Nordic Last Mile Delivery Market Report (2021-2031) by Scope, Segmentation, Dynamics, and Competitive Analysis

No. of Pages: 150 | Report Code: BMIRE00031254 | Category: Automotive and Transportation

No. of Pages: 150 | Report Code: BMIRE00031254 | Category: Automotive and Transportation

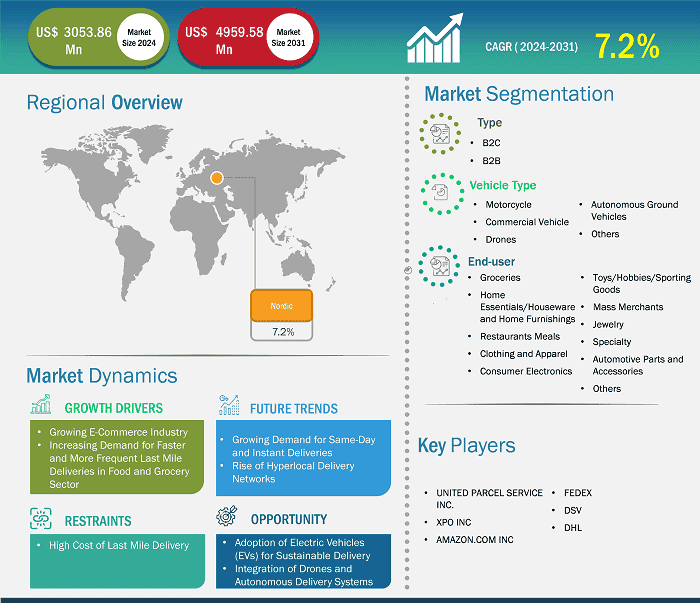

The Last Mile Delivery Market size is expected to reach US$ 4959.58 million by 2031 from US$ 3053.86 million in 2024. The market is estimated to record a CAGR of 7.2% from 2023 to 2031.

Denmark, Finland, Norway, and Sweden are the NORDIC countries known for their high standards of living, advanced infrastructure, and robust digital economies. Over the past decade, the region has experienced significant growth in e-commerce and digital services, which has driven the demand for efficient and flexible last-mile delivery solutions. The Nordic last-mile delivery market is uniquely positioned due to its strong technological capabilities, urbanization trends, sustainability goals, and robust logistical infrastructure. Countries in NORDIC are among the world leaders in technological innovation, extending into logistics and last-mile delivery. The widespread adoption of advanced technologies such as Artificial Intelligence (AI), Internet of Things (IoT), big data analytics, and route optimization software is playing a significant role in the transformation of last-mile delivery services. For instance, route optimization technologies are being used to improve delivery efficiency and reduce costs, while AI is being applied to forecast demand, manage inventory, and optimize delivery windows. The integration of IoT in delivery fleets also allows for real-time tracking, which enhances visibility and transparency for both delivery providers and consumers.

Key segments that contributed to the derivation of the Last Mile Delivery market analysis are type and application.

Nordic companies are at the forefront of developing autonomous delivery solutions, such as drones and self-driving vehicles, which are expected to become more prevalent in the coming years. Sweden, for example, has been involved in several autonomous vehicle trials, exploring how these technologies can be used to improve the efficiency of last-mile delivery.

Governments are also incentivizing the adoption of green logistics solutions with policies that encourage investment in EV infrastructure, as well as emissions-reduction targets set for the transport sector. These sustainability efforts align with the growing consumer preference for environmentally responsible companies, which results in the increasing adoption of eco-friendly delivery methods. As consumer expectations evolve, the demand for faster, more convenient delivery options is increasing in NORDIC. Same-day and next-day deliveries are becoming more common, particularly in major cities where consumers expect quick access to a wide range of products. E-commerce players, including global giants such as Amazon as well as local retailers, are increasingly offering rapid delivery options to meet the growing demand.

Based on Geography, the Nordic Last Mile Delivery market comprises of Sweden, Denmark, Norway, Finland. The Denmark held the largest share in 2023.

The last mile delivery market in Denmark has witnessed significant growth, driven by advancements in e-commerce, changing consumer expectations, and technological innovations. Danish consumers have increasingly high expectations, including speed, flexibility, and transparency, when it comes to delivery services. Consumers are looking for faster delivery times, with many now expecting same-day or next-day deliveries as a standard offering. Additionally, the desire for real-time tracking, eco-friendly delivery options, and the ability to choose delivery time slots are growing factors that are shaping the last mile delivery landscape in Denmark. Many retailers and logistics providers in Denmark are investing in systems that can accommodate faster delivery times to meet this demand. E-commerce giants and local retailers alike are collaborating with last mile delivery service providers to offer these quick turnaround options. Denmark's urban centers, particularly Copenhagen, are experiencing increased pressure on logistics infrastructure due to the concentration of e-commerce demand. To address this, micro-fulfillment centers (MFCs) are becoming a viable solution. These centers are small, strategically located warehouses that store inventory close to urban areas, thus enabling faster deliveries. The rise of these facilities is helping businesses reduce the distance and time it takes to deliver goods to customers in city environments.

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 3053.86 Million |

| Market Size by 2031 | US$ 4959.58 Million |

| Global CAGR (2025 - 2031) | 7.2% |

| Historical Data | 2022-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | Nordic

|

Some of the key players operating in the market includes Amazon Logistics, UPS, FedEx, DHL, Postmates (Uber Eats), XPO Logistics, Instacart, Geodis, Gati Ltd, and Deliveroo among others. These players are adopting various strategies such as expansion, product innovation, and mergers and acquisition to provide innovative products to their consumers and increase their market share.

The following methodology has been followed for the collection and analysis of data presented in this report:

The research process begins with comprehensive secondary research, utilizing both internal and external sources to gather qualitative and quantitative data for each market. Commonly referenced secondary research sources include, but are not limited to:

Note:

All financial data included in the Company Profiles section has been standardized to USD. For companies reporting in other currencies, figures have been converted to USD using the relevant exchange rates for the corresponding year.

The Insight Partners’ conduct a significant number of primary interviews each year with industry stakeholders and experts to validate its data, analysis, and gain valuable insights. These research interviews are designed to:

Primary research is conducted via email interactions and telephone interviews, encompassing various markets, categories, segments, and sub-segments across different regions. Participants typically include:

The Nordic Last Mile Delivery Market is valued at US$ 3053.86 Million in 2024, it is projected to reach US$ 4959.58 Million by 2031.

As per our report Nordic Last Mile Delivery Market, the market size is valued at US$ 3053.86 Million in 2024, projecting it to reach US$ 4959.58 Million by 2031. This translates to a CAGR of approximately 7.2% during the forecast period.

The Nordic Last Mile Delivery Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Nordic Last Mile Delivery Market report:

The Nordic Last Mile Delivery Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Nordic Last Mile Delivery Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Nordic Last Mile Delivery Market value chain can benefit from the information contained in a comprehensive market report.