The increasing use of advanced wound dressings results in better care for individuals. Many advanced wound dressings are available with a wide range of physical performance, characteristics, and costs. Antimicrobial dressings are an alternative to traditional dressings and systemic antibiotics. This dressing type contains antimicrobial agents that reduce wound bacterial colonization and infection to improve healing. Due to the high functional efficiency in post-surgical care and burns, antimicrobial wound dressings are rapidly replacing conventional wound dressings. Advanced wound dressings incorporated with antimicrobial or wound healing agents and with up to 50% better and faster wound healing, low infection rate, painless dressing removal, better cosmetic results with less scarring, non-requisite of frequent dressing changes leading to cost reduction, affordability, and fewer drainage issues are substantially replacing the traditional wound dressings. Furthermore, advanced wound closure products such as adhesives, sealants, and hemostats will replace conventional, traumatizing wound closure devices such as sutures, staples, and ligating clips. The feasibility of these products for surgical wounds, rapid termination of blood loss, prompt and effective closure of the wound, strong adhesion of wound edges, tight sealing, reduced scarring, and reduced risk of infections would accelerate the demand for advanced wound closure products in the coming years. The wound care market is expected to witness an inclination toward wound closure strips. The strips are easy to use, highly efficient, strong, and secure with minimal scarring effects, as well as they can eliminate railroad marks associated with sutures and staples. Thus, the increasing adoption of advanced wound dressings is expected to propel the Middle East & Africa wound care market during the forecast period.

The Middle East & Africa wound care market has been segmented into the UAE, Saudi Arabia, South Africa, and the Rest of Middle East & Africa. Saudi Arabia dominated the market in 2022. An increase in the number of surgeries, the rise in incidences of chronic diseases, and the surge in awareness about wound care propel the growth of the wound care market in the region. Saudi Arabia has a higher prevalence of diabetes than other countries in the Middle East & Africa. According to the IDF’s data published in February 2022, in Saudi Arabia, nearly 4,274,100 adults were affected by diabetes in 2022. The numbers accounted for a prevalence rate of 17.7% of the total population. Therefore, the risk of developing foot ulcers is ~ 25% in a person suffering from diabetes. Thus, with the increase in the diabetic population, the demand for DFU wound care products is estimated to grow in the country during the forecast period. The incidence of chronic diseases is high in Saudi Arabia. According to a qualitative study titled “Noncommunicable diseases and health system responses in Saudi Arabia: focus on policies and strategies. A qualitative study” published in June 2022, chronic diseases are responsible for 73% of total deaths. Therefore, a large portion of the population is expected to suffer from chronic diseases developing a risk of pressure ulcers.

Strategic insights for the Middle East & Africa Wound Care provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

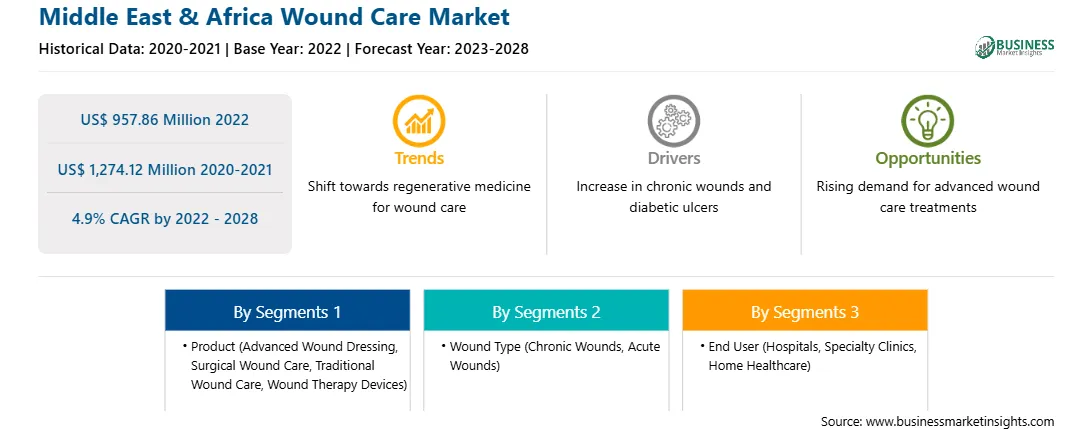

| Market size in 2022 | US$ 957.86 Million |

| Market Size by 2028 | US$ 1,274.12 Million |

| Global CAGR (2022 - 2028) | 4.9% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2028 |

| Segments Covered |

By Product

|

| Regions and Countries Covered | Middle East and Africa

|

| Market leaders and key company profiles |

The geographic scope of the Middle East & Africa Wound Care refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The Middle East & Africa wound care market is segmented based on product, wound type, end user, and country.

Based on product, the Middle East & Africa wound care market is segmented into advanced wound dressing, surgical wound care, traditional wound care, and wound therapy devices. The advanced wound dressing segment held the largest share of Middle East & Africa wound care market in 2022.

Based on wound type, the Middle East & Africa wound care market is bifurcated into chronic wounds and acute wounds. The chronic wounds segment a larger share of the Middle East & Africa wound care market in 2022.

Based on end user, the Middle East & Africa wound care market is segmented into hospitals, specialty clinics, home healthcare, and others. The hospitals segment held the largest share of the Middle East & Africa wound care market in 2022.

Based on country, the Middle East & Africa wound care market has been categorized into the UAE, Saudi Arabia, South Africa, and the Rest of Middle East & Africa. Our regional analysis states that Saudi Arabia dominated the Middle East & Africa wound care market in 2022.

3M Co, Baxter International Inc, Coloplast AS, ConvaTec Group Plc, Ethicon USA LLC, Integra LifeSciences Holdings Corp, Medtronic Plc, MiMedx, PAUL HARTMANN AG, and Smith & Nephew Plc are the leading companies operating in the Middle East & Africa wound care market.

The Middle East & Africa Wound Care Market is valued at US$ 957.86 Million in 2022, it is projected to reach US$ 1,274.12 Million by 2028.

As per our report Middle East & Africa Wound Care Market, the market size is valued at US$ 957.86 Million in 2022, projecting it to reach US$ 1,274.12 Million by 2028. This translates to a CAGR of approximately 4.9% during the forecast period.

The Middle East & Africa Wound Care Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Middle East & Africa Wound Care Market report:

The Middle East & Africa Wound Care Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Middle East & Africa Wound Care Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Middle East & Africa Wound Care Market value chain can benefit from the information contained in a comprehensive market report.