Middle East Heavy Construction Equipment Market Report (2021-2031) by Scope, Segmentation, Dynamics, and Competitive Analysis

No. of Pages: 150 | Report Code: BMIRE00031243 | Category: Manufacturing and Construction

No. of Pages: 150 | Report Code: BMIRE00031243 | Category: Manufacturing and Construction

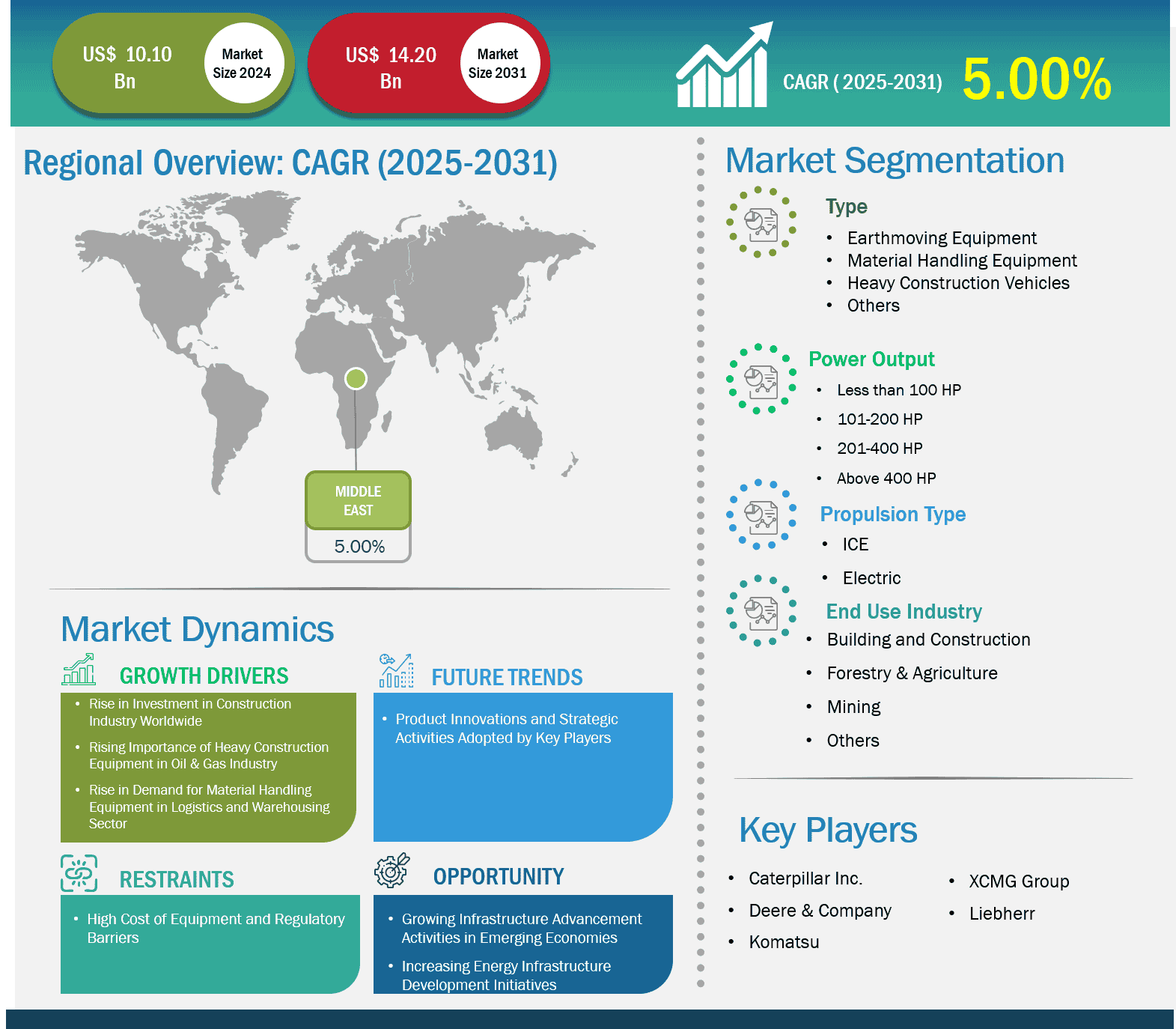

The Heavy Construction Equipment Market size is expected to reach US$ 14.6 million by 2031 from US$ 10.4 million in 2024. The market is estimated to record a CAGR of 5.0% from 2024 to 2031.

In 2023, the Middle East continued to witness substantial infrastructure development, fueled by strategic investments and government-led initiatives focused on economic diversification and urban modernization. Key projects and investments reflect the region's ambitions to transform its cities, improve connectivity, and foster sustainable growth.

NEOM: As part of Vision 2030, Saudi Arabia invested heavily in the NEOM megacity, a US$ 500 billion smart city planned to revolutionize urban living by focusing on technology, sustainability, and renewable energy. Major infrastructure developments include transportation networks, water management, and sustainable energy systems.

Red Sea Project: A luxury tourism destination featuring islands, resorts, and commercial facilities, this US$ 10 billion project aims to enhance the country's tourism and infrastructure. The increase in infrastructure development investment across the Middle East and African countries has created a massive demand for heavy construction equipment.

Key segments that contributed to the derivation of the Heavy Construction Equipment Market analysis are machinery type, propulsion type, power output, and end use industry.

Infrastructure is a significant focus of investment across Middle East regions, with governments prioritizing the development of transportation systems (airports, seaports, railways), roads, bridges, and utilities. Much of the investment is directed at improving connectivity, especially in large countries such as Saudi Arabia.

Investments are increasingly shifting toward smart technologies, including smart city infrastructure, data centers, IoT systems, and renewable energy installations. For instance, Saudi Arabia's Neom and Dubai's Mohammed bin Rashid Al Maktoum Solar Park are development in the country. Middle East countries are increasingly investing in non-oil sectors such as tourism, technology, and manufacturing as part of their economic diversification plans. This is likely to drive continued construction and infrastructure investment, creating a significant demand for heavy construction equipment.

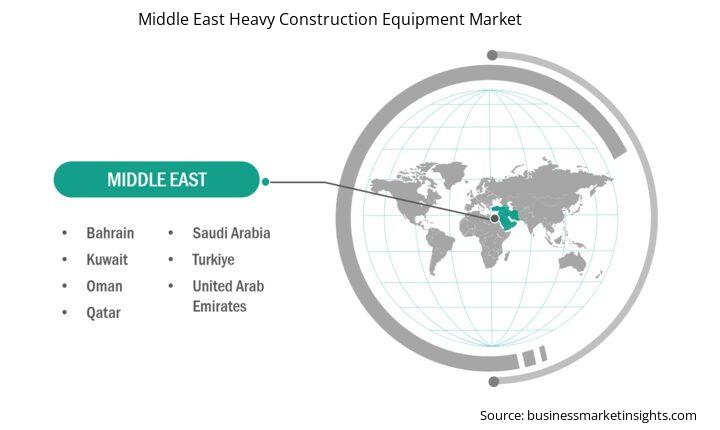

Based on Geography, the Middle East Heavy Construction Equipment Market comprises of Saudi Arabia, UAE, Turkey, Kuwait, Qatar, Bahrain, Oman. Saudi Arabia held the largest share in 2024.

Saudi Arabia has been undergoing significant infrastructure and development transformations in recent years, driven by its Vision 2030 strategy, which aims to diversify the economy, reduce its dependency on oil, and enhance the overall quality of life for its citizens. This vision has led to massive investments in infrastructure, tourism, energy, and technology.

NEOM is Saudi Arabia's flagship US$ 500 billion smart city and technological hub located in the northwest of the country. It is designed to be a futuristic city powered by renewable energy, with advanced AI, sustainable urban planning, and high-tech infrastructure. The LINE project, which is a 170 km linear city within NEOM, promises to revolutionize urban living by eliminating the need for cars and offering vertical communities with integrated public transport. The Jeddah Waterfront Project is one of the most significant urban development initiatives in Saudi Arabia. It aims to turn the coastal city of Jeddah into a major tourist destination. The project includes building waterfront parks, commercial spaces, luxury hotels, and residential complexes, all designed to attract tourists and improve the city's aesthetic appeal. In 2024, Saudi Arabia continued its focus on developing cutting-edge infrastructure projects, from smart cities to renewable energy and tourism hubs. These developments are closely aligned with the kingdom's Vision 2030, which seeks to reduce reliance on oil, create jobs, and enhance the living standards of Saudi citizens while attracting global investment. The increasing investment in infrastructure development in Saudi Arabia has created a massive demand for heavy construction equipment.

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 10.4 Million |

| Market Size by 2031 | US$ 14.6 Million |

| Global CAGR (2025 - 2031) | 5.0% |

| Historical Data | 2022-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Machinery Type

|

| Regions and Countries Covered | Middle East

|

Some of the key players operating in the market includes Caterpillar Inc., Komatsu Ltd., Volvo Construction Equipment, Liebherr Group, and Hitachi Construction Machinery among others. These players are adopting various strategies such as expansion, product innovation, and mergers and acquisition to provide innovative products to their consumers and increase their market share.

The following methodology has been followed for the collection and analysis of data presented in this report:

The research process begins with comprehensive secondary research, utilizing both internal and external sources to gather qualitative and quantitative data for each market. Commonly referenced secondary research sources include, but are not limited to:

Note:

All financial data included in the Company Profiles section has been standardized to USD. For companies reporting in other currencies, figures have been converted to USD using the relevant exchange rates for the corresponding year.

The Insight Partners’ conduct a significant number of primary interviews each year with industry stakeholders and experts to validate its data, analysis, and gain valuable insights. These research interviews are designed to:

Primary research is conducted via email interactions and telephone interviews, encompassing various markets, categories, segments, and sub-segments across different regions. Participants typically include:

The Middle East Heavy Construction Equipment Market is valued at US$ 10.4 Million in 2024, it is projected to reach US$ 14.6 Million by 2031.

As per our report Middle East Heavy Construction Equipment Market, the market size is valued at US$ 10.4 Million in 2024, projecting it to reach US$ 14.6 Million by 2031. This translates to a CAGR of approximately 5.0% during the forecast period.

The Middle East Heavy Construction Equipment Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Middle East Heavy Construction Equipment Market report:

The Middle East Heavy Construction Equipment Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Middle East Heavy Construction Equipment Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Middle East Heavy Construction Equipment Market value chain can benefit from the information contained in a comprehensive market report.