Nordic Heavy Construction Equipment Market Report (2021-2031) by Scope, Segmentation, Dynamics, and Competitive Analysis

No. of Pages: 150 | Report Code: BMIRE00031244 | Category: Manufacturing and Construction

No. of Pages: 150 | Report Code: BMIRE00031244 | Category: Manufacturing and Construction

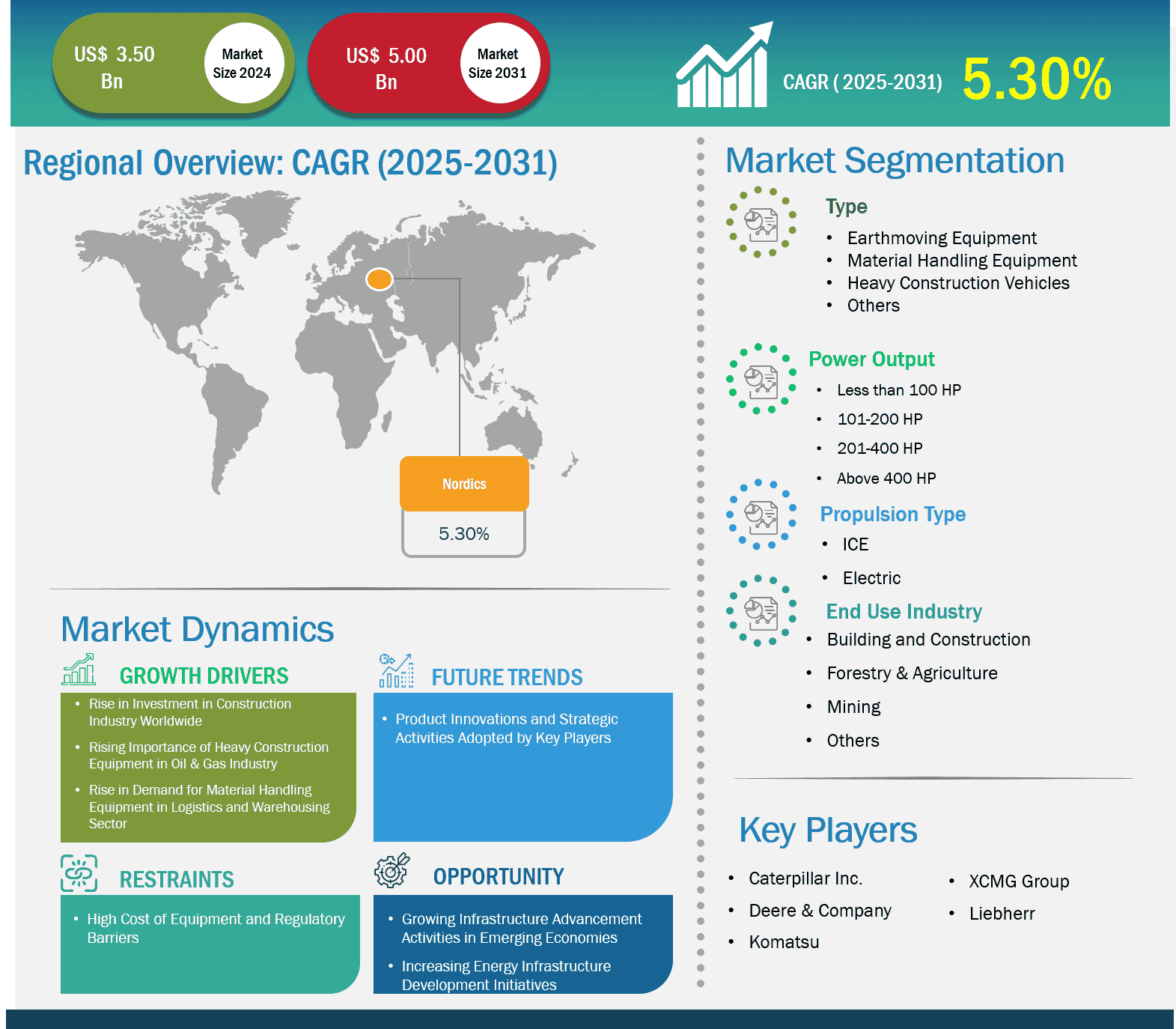

The Heavy Construction Equipment Market size is expected to reach US$ 3.08 billion by 2031 from US$ 5.02 billion in 2024. The market is estimated to record a CAGR of 6.40% from 2023 to 2031.

The Nordic countries, including Sweden, Norway, Denmark, Finland, are known for their robust economies, high standard of living, and progressive approach to sustainability and technology. The construction sector in the Nordics is characterized by innovation, high efficiency, and a strong focus on green and sustainable development. The heavy construction equipment market in these countries is driven by factors such as infrastructure development, residential and commercial projects, and a transition toward more environmentally friendly construction methods. Nordic countries are renowned for their focus on sustainable construction and smart infrastructure. Governments are increasingly encouraging green urban developments, with a particular emphasis on low-carbon emission buildings, energy-efficient transportation systems, and climate-resilient infrastructures. This trend of sustainability and smart infrastructure has a direct positive impact on the demand for various types of construction equipment, especially electric-powered and hybrid construction machinery.

Key segments that contributed to the derivation of the Heavy Construction Equipment market analysis are type and application.

By End Use Industry, the market is segmented into building and construction, forestry and agriculture, energy and power, mining, others. building and construction segment held the largest share of the market in 2024.

Sweden and Denmark are investing heavily in public transportation systems, such as railway networks and metro systems. Norway is focusing on building new and expanding existing hydroelectric power plants. Governments in Nordic countries are investing in new road networks, railway lines, and ports, as well as refurbishing aging infrastructure to keep up with growing demand. Sweden is particularly active in large housing projects, with the Swedish Housing Construction Initiative aimed at meeting the demand for affordable housing. Finland is seeing growth in residential developments in cities such as Helsinki and Espoo to accommodate rising urban populations. For instance, Stockholm in Sweden and Oslo in Norway are seeing significant construction activity in commercial office space, retail developments, and mixed-use buildings. The construction of large industrial projects, such as factories, manufacturing plants, and renewable energy installations (wind turbines, solar farms), in Nordic countries also require heavy construction equipment. Norway is a hub of some significant oil and gas projects, which create a significant demand for heavy construction equipment such as cranes, excavators, and haul trucks in offshore oil rigs and onshore industrial construction. The country’s focus on expanding hydroelectric plants and wind farms has also led to investments in heavy lifting equipment and machinery designed for energy infrastructure development. In Finland, the forest industry and mining sector have fueled demand for specialized construction equipment used in forestry management and large-scale mining operations.

Based on Geography, the Nordic Heavy Construction Equipment market comprises of Sweden, Denmark, Norway, Finland. The Norway held the largest share in 2023.

The Government of Norway has aimed to improve the transportation facilities in the country by undertaking the construction of large-scale infrastructure projects and improving the rail and road network to reduce traffic and congestion. In addition, the increasing number of residential housing, coupled with the government's financial support through the Norwegian State Housing Bank (Husbanken) and municipalities, is further contributing to the demand for heavy construction equipment. The increase in investment in the construction sector across the country has created a massive demand for heavy construction equipment. According to the European Construction Industry Federation, in 2023, total investment in the construction sector in Norway reached US$ 42.81 billion. Further, the government planned to invest US$ 40 billion in rail infrastructure development for 12 years. The new National Transport Plan 2025–2036 consists of rail infrastructure renewals and developments. Such projects require heavy construction equipment to create foundations and railway infrastructure. The heavy construction equipment market in Norway is impacted by several economic, demographic, and technological factors. The country’s strong economy, ambitious infrastructure plans, focus on sustainability, and technological adoption contribute to a growing and evolving market for heavy construction equipment.

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 5.02 Billion |

| Market Size by 2031 | US$ 3.08 Billion |

| Global CAGR (2025 - 2031) | 6.40% |

| Historical Data | 2022-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Machinery Type

|

| Regions and Countries Covered | Nordic

|

Some of the key players operating in the market includes Caterpillar Inc., Komatsu Ltd., Volvo Construction Equipment, Liebherr Group, and Hitachi Construction Machinery among others. These players are adopting various strategies such as expansion, product innovation, and mergers and acquisition to provide innovative products to their consumers and increase their market share.

The following methodology has been followed for the collection and analysis of data presented in this report:

The research process begins with comprehensive secondary research, utilizing both internal and external sources to gather qualitative and quantitative data for each market. Commonly referenced secondary research sources include, but are not limited to:

The Insight Partners’ conduct a significant number of primary interviews each year with industry stakeholders and experts to validate its data, analysis, and gain valuable insights. These research interviews are designed to:

Primary research is conducted via email interactions and telephone interviews, encompassing various markets, categories, segments, and sub-segments across different regions. Participants typically include:

The Nordic Heavy Construction Equipment Market is valued at US$ 5.02 Billion in 2024, it is projected to reach US$ 3.08 Billion by 2031.

As per our report Nordic Heavy Construction Equipment Market, the market size is valued at US$ 5.02 Billion in 2024, projecting it to reach US$ 3.08 Billion by 2031. This translates to a CAGR of approximately 6.40% during the forecast period.

The Nordic Heavy Construction Equipment Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Nordic Heavy Construction Equipment Market report:

The Nordic Heavy Construction Equipment Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Nordic Heavy Construction Equipment Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Nordic Heavy Construction Equipment Market value chain can benefit from the information contained in a comprehensive market report.