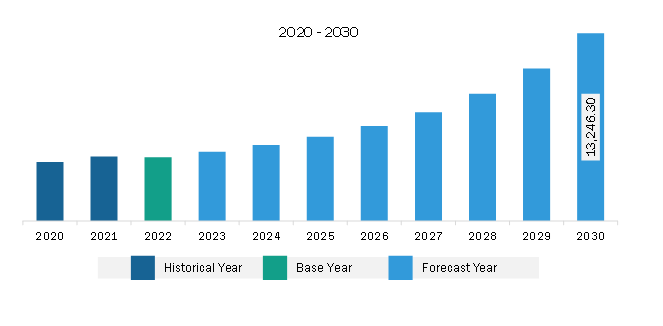

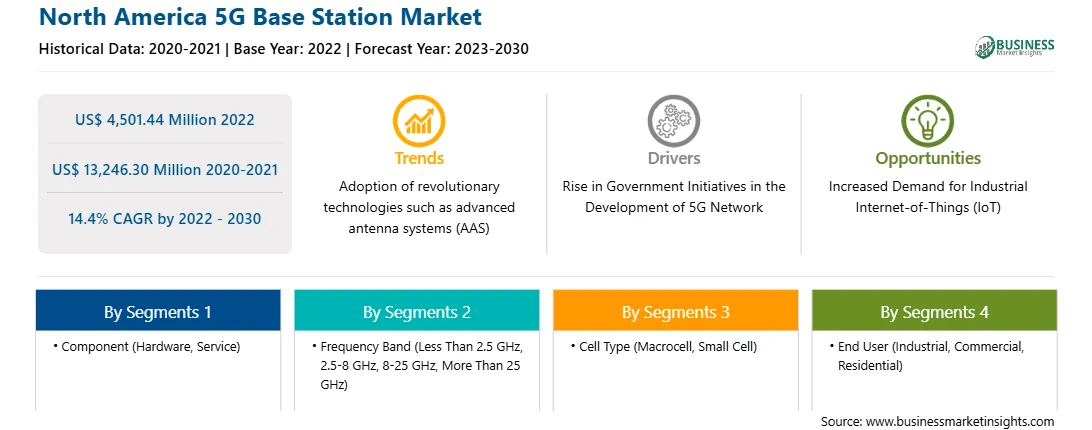

The North America 5G base station market was valued at US$ 4,501.44 million in 2022 and is expected to reach US$ 13,246.30 million by 2030; it is estimated to register a CAGR of 14.4% from 2022 to 2030.

Low latency 5G networks create new possibilities for services that demand nearly instant response time. These services include telemedicine, augmented reality headsets, and communications between autonomous vehicles that support linking into efficient platoons. Less latency means reducing the time between sending and receiving the signal. 5G network brings the network range to at least under ten milliseconds and, in best cases, approximately one millisecond delay, meaning data will be transferred in real-time. The advancement of 5G-based mobile networks achieves low delays, which opens the way to completely new opportunities, including virtual reality experiences, multiplayer mobile gaming, factory robots, and self-driving car applications for which a speedy response is considered a strong criterion. Focusing on self-driving vehicles, existing cellular networks already offer a wide variety of tools that address business requirements. C-V2X and its evolution to 5G V2X will foster synergies between the automotive industry and other verticals moving towards 5G. Its extreme throughput, low latency, and enhanced reliability will allow vehicles to share rich, real-time data, supporting autonomous and connected driving experiences. For example, LTE Cat-M and Narrow Internet of Things (NB-IoT) are excellent low-power sensor communication technologies. In order to determine and recommend individual actions to enable complex vehicle maneuvering, e.g., deceleration, lane changes, or route modifications, acceleration, the vehicles must be able to receive and share information about their driving intentions in real time. This low-latency demand can be fulfilled with the development of an overall 5G system architecture to provide optimized end-to-end vehicle-to-everything (V2X) connectivity. With the increasing use of cloud-based services, big data analytics, and the Internet of Things (IoT), there is an increased demand for high-speed data transmission and low latency. The need for real-time interactions and the increasing use of data-intensive applications across various sectors drive the growing demand for low-latency and high-speed data. 5G base stations are essential in meeting these demands by providing the necessary infrastructure for high-speed, low-latency, and reliable connectivity, making them a crucial component of the evolving telecommunications landscape. Thus, increased demand for low latency and high-speed data drives the 5G base station market.

North American consumers are increasingly adopting 5G-enabled devices, such as smartphones, tablets, and IoT gadgets. As a result, there is a growing need for 5G infrastructure to support these devices with high-speed data and low latency. Telecom operators in North America are engaged in fierce competition to provide the best 5G services. This competition drives the deployment of more 5G base stations to offer better coverage and faster speeds. For instance, in October 2023, Ericsson launched a new software toolkit to strengthen the capabilities of the 5G standalone network and enable premium services with differentiated connectivity. The toolkit aims to help communications service providers (CSPs) deliver high throughput, high reliability, and low latency performance levels for use cases. These use cases include lag-free mobile cloud gaming, video conferencing, live broadcasting, remote-controlled machines/vehicles, public safety services, and future XR. Also, in August 2023, Eastlink partnered with Nokia to enhance its 5G network across Canada. Under this partnership, Eastlink is modernizing its mobile network by using Nokia's AirScale portfolio, including 5G Radio Access Network (RAN) technology, to deliver fast speeds, unparalleled performance, and expanded network capacity.

Similarly, in December 2022, AT&T expanded its 5G network infrastructure to reach 25 cities across Mexico. AT&T Mexico is offering its 5G services in 18 cities across the country. The operator's 5G services are active in Mexico City, Guadalajara, Monterrey, Tijuana, Mexicali, Ciudad Juárez, Mazatlan, Ciudad Obregon, Navojoa, Guasave, Ensenada, Puerto Penasco Guamuchil, Culiacan, Saltillo, Torreon, and Morelia. As the demand for 5G base stations continues to grow, telecom operators, infrastructure providers, and technology companies are investing in expanding and upgrading the 5G infrastructure in North America to meet the requirements of consumers, businesses, and various industries. Therefore, the above instances show that the 5G base station market is growing significantly.

Strategic insights for the North America 5G Base Station provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 4,501.44 Million |

| Market Size by 2030 | US$ 13,246.30 Million |

| Global CAGR (2022 - 2030) | 14.4% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Component

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America 5G Base Station refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The North America 5G base station market is categorized into component, frequency band, cell type, end user, and country.

Based on component, the North America 5G base station market is bifurcated into hardware and service. The hardware segment held a larger market share in 2022.

In terms of frequency band, the North America 5G base station market is segmented into less than 2.5 GHz, 2.5 – 8 GHz, 8 – 25 GHz, and more than 25 GHz. The 2.5 – 8 GHz segment held the largest market share in 2022.

By cell type, the North America 5G base station market is bifurcated into macrocell and small cell. The small cell segment held a larger market share in 2022. Furthermore, the small cell segment is sub segmented into microcell, picocell, and femtocell.

Based on end user, the North America 5G base station market is segmented into industrial, commercial, and residential. The commercial segment held the largest market share in 2022.

By country, the North America 5G base station market is segmented into the US, Canada, and Mexico. The US dominated the North America 5G base station market share in 2022.

Airspan Networks Holdings Inc, Baicells Technologies North America Inc, CommScope Holding Co Inc, Huawei Technologies Co Ltd, NEC Corp, Nokia Corp, Samsung Electronics Co Ltd, Telefonaktiebolaget LM Ericsson, and ZTE Corp are among the leading companies operating in the North America 5G base station market.

1. Airspan Networks Holdings Inc

2. Baicells Technologies North America Inc

3. CommScope Holding Co Inc

4. Huawei Technologies Co Ltd

5. NEC Corp

6. Nokia Corp

7. Samsung Electronics Co Ltd

8. Telefonaktiebolaget LM Ericsson

9. ZTE Corp

The North America 5G Base Station Market is valued at US$ 4,501.44 Million in 2022, it is projected to reach US$ 13,246.30 Million by 2030.

As per our report North America 5G Base Station Market, the market size is valued at US$ 4,501.44 Million in 2022, projecting it to reach US$ 13,246.30 Million by 2030. This translates to a CAGR of approximately 14.4% during the forecast period.

The North America 5G Base Station Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America 5G Base Station Market report:

The North America 5G Base Station Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America 5G Base Station Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America 5G Base Station Market value chain can benefit from the information contained in a comprehensive market report.