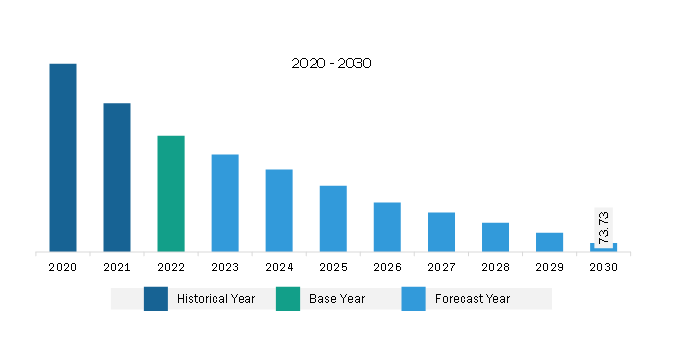

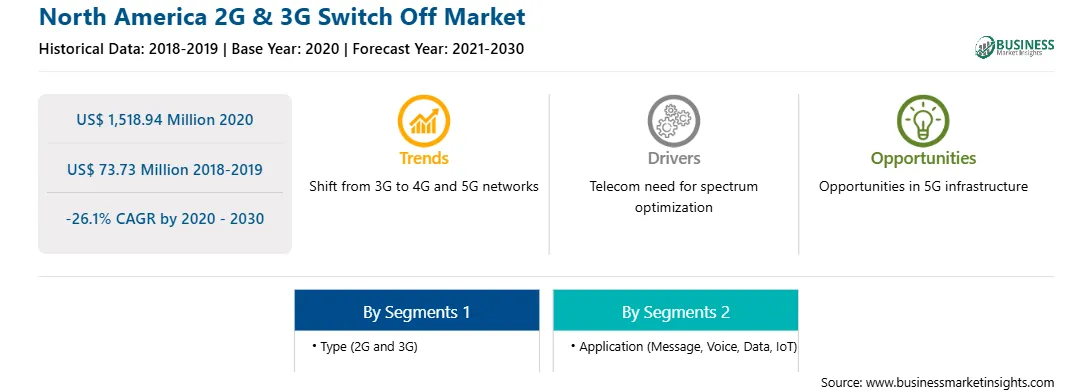

The North America 2G & 3G switch off market was valued at US$ 1,518.94 million in 2020 and is expected to reach US$ 73.73 million by 2030; it is estimated to register a CAGR of -26.1% from 2020 to 2030.Emergence of 5G Technology Fuels North America 2G & 3G Switch Off Market

Emerging 5G networks feature higher capacity, lower latency, and increased bandwidth than 4G. These network enhancements are expected to impact how people work, live, and play worldwide. According to Intel Corporation, 5G will provide up to 1,000 times more capacity than 4G, paving the way for IoT development. 5G and IoT are a great combination, which has the potential to reshape wireless networks and the way the Internet is utilized. With the ability to effortlessly communicate with hundreds or thousands of devices, new applications and use cases for cities, factories, farms, schools, and households will flourish. The transition to 5G could be the most significant growth engine for the smartphone industry in the coming years. According to Ericsson Mobility Report, in 2028, 5G subscription mobile access technology will take the lead. By 2029, there will be more than 5.3 billion 5G subscriptions worldwide, accounting for 58% of all mobile subscriptions at that point. According to projections, in 2029, North America and the GCC would have the greatest 5G penetration rate at 92%, with Western Europe coming in second at 85%. Further, in Q3 2023, 4G subscriptions rose by 6 million, reaching 5.2 billion. Now that 4G subscriptions have peaked, it is anticipated that they will fall to about 3.2 billion by the end of 2029 as users switch to 5G. 3G subscriptions fell by 61 million in Q3, while GSM/EDGE-only subscriptions fell by 55 million, and subscriptions to other technologies fell by roughly 2 million. According to GSMA predictions, Greater China had 29% of 5G mobile device utilization as of 2021, making it the leader in this new technology. As of 2021, more than 10,000 5G-based applications have been developed in the country for education, healthcare, and transportation. North America and Europe are close behind with 13% and 4%, respectively. However, North America is expected to exceed China by 2025 with 63% 5G adoption, while the Rest of the world will continue to rely on 4G.

Apart from that, physical security is an important sector. Industry participants have begun to investigate newer methods of security systems because of the speed and latency of 5G. Although most customers are familiar with wireless bandwidth, the expected latency rate of 1-4 milliseconds will differ in 5G adoption. Low latency 5G networks create new possibilities for services that demand nearly instant response time. These services include telemedicine, augmented reality (AR) headsets, and communications between autonomous vehicles that support linking into efficient platforms. Less latency means reducing the time between sending and receiving the signal. 5G network brings the network range to at least under ten milliseconds and, in best cases, approximately one-millisecond delay, meaning data will be transferred in real-time. The advancement of 5G-based mobile networks achieves low delays, which opens the way to completely new opportunities, including virtual reality experiences, multiplayer mobile gaming, factory robots, and self-driving car applications for which a speedy response is considered a strong criterion. Thus, due to the huge advantages of 5G technology, several countries are adopting it, driving the growth of the 2G & 3G switch off market.North America 2G & 3G Switch Off Market Overview

The North America 2G & 3G switch off market is segmented into the US, Canada, and Mexico. According to the Cellular Telephone Industries Association (CTIA), the US wireless communications industry, ~9% of wireless connections in the US are 2G or 3G. Operators across the region are motivated to switch off to save money on operating expenses and re-purpose the freed spectrum for next-generation mobile technologies like 5G. Telecom operators in North America are engaged in fierce competition to provide the best 5G services. For instance, in October 2023, Ericsson launched a new software toolkit to strengthen the capabilities of the 5G standalone network and enable premium services with differentiated connectivity. As of 2022, the US's main operators, Verizon, T-Mobile, and AT&T, have shut down 3G networks. Verizon shut down its 3G network in December 2022 and AT&T in February 2022.

As of December 2022, various businesses in Canada, such as Bell, Telus, and Rogers, all stopped supporting 3G. Rogers, Canada's main mobile operator supporting the 2G network, retains the 850 MHz band for 2G GSM and 3G W-CDMA services. Still, the company's 2G network is only used in remote areas outside the 3G network footprint. Thus, such a shutdown of the 2G and 3G services promoted the 2G & 3G switch off market.

North America 2G & 3G Switch Off Market Revenue and Forecast to 2030 (US$ Million)

Strategic insights for the North America 2G & 3G Switch Off provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the North America 2G & 3G Switch Off refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

North America 2G & 3G Switch Off Strategic Insights

North America 2G & 3G Switch Off Report Scope

Report Attribute

Details

Market size in 2020

US$ 1,518.94 Million

Market Size by 2030

US$ 73.73 Million

Global CAGR (2020 - 2030)

-26.1%

Historical Data

2018-2019

Forecast period

2021-2030

Segments Covered

By Type

By Application

Regions and Countries Covered

North America

Market leaders and key company profiles

North America 2G & 3G Switch Off Regional Insights

North America 2G & 3G Switch Off Market Segmentation

The North America 2G & 3G switch off market is categorized into type, application, and country.

Based on type, the North America 2G & 3G switch off market is bifurcated into 2G and 3G. The 3G segment held a larger market share in 2020.

In terms of application, the North America 2G & 3G switch off market is segmented into message, voice, data, and IoT. The data segment held the largest market share in 2020.

By country, the North America 2G & 3G switch off market is segmented into the US, Canada, and Mexico. Mexico dominated the North America 2G & 3G switch off market share in 2020.

AT&T Inc, BCE Inc, Deutsche Telekom AG, KDDI Corp, NTT Data Corp, Orange SA, Telenor ASA, and Vodafone Group Plc are some of the leading companies operating in the North America 2G & 3G switch off market.

1. AT&T Inc

2. BCE Inc

3. Deutsche Telekom AG

4. KDDI Corp

5. NTT Data Corp

6. Orange SA

7. Telenor ASA

8. Vodafone Group Plc

The North America 2G & 3G Switch Off Market is valued at US$ 1,518.94 Million in 2020, it is projected to reach US$ 73.73 Million by 2030.

As per our report North America 2G & 3G Switch Off Market, the market size is valued at US$ 1,518.94 Million in 2020, projecting it to reach US$ 73.73 Million by 2030. This translates to a CAGR of approximately -26.1% during the forecast period.

The North America 2G & 3G Switch Off Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America 2G & 3G Switch Off Market report:

The North America 2G & 3G Switch Off Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America 2G & 3G Switch Off Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America 2G & 3G Switch Off Market value chain can benefit from the information contained in a comprehensive market report.